Our History

From local credit union to national financial services innovator, our journey continues, making financial security possible for all workers.

From local credit union to national financial services innovator, our journey continues, making financial security possible for all workers.

1995-1997. Founded in a Desert of Quality Financial Services

Mark Levine founds Credit Where Credit is Due, a 501(c)3 nonprofit, to support the community mobilization effort and raise the capital to secure a Federal Charter for a first-ever community development credit union in Washington Heights. Neighborhood Trust Federal Credit Union opens its doors in 1997.

2002. New CEO Joins with New Vision for Scale and Impact

Justine Zinkin joins as CEO of Credit Where Credit Is Due and Neighborhood Trust Federal Credit Union. In her first two years she orchestrates a turnaround of the credit union and expands Credit Where Credit Is Due’s financial literacy workshops.

Justine plants the seeds of our core model. Instead of the community coming to the office for financial literacy, Justine reimagines our services meeting people in the community, alongside trusted services that matter to them. She goes door-to-door to pitch to schools, job training programs, immigration services, and housing programs on this idea of Neighborhood Trust being embedded within their operations.

2004-2005. The Roots of Our Model: Expert Financial Guidance Comes to You

Justine plants the seeds of our core model. Instead of the community coming to us at the bus terminal for workshops, Justine reimagines our workshops going to the community at local organizations and churches. She goes door-to-door to pitch different groups in the neighborhood on the idea.

2006. The First Financial Empowerment Centers

Mayor Michael Bloomberg’s administration launches the first Financial Empowerment Centers, a free financial coaching program for NYC residents in all five boroughs. CWCID is selected as one of the main service providers for this program.

2008. Getting Ahead

We launch Getting Ahead, a financial basics workshop, developed in partnership with Global Learning Partners (GLP). The Getting Ahead curriculum applied adult learning principles from Global Learning Partners and incorporated curated financial products to help participants achieve their financial goals. The workshop created space for participants to learn about the US financial system and access foundational products & services such as credit cards, secured loans, and free checking & savings accounts.

The onset of the COVID-19 pandemic and a strategic focus on at-scale coaching services, led us to pivot away from the workshop model, leading to the discontinuation of Getting Ahead in 2020. The foundations of Getting Ahead still live on in our financial coaching services today, as the program’s dialogue education methodology and adult learning principles are infused throughout our service design and financial coaching IP.

2012. Becoming Neighborhood Trust Financial Partners

Credit Where Credit Is Due becomes Neighborhood Trust Financial Partners. In addition to debuting a new name, we move-in to a new home at the Triangle Building on 166th Street in Washington Heights.

Neighborhood Trust Financial Partners and Neighborhood Trust Federal Credit Union became independent organizations but remain close partners. This shift in management enabled Neighborhood Trust Financial Partners to expand nationally.

2012. TrustPlus Is Launched

Neighborhood Trust was an early mover in the employee financial wellness space, as we understood first-hand that the changing nature of work was adversely impacting worker financial health. In 2012, we recognized the potential for integrating a financial coaching + product model within the workplace and offering it as a formal employee financial health benefit to employers via TrustPlus.

In TrustPlus’ first iteration, we offered financial coaching onsite in the workplace to employees during their lunch breaks. The service set out to re-think the role HR practices and policies play in workers’ financial lives and to encourage employers to be more accountable to their employees’ financial health.

TrustPlus quickly showed the value this formal benefit held for both employees and employers. By seamlessly accessing financial coaching within their workplace, workers could make the most of their paychecks and reduce their financial stress. For employers, offering a financial health solution that meets the near-term financial needs of their workforce helps increase benefit usage and support a healthier workforce.

2015. Financial Coaching Solutions for Credit Unions and Financial Institutions

We launch Pathways in partnership with credit union network Inclusiv. Pathways trains credit union staff to provide our model of trusted, action-oriented financial coaching to its members and track data and results via our proprietary technology platform. Today, Pathways serves credit unions and financial institutions nationwide.

2017. Financial Coaching Where and When You Need It

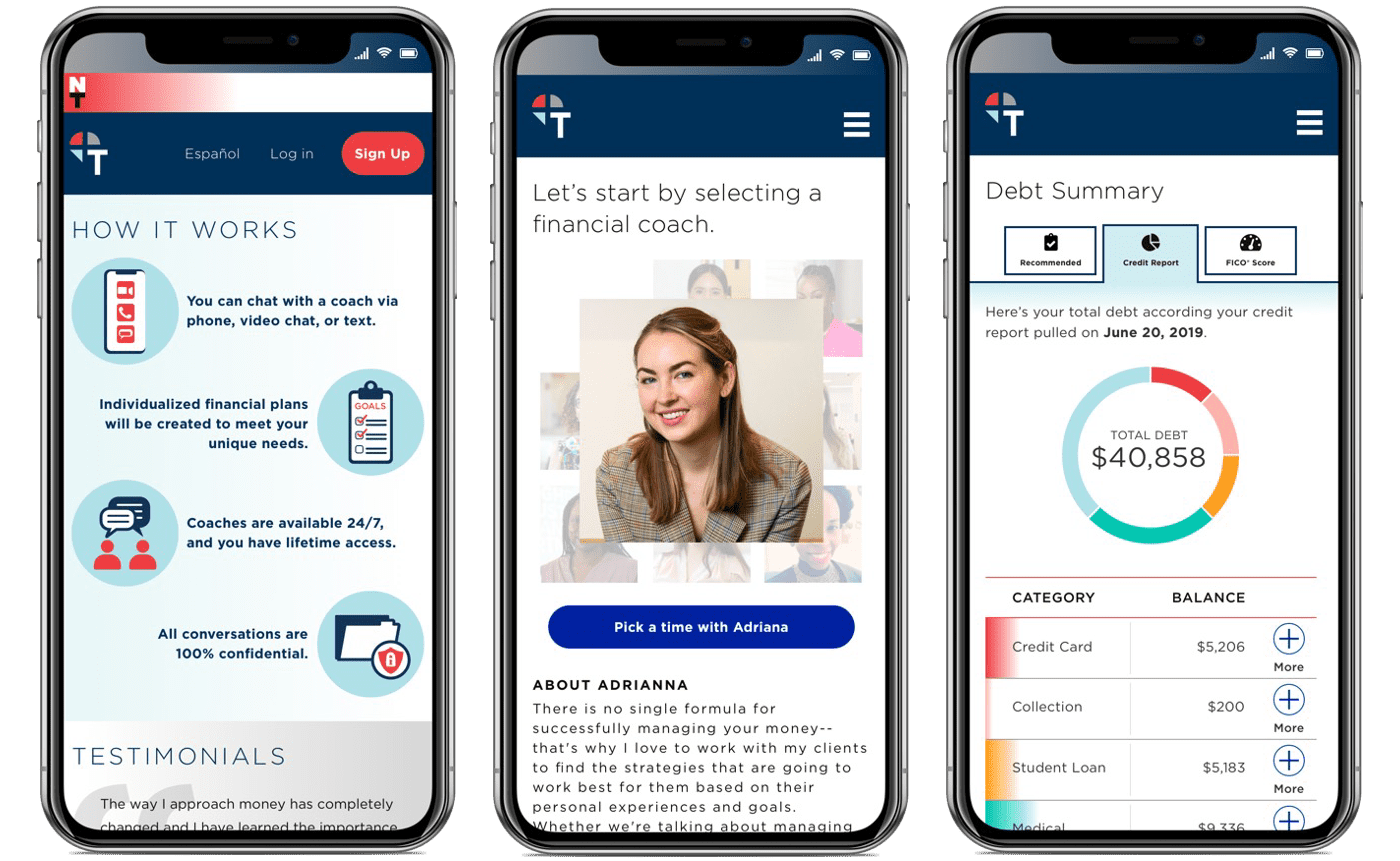

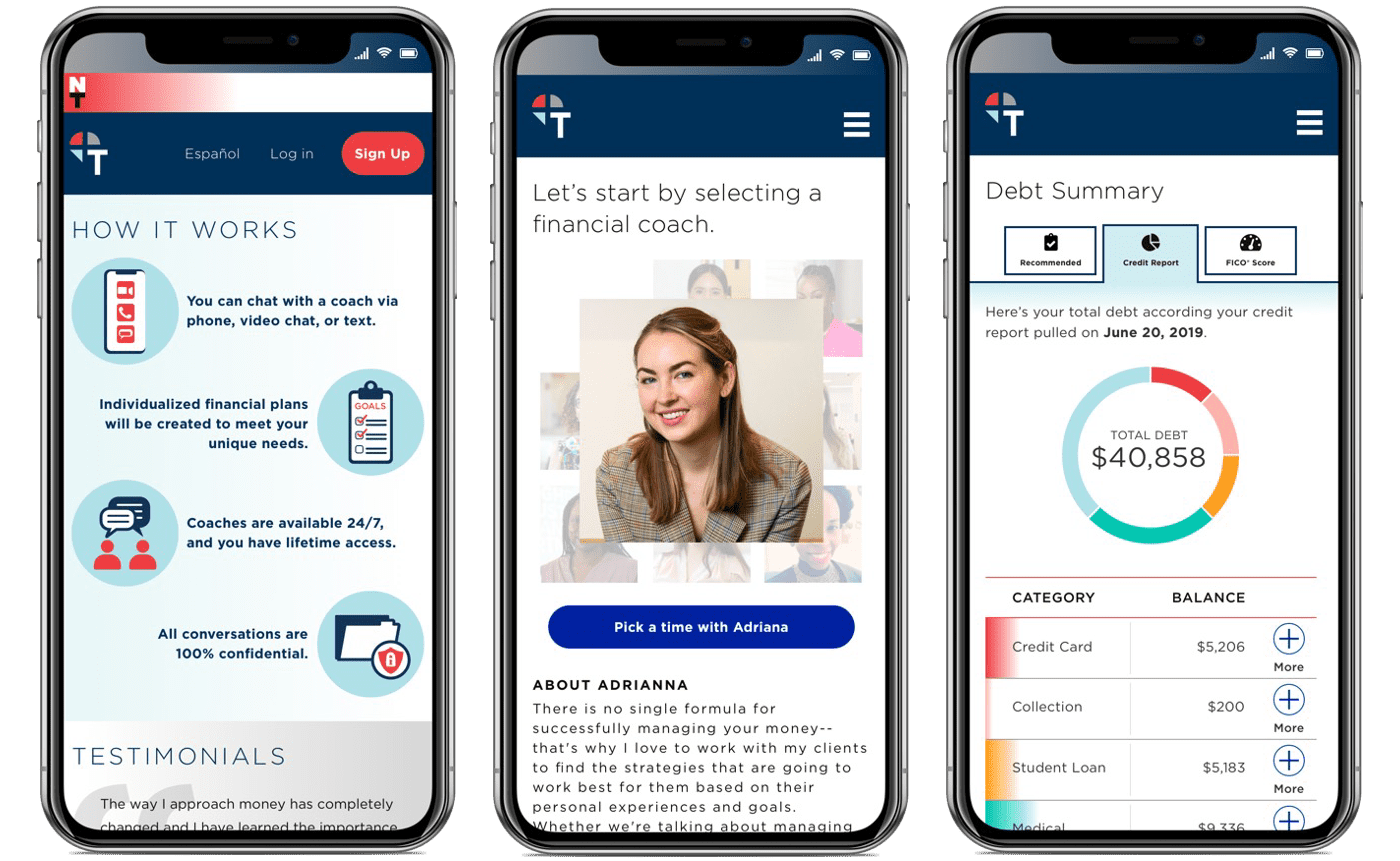

With the launch of the TrustPlus digital platform, Neighborhood Trust set the stage for national expansion and impact. The remote accessibility and ease of the platform enabled busy workers to receive financial coaching anytime, anywhere via phone/Skype. It also enabled further engagement with the service via SMS/email and access to financial health tools like budgeting apps, credit reports, and linkages to bank accounts.

The platform not only enabled TrustPlus to reach workers at employers across the country, but allowed for seamless integrations with FinTechs, digital products, and other financial services platforms. It also set the stage for ongoing advances in the collection and evaluation of worker financial health data, which is core to Neighborhood Trust’s systemic change agenda and Worker Insights Initiative.

2020. Financial First Responders: Putting Cash in Families’ Hands Fast

Responding to the onset of the COVID-19 pandemic, we distribute $2 million to 3,600+ recipients from funders looking to get unconditional cash relief in workers’ hands fast and to magnify its impact by pairing it with our personal finance coaching.

2021. Driving Product and Policy Innovation with the Worker Insights Initiative

We introduce the Worker Insights Initiative to bring the lived reality and complex financial lives of low-wage workers more powerfully to the market, surfacing data to drive product and policy innovation and more inclusive financial solutions that promote worker financial health and productivity.

Today. A National Financial Services Innovator

As a leading national financial services innovator, we are pursuing an ambitious strategy as trusted guides connecting workers to financial benefits, co-designing products and services that meet their complex, immediate and long-term needs. We aim to use the insights from our work to help employers, nonprofits, banks, FinTechs, and policymakers to better understand the financial challenges facing workers–and to push the marketplace to be more accountable to workers’ needs, which is just smart business, social enterprise.

Our national financial health solution for employers, TrustPlus, helps workers manage debt, strengthen credit, and build savings. Our financial coaching methodology and data tracking platform, Pathways to Financial Empowerment, helps credit unions throughout the country integrate coaching into their operations which yields benefits for the credit unions and their members.

We continue to be the lead vendor to New York City’s Financial Empowerment Centers and a trusted source of worker insights and data for a growing list of partners nationwide.

1995-1997. Founded in a Desert of Quality Financial Services

Mark Levine founds Credit Where Credit is Due, a 501(c)3 nonprofit, to support the community mobilization effort and raise the capital to secure a Federal Charter for a first-ever community development credit union in Washington Heights. Neighborhood Trust Federal Credit Union opens its doors in 1997.

2002. New CEO Joins with New Vision for Scale and Impact

Justine Zinkin joins as CEO of Credit Where Credit Is Due and Neighborhood Trust Federal Credit Union. In her first two years she orchestrates a turnaround of the credit union and expands Credit Where Credit Is Due’s financial literacy workshops.

Justine plants the seeds of our core model. Instead of the community coming to the office for financial literacy, Justine reimagines our services meeting people in the community, alongside trusted services that matter to them. She goes door-to-door to pitch to schools, job training programs, immigration services, and housing programs on this idea of Neighborhood Trust being embedded within their operations.

2004-2005. The Roots of Our Model: Expert Financial Guidance Comes to You

Justine plants the seeds of our core model. Instead of the community coming to us at the bus terminal for workshops, Justine reimagines our workshops going to the community at local organizations and churches. She goes door-to-door to pitch different groups in the neighborhood on the idea.

2006. The First Financial Empowerment Centers

Mayor Michael Bloomberg’s administration launches the first Financial Empowerment Centers, a free financial coaching program for NYC residents in all five boroughs. CWCID is selected as one of the main service providers for this program.

2008. Getting Ahead

We launch Getting Ahead, a financial basics workshop, developed in partnership with Global Learning Partners (GLP). The Getting Ahead curriculum applied adult learning principles from Global Learning Partners and incorporated curated financial products to help participants achieve their financial goals. The workshop created space for participants to learn about the US financial system and access foundational products & services such as credit cards, secured loans, and free checking & savings accounts.

The onset of the COVID-19 pandemic and a strategic focus on at-scale coaching services, led us to pivot away from the workshop model, leading to the discontinuation of Getting Ahead in 2020. The foundations of Getting Ahead still live on in our financial coaching services today, as the program’s dialogue education methodology and adult learning principles are infused throughout our service design and financial coaching IP.

2012. Becoming Neighborhood Trust Financial Partners

Credit Where Credit Is Due becomes Neighborhood Trust Financial Partners. In addition to debuting a new name, we move-in to a new home at the Triangle Building on 166th Street in Washington Heights.

Neighborhood Trust Financial Partners and Neighborhood Trust Federal Credit Union became independent organizations but remain close partners. This shift in management enabled Neighborhood Trust Financial Partners to expand nationally.

2012. TrustPlus is Launched

Neighborhood Trust was an early mover in the employee financial wellness space, as we understood first-hand that the changing nature of work was adversely impacting worker financial health. In 2012, we recognized the potential for integrating a financial coaching + product model within the workplace and offering it as a formal employee financial health benefit to employers via TrustPlus.

In TrustPlus’ first iteration, we offered financial coaching onsite in the workplace to employees during their lunch breaks. The service set out to re-think the role HR practices and policies play in workers’ financial lives and to encourage employers to be more accountable to their employees’ financial health.

TrustPlus quickly showed the value this formal benefit held for both employees and employers. By seamlessly accessing financial coaching within their workplace, workers could make the most of their paychecks and reduce their financial stress. For employers, offering a financial health solution that meets the near-term financial needs of their workforce helps increase benefit usage and support a healthier workforce.

2015. Financial Coaching Solutions for Credit Unions and Financial Institutions

We launch Pathways in partnership with credit union network Inclusiv. Pathways trains credit union staff to provide our model of trusted, action-oriented financial coaching to its members and track data and results via our proprietary technology platform. Today, Pathways serves credit unions and financial institutions nationwide.

2017. Financial Coaching Where and When You Need It

With the launch of the TrustPlus digital platform, Neighborhood Trust set the stage for national expansion and impact. The remote accessibility and ease of the platform enabled busy workers to receive financial coaching anytime, anywhere via phone/Skype. It also enabled further engagement with the service via SMS/email and access to financial health tools like budgeting apps, credit reports, and linkages to bank accounts.

The platform not only enabled TrustPlus to reach workers at employers across the country, but allowed for seamless integrations with FinTechs, digital products, and other financial services platforms. It also set the stage for ongoing advances in the collection and evaluation of worker financial health data, which is core to Neighborhood Trust’s systemic change agenda and Worker Insights Initiative.

2020. Financial First Responders: Putting Cash in Families’ Hands Fast

Responding to the onset of the COVID-19 pandemic, we distribute $2 million to 3,600+ recipients from funders looking to get unconditional cash relief in workers’ hands fast and to magnify its impact by pairing it with our personal finance coaching.

2021. Driving Product and Policy Innovation with the Worker Insights Initiative

We introduce the Worker Insights Initiative to bring the lived reality and complex financial lives of low-wage workers more powerfully to the market, surfacing data to drive product and policy innovation and more inclusive financial solutions that promote worker financial health and productivity.

Today. A National Financial Services Innovator

As a leading national financial services innovator, we are pursuing an ambitious strategy as trusted guides connecting workers to financial benefits, co-designing products and services that meet their complex, immediate and long-term needs. We aim to use the insights from our work to help employers, nonprofits, banks, FinTechs, and policymakers to better understand the financial challenges facing workers–and to push the marketplace to be more accountable to workers’ needs, which is just smart business, social enterprise.

Our national financial health solution for employers, TrustPlus, helps workers manage debt, strengthen credit, and build savings. Our financial coaching methodology and data tracking platform, Pathways to Financial Empowerment, helps credit unions throughout the country integrate coaching into their operations which yields benefits for the credit unions and their members.

We continue to be the lead vendor to New York City’s Financial Empowerment Centers and a trusted source of worker insights and data for a growing list of partners nationwide.

Follow Us