2021 annual report

FREEDOM FROM DEBT

Insights that Fuel Innovation

2021 annual report

FREEDOM FROM DEBT

Insights that Fuel Innovation

25 YEARS OF SOLUTIONS

Neighborhood Trust is a financial services innovator that creates financial security for low-wage workers through workplace and marketplace solutions.

25 YEARS OF SOLUTIONS

Neighborhood Trust is a financial services innovator that creates financial security for low-wage workers through workplace and marketplace solutions.

25 YEARS OF SOLUTIONS

Neighborhood Trust is a financial services innovator that creates financial security for low-wage workers through workplace and marketplace solutions.

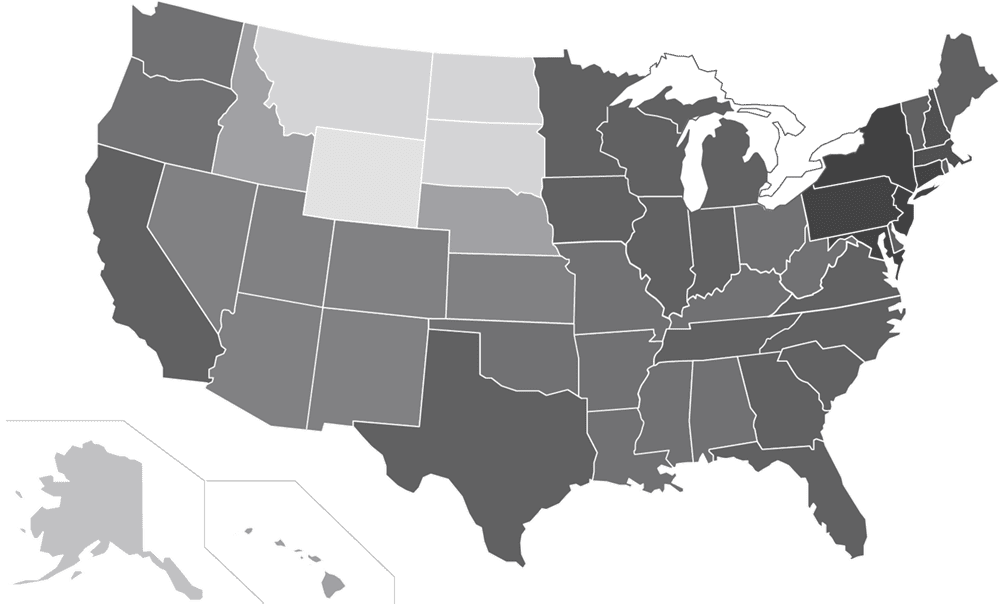

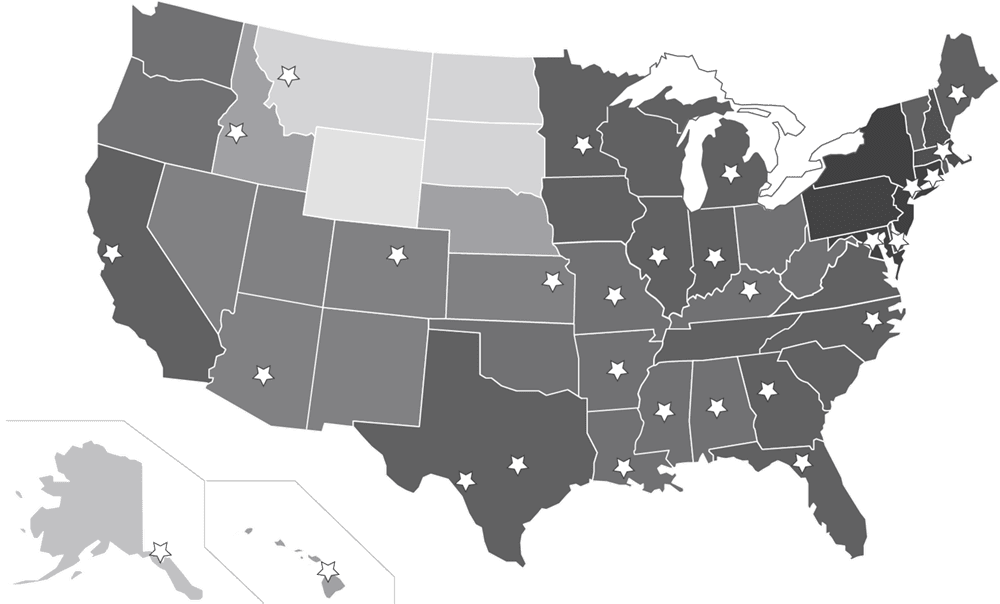

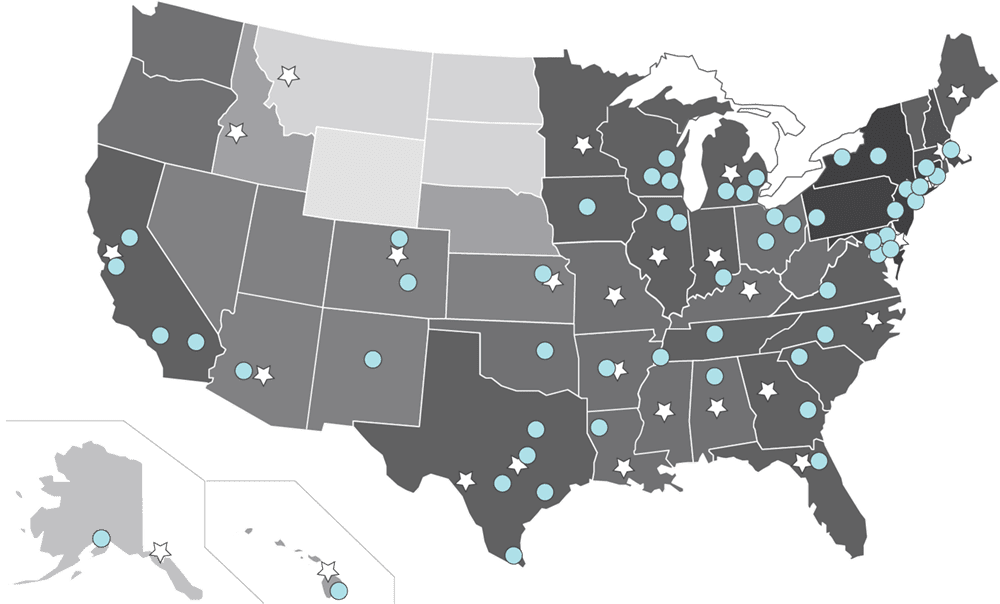

Since our national expansion in 2012, Neighborhood Trust’s Financial Coaching has reached:

62,450 workers in 49 states

and 250+ Customers

Since our national expansion in 2012, Neighborhood Trust’s Financial Coaching has reached:

62,450 workers in 49 states

and 250+ Customers

at 24 credit unions

Since our national expansion in 2012, Neighborhood Trust’s Financial Coaching has reached:

62,450 workers in 49 states

and 250+ Customers

at 24 credit unions

and in 61 cities in partnership with the Cities for Financial Empowerment Fund

Since our national expansion in 2012, Neighborhood Trust’s Financial Coaching has reached:

62,450 workers

in 49 states

and 250+ Customers

at 24 credit unions

and in 61 cities in partnership with the Cities for Financial Empowerment Fund

We make financial security possible for all workers:

Through 2021, we have:

reduced $131M in debt

2,610 workers eliminated their debt

7,477 eliminated their collections debts

5,484 established credit

6,830 reached prime credit scores

62% of our clients are women, 83% are people of color, and 46% have debt in collections. Their median annual income is $30,000.

We make financial security possible for all workers:

62% of our clients are women, 83% are people of color, and 46% have debt in collections. Their median annual income is $30,000.

Through 2021, we have:

reduced $131M in debt

2,610 workers eliminated their debt

7,477 eliminated their collections debts

5,484 established credit

6,830 reached prime credit scores

Existing Financial Services solutions exacerbate the precarious financial positions of low-wage workers. Lenders entrap workers with product features such as high interest rates, balloon payments, auto-withdrawals, unexpected fees, and easy access via low underwriting standards. In communities of color, 39% of workers have debts in collections.

In the Workplace, 44% of all U.S. workers are low-wage, earning a median of $10.22 per hour, with Black and Hispanic/Latino workers most likely to earn low-wages. Even the common narrative that the Great Resignation has given workers greater leverage is illusory. Without the right financial benefits, workers’ cash shortfalls often lead to high-interest debt cycles.

With razor-thin margins, Workers often turn to debt to weather financial shocks.

- In 27 states, at least 40% of households live above the poverty line, yet cannot afford the essentials in their communities.

- 50% of consumers who reported that they struggle to pay their bills, also reported borrowing money either using formal or informal credit.

- Even “good” debts like student loans, which should build wealth, are inaccessible or harmful to low-wage, particularly Black and Hispanic/Latino workers. The median Black borrower still owes 95% of their original student debt balance 20 years after starting college, compared to White borrowers who are almost 95% paid down in this time.

Existing Financial Services solutions exacerbate the precarious financial positions of low-wage workers. Lenders entrap workers with product features such as high interest rates, balloon payments, auto-withdrawals, unexpected fees, and easy access via low underwriting standards. In communities of color, 39% of workers have debts in collections.

In the Workplace, 44% of all U.S. workers are low-wage, earning a median of $10.22 per hour, with Black and Hispanic/Latino workers most likely to earn low-wages. Even the common narrative that the Great Resignation has given workers greater leverage is illusory. Without the right financial benefits, workers’ cash shortfalls often lead to high-interest debt cycles.

With razor-thin margins, Workers often turn to debt to weather financial shocks.

- In 27 states, at least 40% of households live above the poverty line, yet cannot afford the essentials in their communities.

- 50% of consumers who reported that they struggle to pay their bills, also reported borrowing money either using formal or informal credit.

- Even “good” debts like student loans, which should build wealth, are inaccessible or harmful to low-wage, particularly Black and Hispanic/Latino workers. The median Black borrower still owes 95% of their original student debt balance 20 years after starting college, compared to White borrowers who are almost 95% paid down in this time.

TrustPlus Client: Fiorela

Growing up, Fiorela’s family didn’t talk much about money. In Peru, Fiorela lived a middle-class life until age nine when she moved to New Jersey. Her mom graduated college while her dad was working odd jobs to support the household.

Today, Fiorela still thinks about the challenges of transitioning from having financial security to navigating financial insecurity, while also adjusting to life in the U.S.

Fiorela recently worked with Elise, her Financial Coach, to navigate retirement offerings through her employer, the National Association of Drug Abuse Problems. They also created a plan to pay off the credit card debt Fiorela accrued after college while working her first job in human services.

When she finishes paying down her debt, Fiorela wants to get a dual masters in social work and public policy because, “in this country our systems—including healthcare, education, and criminal justice—are limiting and counterproductive.”

With her Financial Coach’s help, Fiorela is becoming a part of the solution.

“Since I’m at a place where I’m managing my finances in a secure way, I can make more comfortable decisions around money, like going to grad school, starting an IRA, and saving up a bigger emergency cushion.”

TrustPlus Client: Fiorela

Growing up, Fiorela’s family didn’t talk much about money. In Peru, Fiorela lived a middle-class life until age nine when she moved to New Jersey. Her mom graduated college while her dad was working odd jobs to support the household.

Today, Fiorela still thinks about the challenges of transitioning from having financial security to navigating financial insecurity, while also adjusting to life in the U.S.

Fiorela recently worked with Elise, her Financial Coach, to navigate retirement offerings through her employer, the National Association of Drug Abuse Problems. They also created a plan to pay off the credit card debt Fiorela accrued after college while working her first job in human services.

When she finishes paying down her debt, Fiorela wants to get a dual masters in social work and public policy because, “in this country our systems—including healthcare, education, and criminal justice—are limiting and counterproductive.”

With her Financial Coach’s help, Fiorela is becoming a part of the solution.

Letter from the CEO

Listening to Workers

Listening to Workers

Dear Friends and Colleagues,

For the past 25 years, workers across all industries and regions have pointed to their debt—medical debt, student loan debt, payday loans, and loan sharks—as a daily “best of bad options” for getting by. They tell our Financial Coaches that our services signify “freedom.” This is the most common refrain in the stories we hear.

It’s on us to amplify this message of indebtedness as a permanent fixture of workers’ lives, and be real about the costs of this psychological, as well as economic, toll. Most importantly, we must take on the structural fixes to the workplace and financial services that perpetuate workers’ reliance on debt, eliminating indebtedness as an essential feature of working life once and for all.

I was recently moved by Tara Westover’s profile of the moment she felt free: “A few thousand dollars was enough to alter the whole course of my life… It allowed me to experience for the first time what I now know to be the most powerful advantage of money, which is the ability to think of things beside money. That’s what money does. It frees your mind for living.”

At this moment, the Great Resignation is not causing the great shifts in job quality and financial justice and equity that we hope for. So far there is little evidence of permanent shifts in employers’ investment in better jobs. We at Neighborhood Trust have work to do.

In 2021 we reframed our impact to be laser-focused on whether workers are free from costly and exploitative debt. In 2022 we look forward to the continued reach of our social enterprise, including our national worker benefit, TrustPlus; and our CDFI solution, Pathways. We are confident in the power of our growing platform of workers to pinpoint the market change needed, in work, banking and benefits, to enable financial freedom.

In gratitude,

Justine Zinkin

Chief Executive Officer

Our Approach

INSIGHTS THAT FUEL INNOVATION

Solutions FOR WORKERS

We provide trusted financial guidance to workers, and connect them to safe and effective financial products that help reduce and avoid debt and address immediate financial challenges.

Insights FOR CUSTOMERS + PARTNERS

We inform our customers and institutional partners how to more effectively advance and support workers’ financial needs, and we co-design innovative financial products.

Transformation FOR THE MARKETPLACE

We share data and qualitative insights on the financial realities of workers to inform, influence, and motivate market leaders, advocates and policy makers as we pursue a more equitable economic system together.

Our Approach

INSIGHTS THAT FUEL INNOVATION

Solutions FOR WORKERS

Solutions FOR WORKERS

We provide trusted financial guidance to workers, and connect them to safe and effective financial products that help reduce and avoid debt and address immediate financial challenges.

Insights FOR CUSTOMERS + PARTNERS

Insights FOR CUSTOMERS + PARTNERS

We inform our customers and institutional partners how to more effectively advance and support workers’ financial needs, and we co-design innovative financial products.

Transformation FOR THE MARKETPLACE

Transformation FOR THE MARKETPLACE

We share data and qualitative insights on the financial realities of workers to inform, influence, and motivate market leaders, advocates and policy makers as we pursue a more equitable economic system together.

TrustPlus client: Nade

“Nothing was working on my side during the pandemic. I remember I cried to Tiffany one day because I was thinking about how everything was upside down all of a sudden. She followed up with all the resources she could find. When those types of people reach out to you it empowers you to not give up because you have people counting on you.”

TrustPlus client: Nade

“Nothing was working on my side during the pandemic. I remember I cried to Tiffany one day because I was thinking about how everything was upside down all of a sudden. She followed up with all the resources she could find. When those types of people reach out to you it empowers you to not give up because you have people counting on you.”

TrustPlus is our worker benefit, which brings our financial coaching+product model into the workplace via phone/video, and uses an agile technology infrastructure that allows for seamless integration into a range of customer platforms.

Listen to Alex Lofton, Co-Founder of Landed, share why his company partnered with TrustPlus.

TACKLING WORKERS’ DEBT

In 2021, we reimagined the tools we use to tackle workers’ unmanageable debt loads.

We are adding to our human-touch financial coaching with machine-learning techniques that predict points of cash flow shortfall and proactively intervene.

For the 40% of our clients with debt in collections, we’re delivering value to users right away. Our digital tools walk them through validating, disputing, and negotiating debts, which helps clients avoid wage garnishment, hobbled credit scores, and the fear of answering the phone.

Our enhanced digital tools for clients drive data toward new products and features, and generate invaluable insights for customers and advocates.

Worker financial health and debt solutions

Investing in worker financial health and debt solutions improves job quality, which reduces turnover, increases productivity, and strengthens the bottom line.

In 2021, we launched a new, employer-facing product to feed insights from our financial coaching sessions and workforce financial data back to company leaders. Employers looking for a new tool to improve their workers’ financial health will receive a new, in-depth profile of workers’ financial needs alongside curated product recommendations.

TrustPlus is our worker benefit, which brings our financial coaching+product model into the workplace via phone/video, and uses an agile technology infrastructure that allows for seamless integration into a range of customer platforms.

Listen to Alex Lofton, Co-Founder of Landed, share why his company partnered with TrustPlus.

TACKLING WORKERS’ DEBT

In 2021, we reimagined the tools we use to tackle workers’ unmanageable debt loads.

We are adding to our human-touch financial coaching with machine-learning techniques that predict points of cash flow shortfall and proactively intervene.

For the 40% of our clients with debt in collections, we’re delivering value to users right away. Our digital tools walk them through validating, disputing, and negotiating debts, which helps clients avoid wage garnishment, hobbled credit scores, and the fear of answering the phone.

Our enhanced digital tools for clients drive data toward new products and features, and generate invaluable insights for customers and advocates.

Worker financial health and debt solutions

Investing in worker financial health and debt solutions improves job quality, which reduces turnover, increases productivity, and strengthens the bottom line.

In 2021, we launched a new, employer-facing product to feed insights from our financial coaching sessions and workforce financial data back to company leaders. Employers looking for a new tool to improve their workers’ financial health will receive a new, in-depth profile of workers’ financial needs alongside curated product recommendations.

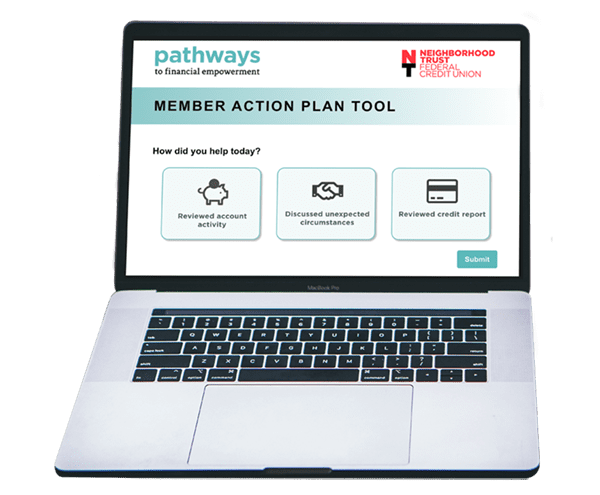

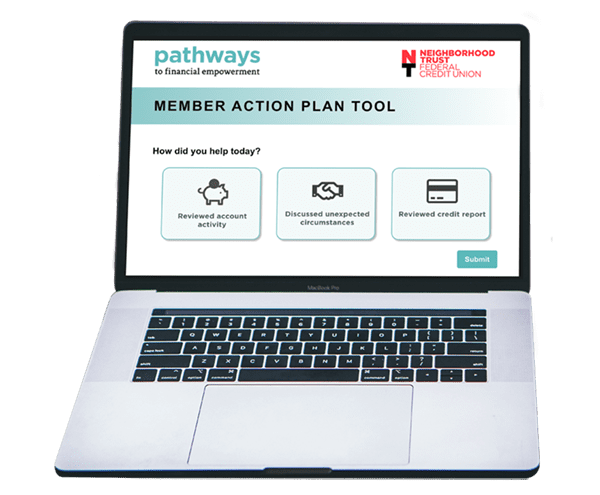

A partnership between Neighborhood Trust and credit union network Inclusiv, Pathways for Financial Empowerment embeds our model of trusted, action-oriented financial coaching into credit unions, with trackable results via our proprietary technology platform. Our portfolio consists of 21 credit unions holding more than $13.7B in assets and reaching more than one million members nationwide.

“Joining Pathways to Financial Empowerment was a tangible way to deliver on our mission of improving members’ financial wellness. The program has significantly enhanced our existing financial coaching capabilities by providing a platform to support and guide members on the next steps in their own financial journeys. Pathways has allowed us to quantify and track the impact of our one-on-one Financial counseling.”

—Wendy Haller, VP of Member Experience, Patelco Credit Union

FRICTIONLESS GUIDANCE

In 2021, we piloted a new product, microcoaching, which built light-touch financial health nudges and recommendations into member interactions with loan officers and other credit union staff.

Our research shows that microcoaching leverages what already occurs daily: credit union staff frequently offer financial guidance to members around members’ daily usage of the credit union.

Microcoaching standardizes and tracks these interventions through our proprietary data platform, enabling credit unions to measure the impact of their frontline staff like never before.

A partnership between Neighborhood Trust and credit union network Inclusiv, Pathways for Financial Empowerment embeds our model of trusted, action-oriented financial coaching into credit unions, with trackable results via our proprietary technology platform. Our portfolio consists of 21 credit unions holding more than $13.7B in assets and reaching more than one million members nationwide.

“Joining Pathways to Financial Empowerment was a tangible way to deliver on our mission of improving members’ financial wellness. The program has significantly enhanced our existing financial coaching capabilities by providing a platform to support and guide members on the next steps in their own financial journeys. Pathways has allowed us to quantify and track the impact of our one-on-one Financial counseling.”

—Wendy Haller, VP of Member Experience, Patelco Credit Union

FRICTIONLESS GUIDANCE

In 2021, we piloted a new product, microcoaching, which built light-touch financial health nudges and recommendations into member interactions with loan officers and other credit union staff.

Our research shows that microcoaching leverages what already occurs daily: credit union staff frequently offer financial guidance to members around members’ daily usage of the credit union.

Microcoaching standardizes and tracks these interventions through our proprietary data platform, enabling credit unions to measure the impact of their frontline staff like never before.

Today Was a Good Day

LESS DEBT, MORE CONTROL

Results FOR WORKERS

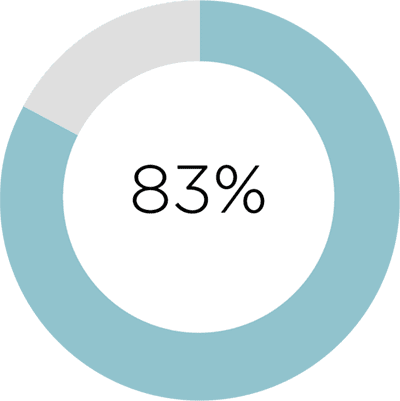

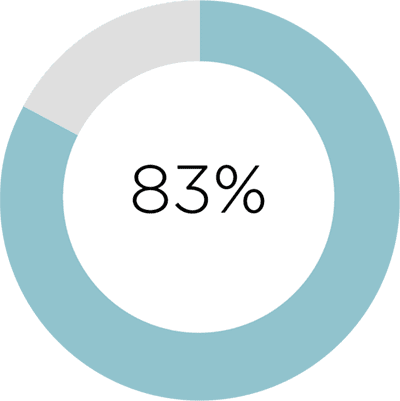

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

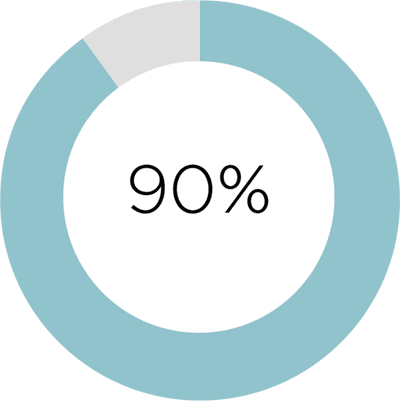

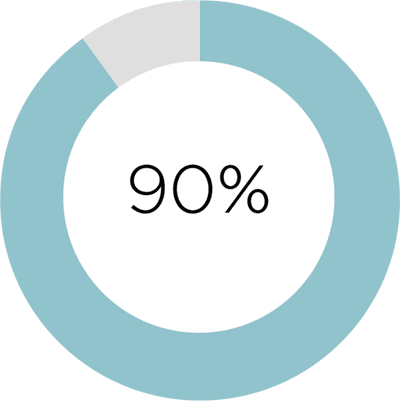

90% of clients agreed that “Working with my coach helped me create or improve a plan for managing my finances during these uncertain times.”

We served more than 8,000 workers in 2021

While 90% of clients carry consumer debt…

|

55% then reduced their debt by a median of $4,248

|

While 46% of our clients had debt in collections…

|

49% reduced these debts and a quarter eliminated them entirely

|

While 72% of our clients had subprime credit scores…

|

67% improved their credit and 18% improved to a prime credit score

|

HELPING NEW YORK’S TAXI DRIVERS NAVIGATE THEIR DEBT

Neighborhood Trust has provided Financial Counseling and Coaching to taxi medallion owners and drivers since 2020 in partnership with the Taxi and Limousine Commission’s Owner Driver Resource Center.

In 2021, owners of New York City taxi medallions won substantial debt relief in the wake of plummeting medallion values that led to increased financial and emotional hardship for driver/owners. Most of these driver/owners are immigrants who took out loans on their medallions when medallions were worth upwards of $1M, but in the wake of Uber and Lyft flooding the market, these medallion owners found themselves under water as the value of the medallions collapsed.

We’re proud to have given more than 640 drivers timely and relevant financial guidance as they navigate an uncertain time. Our Financial Coaches connected them to small business relief programs, helped them reduce their consumer debt, and walked them through improving their credit scores to widen their eligibility for safe financial products.

DCWP Commissioner Peter A. Hatch

“The NYC Department of Consumer and Worker Protection has worked with Neighborhood Trust Financial Partners for over 12 years to provide free financial counseling to more than 23,000 New Yorkers in all five boroughs. Building on this partnership, we’ve now helped hundreds of taxicab medallion owners benefit from free financial counseling to help manage and lower their debt. We would like to thank Neighborhood Trust Financial Partners for their tireless support of these essential New Yorkers by providing the right tools to reach stability.”

CO-DESIGNING FINANCIAL PRODUCTS FOR WORKERS

For the credit unions using our Pathways service, financial solutions for workers are a win-win for the institution, as well. At Guadalupe Credit Union in New Mexico, their Financial Coaches noticed that their credit-challenged members were losing thousands of dollars to exorbitant interest from predatory lending products—and they could help.

Guadalupe Credit Union developed a Predatory Debt Relief Loan that most of their members could easily qualify for, which covered the cost of the predatory loans with far better terms. In one typical example, a title lender was charging a rate of 130% APR on a loan, requiring 48 monthly payments of $962. Guadalupe’s loan replaced that with 15% APR, and 40 monthly payments of $242.

With personalized intelligence about the financial health of their members and employees, financial institutions and employers reimagine the products and benefits they offer to build financial security.

LAUNCHING THE WORKER INSIGHTS INITIATIVE

In 2021, Neighborhood Trust launched the Worker Insights Initiative, leveraging our trusted guidance and dialogue with workers alongside a dynamic new data mining system to generate nuanced and complete pictures of workers’ financial lives. We harness client insights and data to create feedback loops for financial institutions, FinTechs, benefits providers, and human resources departments, so they can design and deliver more inclusive and productive financial solutions that promote worker financial health.

These insights also enhance public advocacy and information campaigns. Last year, in coalition with Commonwealth and SaverLife, we addressed a looming financial cliff for millions of workers: they were at risk of losing thousands of dollars in tax refunds unless they proactively took advantage of an obscure provision in the tax code.

Many of the low-wage workers we serve rely on the Earned Income Tax Credit (EITC) and Child Tax Credits (CTC) to receive thousands of dollars in their tax refunds, but with so many losing work in 2020, those credits were at risk. Though Congress passed a lookback provision that allowed workers to use their 2019 income when calculating the EITC and CTC, without a major public awareness campaign, many tax filers were unlikely to take advantage of this provision.

Neighborhood Trust and our coalition partners got to work. We leveraged our vast data and insights, and conducted extensive interviews to compile tested messages that would resonate with workers. With Commonwealth’s vast communications infrastructure, our messages and guidance reached 8.7M people through 400 organizations, and appeared in 304 news articles. The taxtimehub.org website had over 100,000 visits, and our partnership continues in 2022 to build public support for resuming the transformative investment in the Child Tax Credits.

![]()

![]()

LESS DEBT, MORE CONTROL

Results FOR WORKERS

Results FOR WORKERS

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

90% of clients agreed that “Working with my coach helped me create or improve a plan for managing my finances during these uncertain times.”

We served more than 8,000 workers in 2021

While 90% of clients carry consumer debt…

|

55% then reduced their debt by a median of $4,248

|

While 46% of our clients had debt in collections…

|https://neighborhoodtrust.org/wp-admin/post.php?post=8855&action=edit#

49% reduced these debts and a quarter eliminated them entirely

|

While 72% of our clients had subprime credit scores,

|

67% improved their credit and 18% improved to a prime credit score.

|

HELPING NEW YORK’S TAXI DRIVERS NAVIGATE THEIR DEBT

Neighborhood Trust has provided Financial Counseling and Coaching to taxi medallion owners and drivers since 2020 in partnership with the Taxi and Limousine Commission’s Owner Driver Resource Center.

![]()

In 2021, owners of New York City taxi medallions won substantial debt relief in the wake of plummeting medallion values that led to increased financial and emotional hardship for driver/owners. Most of these driver/owners are immigrants who took out loans on their medallions when medallions were worth upwards of $1M, but in the wake of Uber and Lyft flooding the market, these medallion owners found themselves under water as the value of the medallions collapsed.

We’re proud to have given more than 640 drivers timely and relevant financial guidance as they navigate an uncertain time. Our Financial Coaches connected them to small business relief programs, helped them reduce their consumer debt, and walked them through improving their credit scores to widen their eligibility for safe financial products.

DCWP Commissioner Peter A. Hatch

“The NYC Department of Consumer and Worker Protection has worked with Neighborhood Trust Financial Partners for over 12 years to provide free financial counseling to more than 23,000 New Yorkers in all five boroughs. Building on this partnership, we’ve now helped hundreds of taxicab medallion owners benefit from free financial counseling to help manage and lower their debt. We would like to thank Neighborhood Trust Financial Partners for their tireless support of these essential New Yorkers by providing the right tools to reach stability.”

CO-DESIGNING FINANCIAL PRODUCTS FOR WORKERS

CO-DESIGNING FINANCIAL PRODUCTS FOR WORKERS

For the credit unions using our Pathways service, financial solutions for workers are a win-win for the institution, as well. At Guadalupe Credit Union in New Mexico, their Financial Coaches noticed that their credit-challenged members were losing thousands of dollars to exorbitant interest from predatory lending products—and they could help.

Guadalupe Credit Union developed a Predatory Debt Relief Loan that most of their members could easily qualify for, which covered the cost of the predatory loans with far better terms. In one typical example, a title lender was charging a rate of 130% APR on a loan, requiring 48 monthly payments of $962. Guadalupe’s loan replaced that with 15% APR, and 40 monthly payments of $242.

With personalized intelligence about the financial health of their members and employees, financial institutions and employers reimagine the products and benefits they offer to build financial security.

Launching the Worker Insights Initiative

Launching the Worker Insights Initiative

In 2021, Neighborhood Trust launched the Worker Insights Initiative, leveraging our trusted guidance and dialogue with workers alongside a dynamic new data mining system to generate nuanced and complete pictures of workers’ financial lives. We harness client insights and data to create feedback loops for financial institutions, FinTechs, benefits providers, and human resources departments, so they can design and deliver more inclusive and productive financial solutions that promote worker financial health.

These insights also enhance public advocacy and information campaigns. Last year, in coalition with Commonwealth and SaverLife, we addressed a looming financial cliff for millions of workers: they were at risk of losing thousands of dollars in tax refunds unless they proactively took advantage of an obscure provision in the tax code.

Many of the low-wage workers we serve rely on the Earned Income Tax Credit (EITC) and Child Tax Credits (CTC) to receive thousands of dollars in their tax refunds, but with so many losing work in 2020, those credits were at risk. Though Congress passed a lookback provision that allowed workers to use their 2019 income when calculating the EITC and CTC, without a major public awareness campaign, many tax filers were unlikely to take advantage of this provision.

Neighborhood Trust and our coalition partners got to work. We leveraged our vast data and insights, and conducted extensive interviews to compile tested messages that would resonate with workers. With Commonwealth’s vast communications infrastructure, our messages and guidance reached 8.7M people through 400 organizations, and appeared in 304 news articles. The taxtimehub.org website had over 100,000 visits, and our partnership continues in 2022 to build public support for resuming the transformative investment in the Child Tax Credits.

![]()

![]()

TrustPlus client: Lina

“My Coach has been giving me time to adjust to the past year’s transitions and the pain of losing a few family members throughout the last year. I had paused many of my goals, but now I am looking forward to picking up where I left off.”

TrustPlus client: Lina

“My Coach has been giving me time to adjust to the past year’s transitions and the pain of losing a few family members throughout the last year. I had paused many of my goals, but now I am looking forward to picking up where I left off.”

TrustPlus client: Lina

“My Coach has been giving me time to adjust to the past year’s transitions and the pain of losing a few family members throughout the last year. I had paused many of my goals, but now I am looking forward to picking up where I left off.”

Our Social Enterprise

We reach workers nationwide through a network of employers, financial services providers and worker organizations that integrate our trusted personalized financial guidance with their benefits, products and services.

As a social enterprise, every day, we prove the business value of centering workers’ needs in the benefits and financial services markets.