Through the Eyes of Financial Coaches

2022 ANNUAL REPORT

Through the Eyes of Financial Coaches

2022 ANNUAL REPORT

I am a Financial Coach because:

![]()

I am passionate about reducing the ever-widening wealth gap. Bridging the divide between impoverished and wealthy individuals has become an urgent priority, and I strive to be a driving force behind this effort. Earning my clients’ trust is important because often I’m the only person they can turn to for sharing their financial issues. As the head of household, this can be an overwhelming burden, and sometimes our sessions become therapeutic. It’s impossible to move forward without unburdening yourself.

Dametria Douglas,

Financial Coach at Neighborhood Trust

At Neighborhood Trust, financial coaching is not just a service we provide—it’s at the core of everything we do. In 2022, our Financial Coaches helped workers overcome their financial hurdles and reach their financial goals. And through these daily interactions with clients, we also captured insights that help us amplify workers’ voices across the institutions and systems that deeply impact their finances.

At Neighborhood Trust, financial coaching is not just a service we provide—it’s at the core of everything we do. In 2022, our Financial Coaches helped workers overcome their financial hurdles and reach their financial goals. And through these daily interactions with clients, we also captured insights that help us amplify workers’ voices across the institutions and systems that deeply impact their finances.

Letter from the CEO

Dear Friends and Colleagues,

As I celebrate my 20-year anniversary at Neighborhood Trust I remain inspired by Marisol, a colleague from the early days, circa 2003, when we were a nonprofit fully intertwined with Neighborhood Trust Federal Credit Union.

In response to a survey question on our teller line: “Do you bank here because of a particular product and, if so, which one?” almost all had written across the bulleted options: “Marisol”. Of course. Banking isn’t about transactions. It’s about trust. Especially when you are juggling today’s bills and tomorrow’s dreams, vigilant about predatory “deals” and in the context of a legacy of discrimination.

Marisol was a skilled expert who played a vital role in creating our first Financial Coach role, combining hard-nosed financial analysis with empathy, drawing from shared lived experiences. Today, our Financial Coaches continue to uncover the countless ways our financial markets and policies misunderstand, undervalue, or overlook the financial services needs of the 60% of working Americans living paycheck to paycheck, reliant on expensive debt to get by.

In 2022, we advanced our Worker Insights Initiative so that we could amplify workers’ voices and eliminate indebtedness as an essential feature of their lives.

This Annual Report is a celebration of financial coaching reimagined as a force for market disruption. Alongside welcoming diverse employer, credit union, FinTech and worker platform customers into our network, enabling a worker community of tens of thousands, we’ve progressed with the build of an exciting insights and innovation engine that, at its heart, is a tool for enabling each of our Financial Coaches’ personally cultivated insights and ideas to be a part of our pursuit of systems change for freedom from debt.

Thank you to each of you, who serve our clients each day, and help point to the root causes and identify solutions for insurmountable debt in our hardworking clients’ lives.

In gratitude,

Justine Zinkin

CEO

Letter from the CEO

Dear Friends and Colleagues,

As I celebrate my 20-year anniversary at Neighborhood Trust I remain inspired by Marisol, a colleague from the early days, circa 2003, when we were a nonprofit fully intertwined with Neighborhood Trust Federal Credit Union.

In response to a survey question on our teller line: “Do you bank here because of a particular product and, if so, which one?” almost all had written across the bulleted options: “Marisol”. Of course. Banking isn’t about transactions. It’s about trust. Especially when you are juggling today’s bills and tomorrow’s dreams, vigilant about predatory “deals” and in the context of a legacy of discrimination.

Marisol was a skilled expert who played a vital role in creating our first Financial Coach role, combining hard-nosed financial analysis with empathy, drawing from shared lived experiences. Today, our Financial Coaches continue to uncover the countless ways our financial markets and policies misunderstand, undervalue, or overlook the financial services needs of the 60% of working Americans living paycheck to paycheck, reliant on expensive debt to get by.

In 2022, we advanced our Worker Insights Initiative so that we could amplify workers’ voices and eliminate indebtedness as an essential feature of their lives.

This Annual Report is a celebration of financial coaching reimagined as a force for market disruption. Alongside welcoming diverse employer, credit union, FinTech and worker platform customers into our network—enabling a worker community of tens of thousands—we’ve progressed with the build of an exciting insights and innovation engine that, at its heart, is a tool for enabling each of our Financial Coaches’ personally cultivated insights and ideas to be a part of our pursuit of systems change for freedom from debt.

Thank you to each of you, who serve our clients each day, and help point to the root causes and identify solutions for insurmountable debt in our hardworking clients’ lives.

In gratitude,

Justine Zinkin

CEO

Who We Are

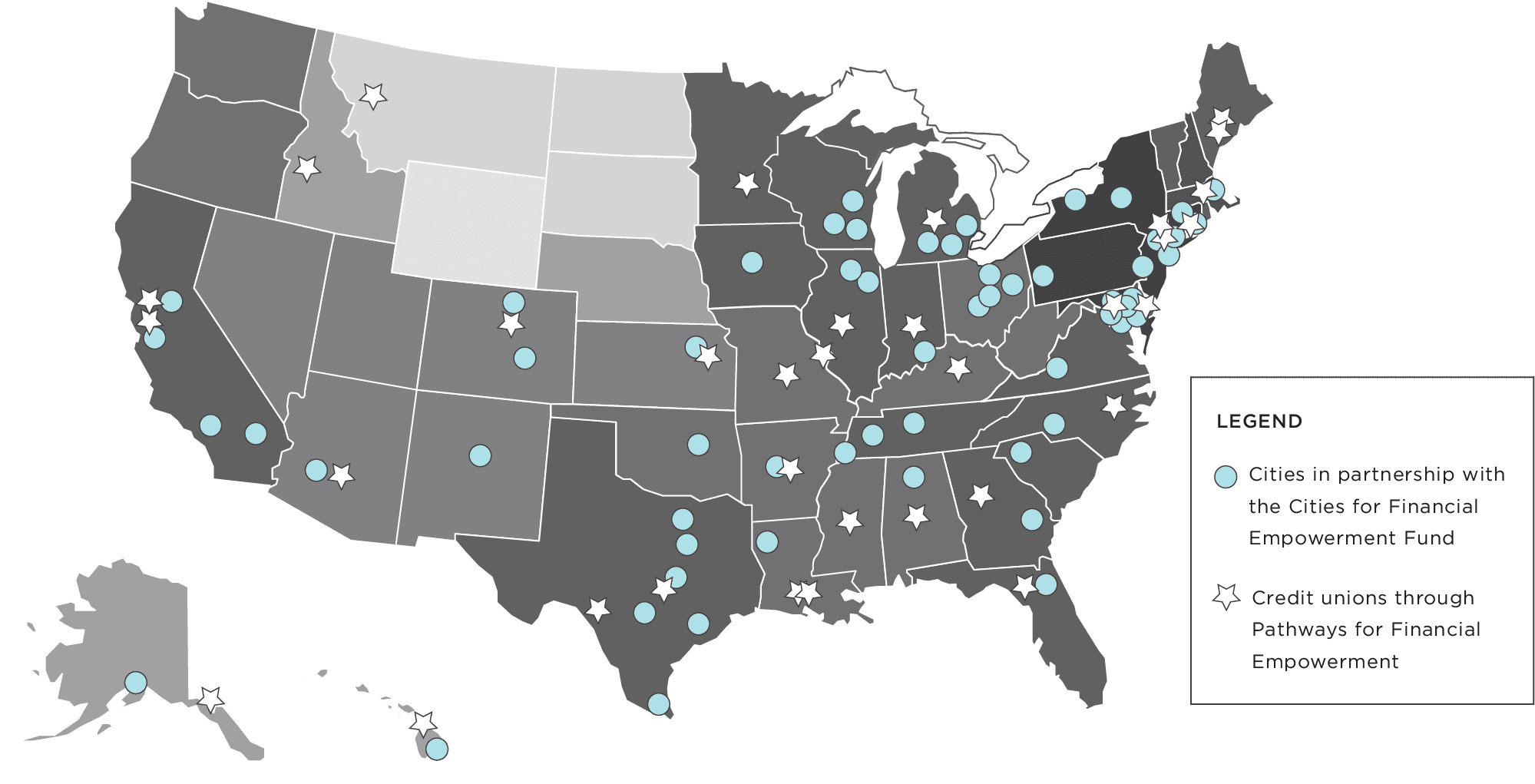

Neighborhood Trust is a national financial services innovator dedicated to building worker financial security. Our solutions, TrustPlus and Pathways to Financial Empowerment, provide comprehensive support to workers.

TrustPlus is our workplace financial health benefit that is embedded nationwide within employers, financial institutions, and FinTechs. Pathways to Financial Empowerment integrates our trusted, action-oriented financial coaching model into credit unions, in partnership with the national credit union network, Inclusiv.

These solutions help workers eliminate and avoid debt, enabling them to build savings and escape the vicious cycle of living paycheck to paycheck. For over 25 years, we have worked closely with workers as trusted human guides, helping them achieve the financial security they deserve.

Who We Are

Neighborhood Trust is a national financial services innovator dedicated to building worker financial security. Our solutions, TrustPlus and Pathways to Financial Empowerment, provide comprehensive support to workers.

TrustPlus is our workplace financial health benefit that is embedded nationwide within employers, financial institutions, and FinTechs. Pathways to Financial Empowerment integrates our trusted, action-oriented financial coaching model into credit unions, in partnership with the national credit union network, Inclusiv.

These solutions help workers eliminate and avoid debt, enabling them to build savings and escape the vicious cycle of living paycheck to paycheck. For over 25 years, we have worked closely with workers as trusted human guides, helping them achieve the financial security they deserve.

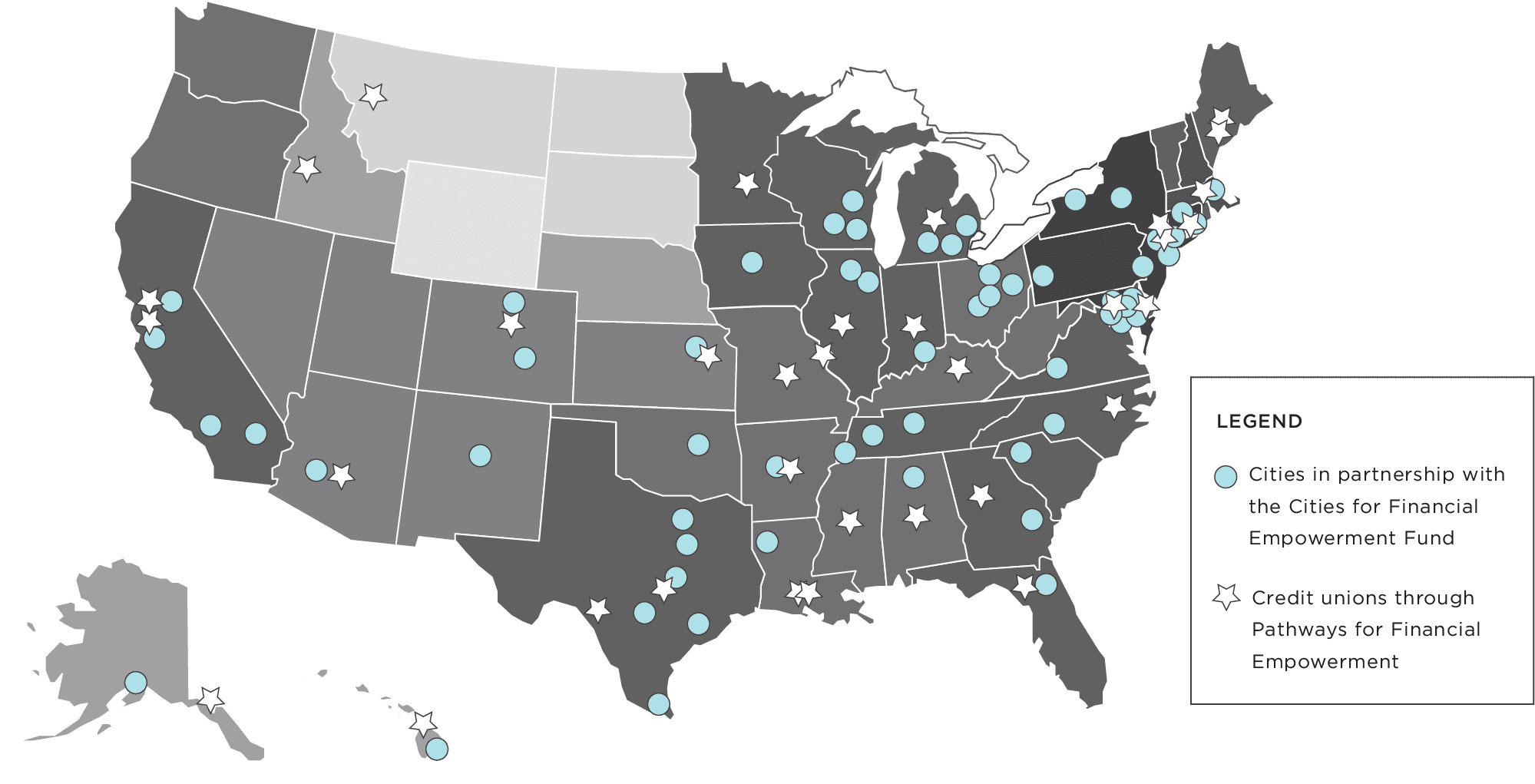

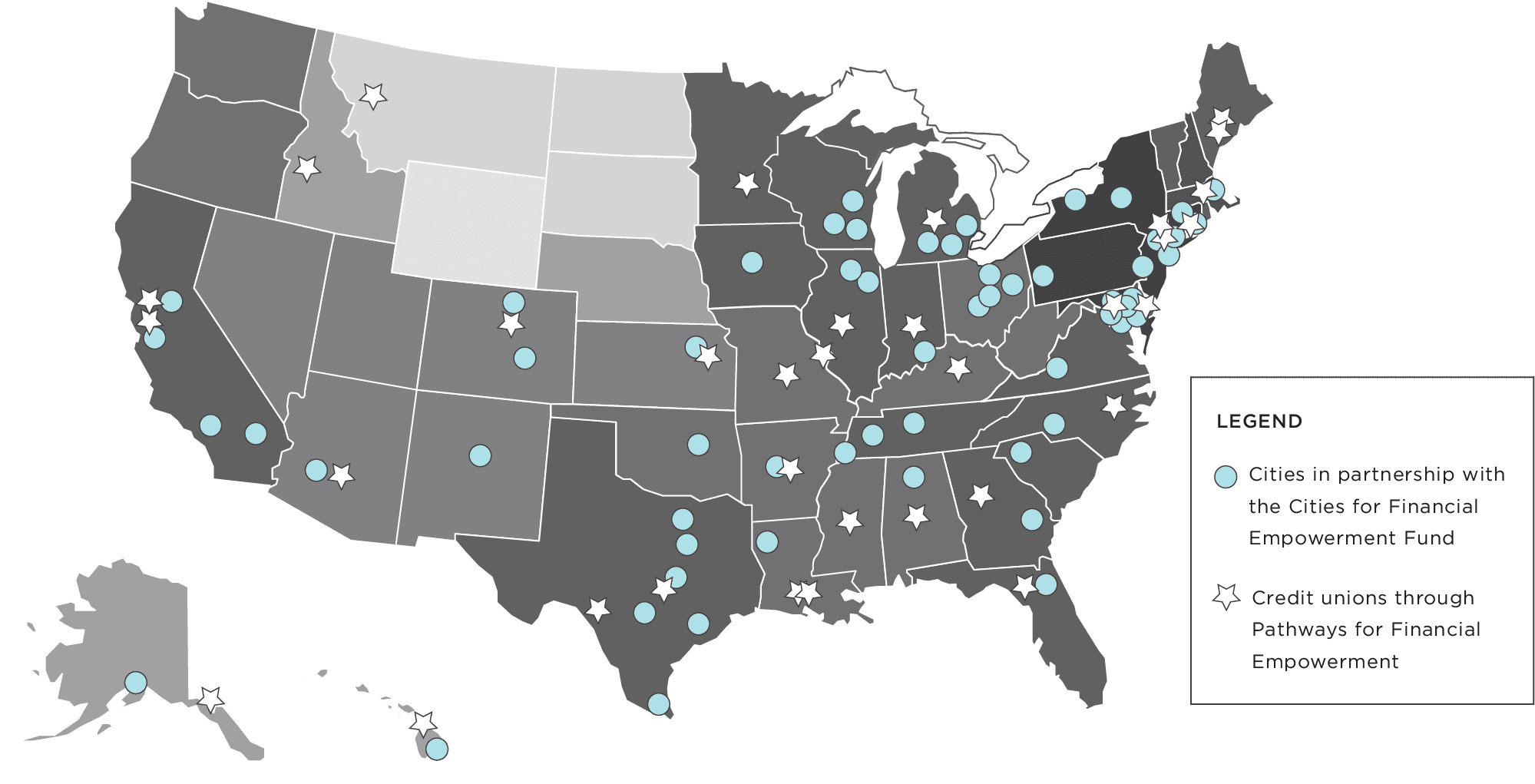

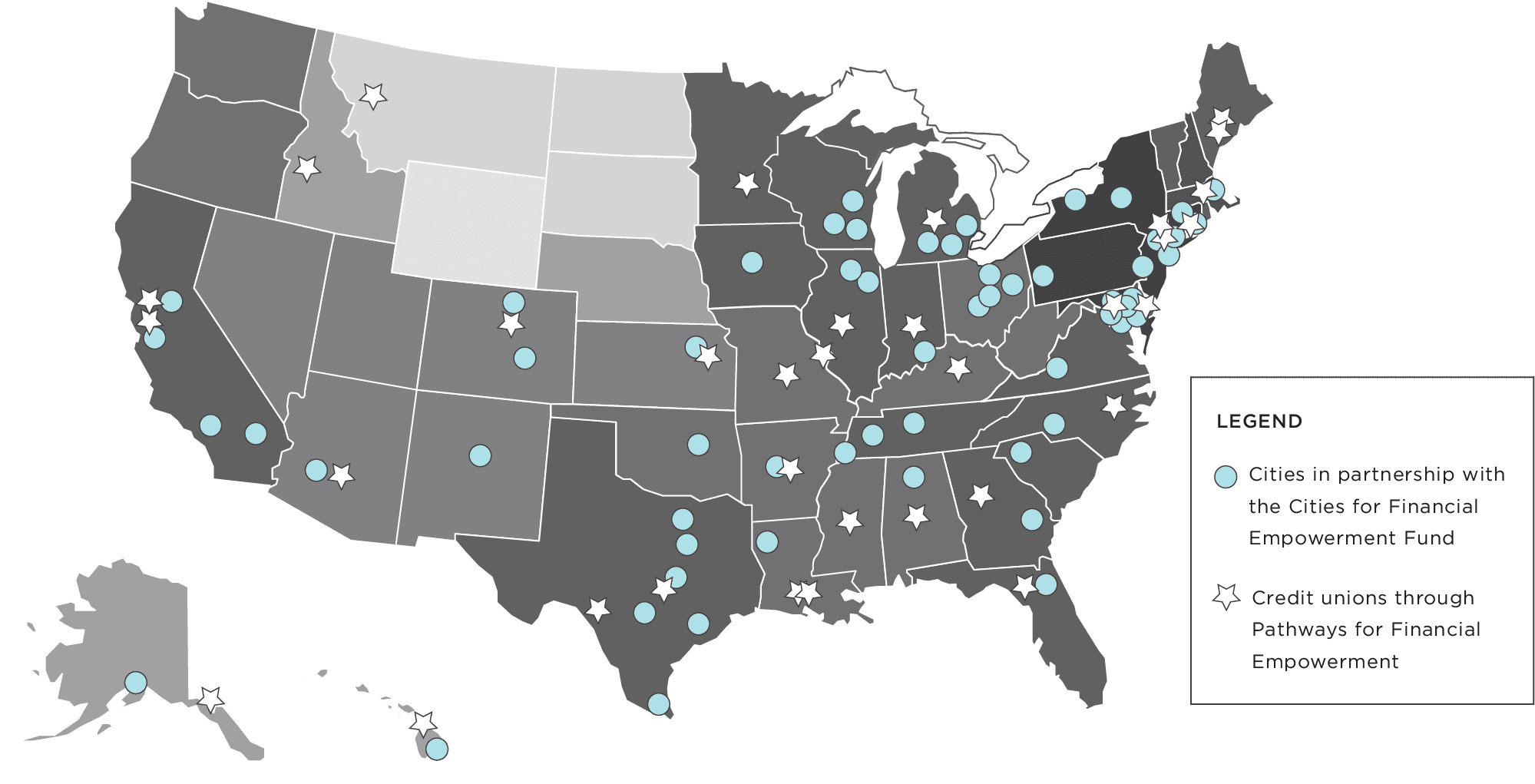

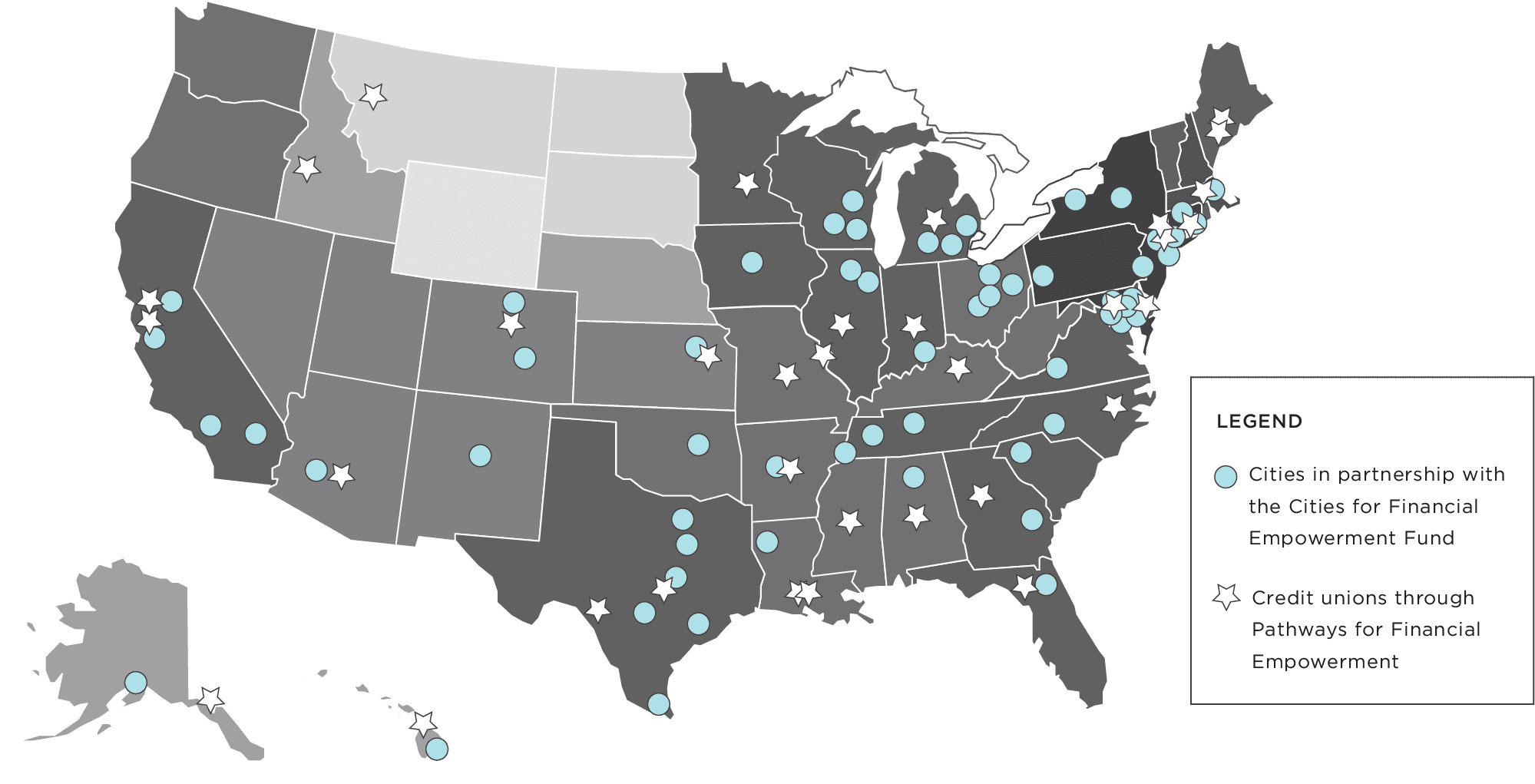

Since 2012, Neighborhood Trust has provided financial coaching to individuals nationally. In the past decade, we have reached:

70,000 workers across 49 states and 250+ customers through TrustPlus

29 credit unions through Pathways for Financial Empowerment

66 cities in partnership with the Cities for Financial Empowerment Fund

Since 2012, Neighborhood Trust has provided financial coaching to individuals nationally. In the past decade, we have reached:

70,000 workers across 49 states and 250+ customers through TrustPlus

29 credit unions through Pathways for Financial Empowerment

66 cities in partnership with the Cities for Financial Empowerment Fund

Our Financial Coaches See:

Workers Tackling Consumer Debt

Workers Tackling Consumer Debt

The prevalence of consumer debt was a major issue among our clients in 2022, affecting 9 out of 10.

The rising costs of essential needs like childcare, food, utilities, and auto loans outpaced wages, forcing many of our clients to rely on debt to cover basic needs. It is no surprise, then, that Financial Coaches, like Adrianna Gregory and Ivania Mora, overwhelmingly identify consumer debt as the most common challenge clients face.

Our Financial Coaches See:

Workers Tackling Consumer Debt

Workers Tackling Consumer Debt

The prevalence of consumer debt was a major issue among our clients in 2022, affecting 9 out of 10.

The rising costs of essential needs like childcare, food, utilities, and auto loans outpaced wages, forcing many of our clients to rely on debt to cover basic needs. It is no surprise, then, that Financial Coaches, like Adrianna Gregory and Ivania Mora, overwhelmingly identify consumer debt as the most common challenge clients face.

The weight of high-interest credit card debt and auto loans is a constant challenge for many people I work with. With monthly payments consuming a large part of their budget, it’s easy for people to feel like they’re not making any progress towards paying down debts. And when so much money is going towards debt and rising living costs, it can be difficult to save for the future or handle unexpected expenses.

Adrianna Gregory

Financial Coach at Neighborhood Trust

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The weight of high-interest credit card debt and auto loans is a constant challenge for many people I work with. With monthly payments consuming a large part of their budget, it’s easy for people to feel like they’re not making any progress towards paying down debts. And when so much money is going towards debt and rising living costs, it can be difficult to save for the future or handle unexpected expenses.

Adrianna Gregory,

Financial Coach at Neighborhood Trust

Financial Coaches work with partners like the Hebrew Free Loan Society to provide solutions for workers to manage their debt in a way that aligns with their financial situation, and promotes long-term financial health.

The Hebrew Free Loan Society (HFLS) is a nonprofit lender committed to promoting economic stability and opportunity for lower-income New Yorkers of all backgrounds by providing access to safe, affordable interest-free loans.

The Fresh Start Loan program, launched in July 2022 in partnership with Neighborhood Trust, Bedford-Stuyvesant Restoration Corporation, and New York Legal Assistance Group, helps clients pay down high-interest debt by offering 0%-interest loans of up to $20,000, without any fees. The key to the program’s success is that it’s only available to applicants referred by a Financial Coach from one of the three partner organizations, and only after the Coach and client have worked together to address the client’s overall financial situation and confirm their eligibility and ability to repay the loan. This referral strategy enables HFLS to offer flexible repayment plans based on the clients’ unique financial circumstances and take the Financial Coaches’ recommendations into account during the loan underwriting process.

Financial Coaches work with partners like the Hebrew Free Loan Society to provide solutions for workers to manage their debt in a way that aligns with their financial situation, and promotes long-term financial health.

The Hebrew Free Loan Society (HFLS) is a nonprofit lender committed to promoting economic stability and opportunity for lower-income New Yorkers of all backgrounds by providing access to safe, affordable interest-free loans.

The Fresh Start Loan program, launched in July 2022 in partnership with Neighborhood Trust, Bedford-Stuyvesant Restoration Corporation, and New York Legal Assistance Group, helps clients pay down high-interest debt by offering 0%-interest loans of up to $20,000, without any fees. The key to the program’s success is that it’s only available to applicants referred by a Financial Coach from one of the three partner organizations, and only after the Coach and client have worked together to address the client’s overall financial situation and confirm their eligibility and ability to repay the loan. This referral strategy enables HFLS to offer flexible repayment plans based on the clients’ unique financial circumstances and take the Financial Coaches’ recommendations into account during the loan underwriting process.

For many of my clients, consumer debt is a constant struggle that can easily turn into a vicious cycle. My job is to empower them with options, like Hebrew Free Loan Society’s Fresh Start Loan, that will enable them to tackle their debt effectively and find the best solutions to help them get a good night’s sleep.

Ivania Mora

Financial Coach at Neighborhood Trust

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

For many of my clients, consumer debt is a constant struggle that can easily turn into a vicious cycle. My job is to empower them with options, like Hebrew Free Loan Society’s Fresh Start Loan, that will enable them to tackle their debt effectively and find the best solutions to help them get a good night’s sleep.

Ivania Mora,

Financial Coach at Neighborhood Trust

I am a Financial Coach because:

I recognize the immense strain that financial matters can place on people, making it hard for them to focus on their long-term goals. To achieve real financial equity, we must meet people where they are and provide guidance that is both practical and effective. It’s essential to listen actively and come up with solutions that are customized to their unique situation, keeping in mind their readiness to receive advice. By doing this, we can provide guidance that truly makes a difference in their lives.

Elise Nussbaum

Financial Coach at Neighborhood Trust

I am a Financial Coach because:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

I recognize the immense strain that financial matters can place on people, making it hard for them to focus on their long-term goals. To achieve real financial equity, we must meet people where they are and provide guidance that is both practical and effective. It’s essential to listen actively and come up with solutions that are customized to their unique situation, keeping in mind their readiness to receive advice. By doing this, we can provide guidance that truly makes a difference in their lives.

Elise Nussbaum

Financial Coach at Neighborhood Trust

Our Financial Coaches See:

Workers Finding A Place to Call Home

Workers Finding A Place to Call Home

Inflation ran rampant throughout 2022, and the cost of rent was no exception. The average housing expense for our clients increased by $600 in 2022, reaching $2,549 per month.

Adrianna Gregory, a Financial Coach, saw many clients struggle due to the staggering cost of housing in 2022. “The high cost of housing is one of the biggest obstacles our clients face today,” she stated. “It’s a major reason people would like to own a home, yet it’s also a barrier to saving for that home. With rents soaring to new heights, there can be pressure to fast-track that path to homeownership, and a temptation to skip important financial steps along the way.”

Adrianna’s personal experience of purchasing a home in 2021 gave her an inside look at the complexities of the process. Now, Adrianna shares her insights and experiences with her clients, empowering them to navigate the process with confidence.

Our Financial Coaches See:

Workers Finding A Place to Call Home

Workers Finding A Place to Call Home

Inflation ran rampant throughout 2022, and the cost of rent was no exception. The average housing expense for our clients increased by $600 in 2022, reaching $2,549 per month.

Adrianna Gregory, a Financial Coach, saw many clients struggle due to the staggering cost of housing in 2022. “The high cost of housing is one of the biggest obstacles our clients face today,” she stated. “It’s a major reason people would like to own a home, yet it’s also a barrier to saving for that home. With rents soaring to new heights, there can be pressure to fast-track that path to homeownership, and a temptation to skip important financial steps along the way.”

Adrianna’s personal experience of purchasing a home in 2021 gave her an inside look at the complexities of the process. Now, Adrianna shares her insights and experiences with her clients, empowering them to navigate the process with confidence.

Buying my home was an eye-opening experience, so I try to share what I learned with my clients who are preparing for the same process.

Adrianna Gregory

Financial Coach at Neighborhood Trust

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Buying my home was an eye-opening experience, so I try to share what I learned with my clients who are preparing for the same process.

Adrianna Gregory

Financial Coach at Neighborhood Trust

I am a Financial Coach because:

I believe education is the foundation of everything. It’s crucial that people understand their rights, responsibilities, and what they can do to improve their financial well-being. When individuals understand how the financial system operates, they are empowered to make informed decisions and seek opportunities that are most beneficial to them. Ultimately, my goal is to equip all my clients with the knowledge they need to make confident decisions on their own.

Ana Paez

Financial Coach at Neighborhood Trust

I am a Financial Coach because:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

I believe education is the foundation of everything. It’s crucial that people understand their rights, responsibilities, and what they can do to improve their financial well-being. When individuals understand how the financial system operates, they are empowered to make informed decisions and seek opportunities that are most beneficial to them. Ultimately, my goal is to equip all my clients with the knowledge they need to make confident decisions on their own.

Ana Paez

Financial Coach at Neighborhood Trust

Our Financial Coaches See:

The Human Side of Debt in Collections

The Human Side of Debt in Collections

In 2022, many of our clients faced the harsh reality of debt in collections, with 47% of them having outstanding Debt in Collections. Financial Coaches, like Ana Paez, observed that these debts often felt like personal failures, making it difficult for clients to focus on their current financial situation and plan for their future. At Neighborhood Trust, we know that our clients’ inability to repay debt is not a reflection of personal failure, but rather a symptom of a larger system that entraps individuals in a cycle of debt. Our clients have debt in collections because of predatory practices and an inability to repay high cost debt when they must prioritize basic living expenses.

Our Financial Coaches See:

The Human Side of Debt in Collections

The Human Side of Debt in Collections

In 2022, many of our clients faced the harsh reality of debt in collections, with 47% of them having outstanding Debt in Collections. Financial Coaches, like Ana Paez, observed that these debts often felt like personal failures, making it difficult for clients to focus on their current financial situation and plan for their future. At Neighborhood Trust, we know that our clients’ inability to repay debt is not a reflection of personal failure, but rather a symptom of a larger system that entraps individuals in a cycle of debt. Our clients have debt in collections because of predatory practices and an inability to repay high cost debt when they must prioritize basic living expenses.

Financial Coach Ana Paez at Neighborhood Trust notes, “Many of my clients who have debt in collections come to our sessions with feelings of helplessness. I notice that the debt influences their mood and motivation. Despite their desire to improve their financial situation, they say they feel powerless and overwhelmed. The process of dealing with unpaid debt, creditors and collections can be overwhelming and intimidating, and worry continually consumes them.”

Given that 45% of households earn less than $50,000 per year, many clients face the ongoing struggle of choosing between paying today’s bills or yesterday’s debts.

Financial Coach Ana Paez at Neighborhood Trust notes, “Many of my clients who have debt in collections come to our sessions with feelings of helplessness. I notice that the debt influences their mood and motivation. Despite their desire to improve their financial situation, they say they feel powerless and overwhelmed. The process of dealing with unpaid debt, creditors and collections can be overwhelming and intimidating, and worry continually consumes them.”

Given that 45% of households earn less than $50,000 per year, many clients face the ongoing struggle of choosing between paying today’s bills or yesterday’s debts.

Talking about debt or collections and how they originated is not an easy conversation. Sometimes, the shame and guilt associated with the debt can be overwhelming, causing some clients to disregard it altogether. It’s a delicate balance to manage, but I work in educating them about how the system works, their rights and the options to manage it. Bringing their debt to light so they can begin to move forward can be a slow process. Sometimes they feel stuck, uncertain about how to proceed, or even change their minds, which creates a lot of anxiety. But I reassure them that I’m with them every step of the way and that we can solve the problem together.

Ana Paez

Financial Coach at Neighborhood Trust

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Talking about debt or collections and how they originated is not an easy conversation. Sometimes, the shame and guilt associated with the debt can be overwhelming, causing some clients to disregard it altogether. It’s a delicate balance to manage, but I work in educating them about how the system works, their rights and the options to manage it. Bringing their debt to light so they can begin to move forward can be a slow process. Sometimes they feel stuck, uncertain about how to proceed, or even change their minds, which creates a lot of anxiety. But I reassure them that I’m with them every step of the way and that we can solve the problem together.

Ana Paez

Financial Coach at Neighborhood Trust

Medical debt that ends up in collections can be incredibly challenging for clients. My clients frequently find themselves in this position without warning or knowledge of the debt. This situation can be even more difficult for those with complicated medical issues, who receive bills from multiple sources without a clear understanding of the charges. Managing these bills is an enormous challenge, especially for those trying to recover. This is a major reason why medical debt ends up in collections—it’s simply too stressful and confusing to manage.

Elise Nussbaum

Financial Coach at Neighborhood Trust

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Medical debt that ends up in collections can be incredibly challenging for clients. My clients frequently find themselves in this position without warning or knowledge of the debt. This situation can be even more difficult for those with complicated medical issues, who receive bills from multiple sources without a clear understanding of the charges. Managing these bills is an enormous challenge, especially for those trying to recover. This is a major reason why medical debt ends up in collections—it’s simply too stressful and confusing to manage.

Elise Nussbaum

Financial Coach at Neighborhood Trust

Celebrate the Wins!

At Neighborhood Trust, we are inspired by our clients’ successes, which drives us to continue providing support. In this section, we highlight some of our clients’ achievements through snippets from our internal chat. These conversations serve as a powerful source of motivation and remind us of the impact of our work on our clients’ lives.

Celebrate the Wins!

At Neighborhood Trust, we are inspired by our clients’ successes, which drives us to continue providing support. In this section, we highlight some of our clients’ achievements through snippets from our internal chat. These conversations serve as a powerful source of motivation and remind us of the impact of our work on our clients’ lives.

Celebrate the Wins!

At Neighborhood Trust, we are inspired by our clients’ successes, which drives us to continue providing support. In this section, we highlight some of our clients’ achievements through snippets from our internal chat. These conversations serve as a powerful source of motivation and remind us of the impact of our work on our clients’ lives.

I am a Financial Coach because:

I believe everyone deserves a safe and trustworthy space to discuss their finances. Too often, people are left without an outlet to express their concerns, without being bombarded by predatory tactics or sales pitches. I take pride in being that sounding board and offering genuine support, always with their best interests in mind. Accessibility to this kind of resource is crucial and unfortunately, not always readily available.

Adrianna Gregory

Financial Coach at Neighborhood Trust

I am a Financial Coach because:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

I believe everyone deserves a safe and trustworthy space to discuss their finances. Too often, people are left without an outlet to express their concerns, without being bombarded by predatory tactics or sales pitches. I take pride in being that sounding board and offering genuine support, always with their best interests in mind. Accessibility to this kind of resource is crucial and unfortunately, not always readily available.

Adrianna Gregory

Financial Coach at Neighborhood Trust

Financials

*2022 Unaudited Actuals as of December 31, 2022.

**Our Total Revenue in 2022 includes the forgiveness of two Paycheck Protection Program (PPP) Loans in that year, which were received in 2020 and 2021 in response to the pandemic.

Click here for additional financial data.

Financials

*2022 Unaudited Actuals as of December 31, 2022.

**Our Total Revenue in 2022 includes the forgiveness of two Paycheck Protection Program (PPP) Loans in that year, which were received in 2020 and 2021 in response to the pandemic.

Click here for additional financial data.

Follow Us