WageGoal Featured in Aspen EPIC Issue Brief

Payroll innovation isn’t just socially responsible—it’s smart business with the potential to impact clients’ financial health, starting with where they get paid. This recent issue of the Aspen Institute’s EPIC features our WageGoal pilot with Catholic Charities as an innovative and evidence-based fin-tech product that helps clients manage cash flow issues and overcome income volatility.

In addition to profiling WageGoal as an innovative tool for employees to gain access to accrued wages, EPIC also explores a variety of questions about how cash flow management tools can help workers take control of their finances. How are workers actually using these tools? What are the results? And what does an effective cash flow management product look like—one that builds real savings and reduces workers’ reliance on high-interest credit and late fees in order to make ends meet?

Neighborhood Trust is already exploring these issues as we use our data-driven approach to build out WageGoal and optimize the user experience. Our data analysis found clients using WageGoal in ways we hadn’t anticipated but that made real financial sense. Some users have figured out how to use WageGoal to create a weekly paycheck for themselves, thereby better matching their income and expenses. Others have noted that the increased visibility into their cash flows has provided them more confidence in their ability to manage their finances, and as a result, they have shifted bills from their credit cards to checking account debit.

Over the next year, our expert product development team will integrate these learnings to optimize the user experience and further tailor WageGoal to our clients’ needs and usage patterns. To support this effort, this summer we are also partnering with IBM’s Social Good initiative, through which IBM has provided us with a team of data scientists who are supporting us to refine and improve the cash flow model.

Wall Street Journal Showcases Pathways to Financial Empowerment

Through our Pathways program, Neighborhood Trust is working with the National Federation of Community Development Credit Unions to package our Trusted Advisor model to expand our services and provide financial counseling in new settings and regions. This video shows how credit unions are using our Trusted Advisor model to tackle the challenges they see in their communities. After an outstanding pilot year, Pathways has expanded in 2017, now serving 12 credit unions nationwide. The program has served nearly 1,800 people since launching less than two years ago.

In Other News

In fact, the last few months have been quite an exciting time for us, with our expertise recognized in a number of other places, too:

- Our new cash flow management tool WageGoal was included in a working paper published by the Harvard Kennedy School of Business entitled “FinTech Alternatives to Short-Term Small-Dollar Credit: Helping Low-Income Working Families Escape the High-Cost Lending Trap.”

- WageGoal was also featured in “Solving “more month than money” puzzle” in Banking Exchange.

- Our Pathways to Financial Empowerment program in collaboration with the National Federation of Community Development Credit Unions was also written about in CUInsight.

- Neighborhood Trust Federal Credit Union member and Neighborhood Trust Financial Partners client Clemente was featured in the National Federation of Community Development Credit Unions’s social media blitz “CDFI Credit Unions Build Inclusive Economies,” a campaign in support of the Consumer Financial Protection Bureau that has helped so many of our clients.

- For Mother’s Day, Financial Counselor Michelle Morillo was honored by New York City’s Department of Youth and Community Development as a Community Mom.

- Associate Director of Programs and former Financial Counselor Eric Espinoza was quoted in dual English and Spanish articles “The Shadow Banks of the Barrio” in a joint project of The Atlantic and Univison.

- In a blog postfor the Center for Financial Services Innovation’s national #FinHealthMatters Day, Financial Counselor Natalia Joaquin tells her story about the challenges for Latino families.

- Former Financial Counselor Yuly Arenas-Rodríguez, who is now the Director of Project HOME at New Destiny Housing in collaboration with the mayor’s office, mentions her start at Neighborhood Trust in a profile by El Diario.

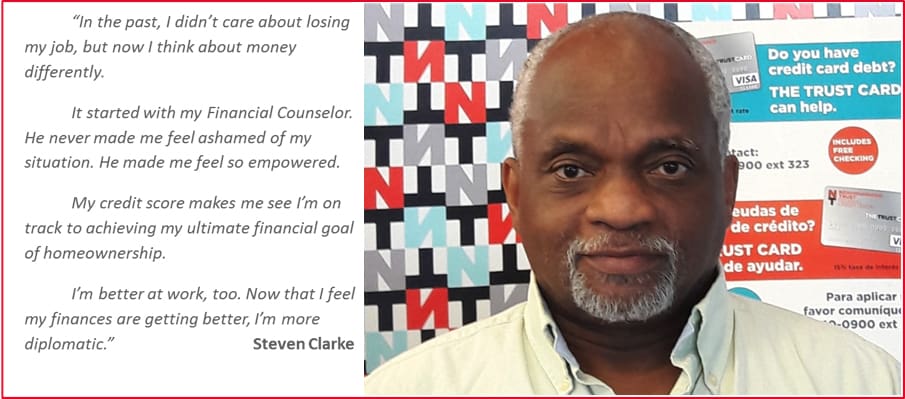

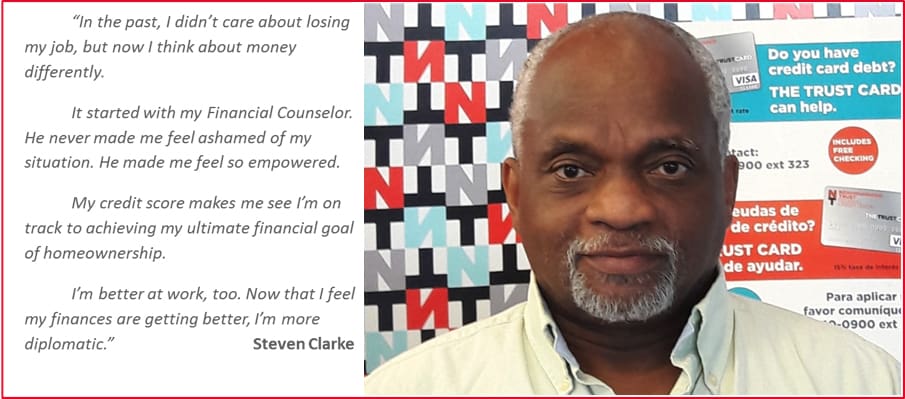

- Nevertheless, we think our clients say it best. This July, Credit Union Education Program client Steven Clarke couldn’t say enough about how transformative his experience with a Financial Counselor has been:

Follow Us