The Role of Human Touch in Emergency Cash Relief

Financial coaching can support cash relief efforts by:

- Addressing the digital and banking divide by helping recipients navigate the cash relief process and overcome barriers to a technology-based cash relief application;

- Leveraging one-time cash disbursements into ongoing support with creating a holistic plan to achieve financial security; and

- Informing product design by surfacing issues that vulnerable populations face when trying to access financial services and generate solutions that make those products more inclusive and effective.

Mission + Technology: The Power of Nonprofit Fintechs

In March 2020, as the U.S. realized the severity of the coronavirus pandemic and prepared for an economic shut down, Neighborhood Trust Financial Partners and SaverLife—two nonprofit FinTechs dedicated to financial security and inclusion for working families typically left out of the financial system—anticipated the devastating impact the financing crisis would have on low-to-moderate income families.

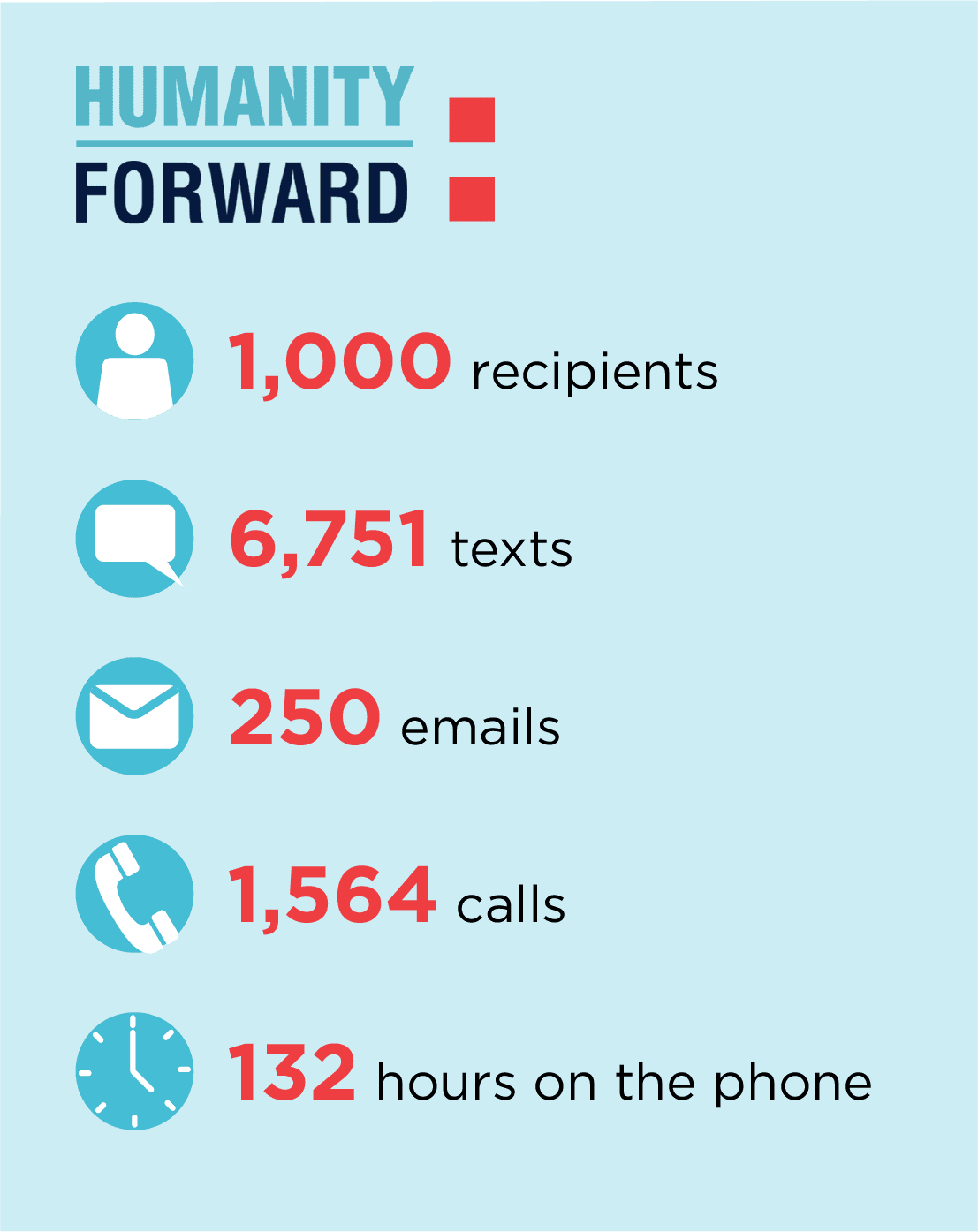

Given our existing partnership and a shared belief in combining mission with technology, Neighborhood Trust and SaverLife brought together our complementary strengths. Neighborhood Trust utilized its TrustPlus financial coaching to help workers navigate financial shocks and link them to smart financial tools and products. SaverLife leveraged its tech infrastructure to turn a savings platform into a cash distribution platform, deploying this same technology to send money straight to those who need it. Together, we launched an emergency cash relief + coaching effort to disburse money quickly and to help recipients build and pursue a financial plan.

The resulting collaboration on program and user experience design, recruitment of vulnerable families, onboarding support, cash disbursement, and financial coaching to help cash recipients make a financial plan was an extensive effort that came together in just a few weeks.

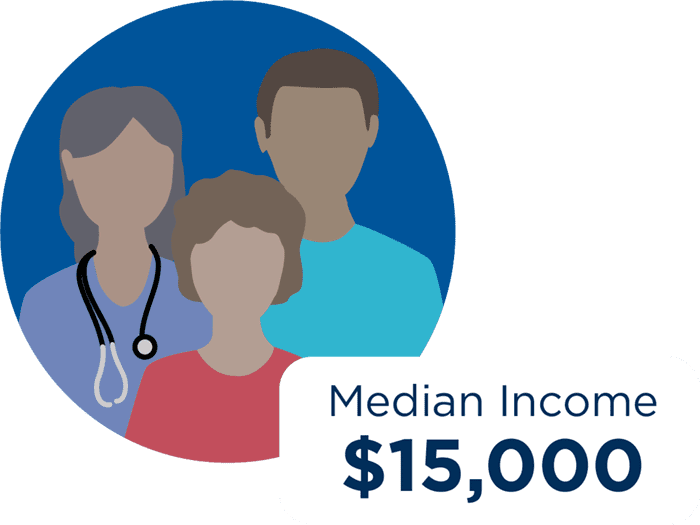

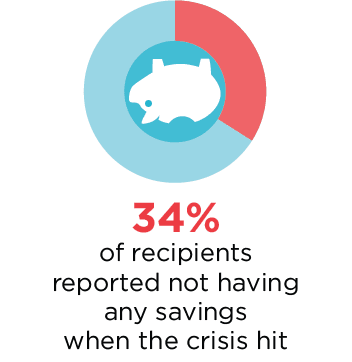

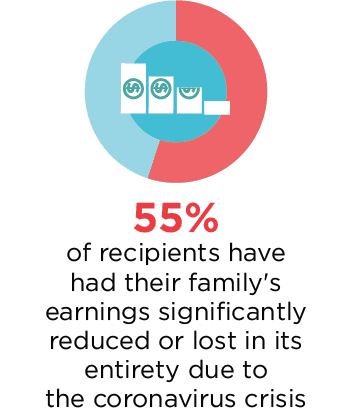

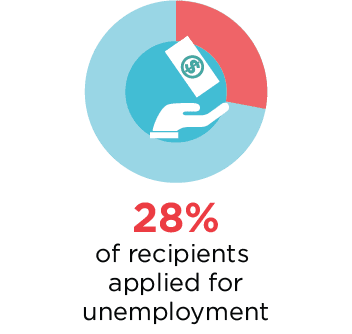

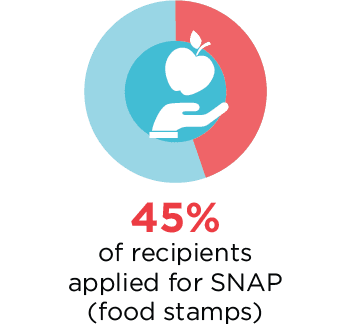

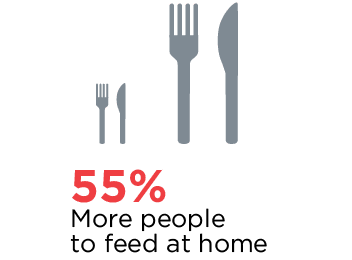

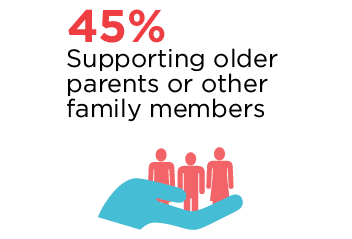

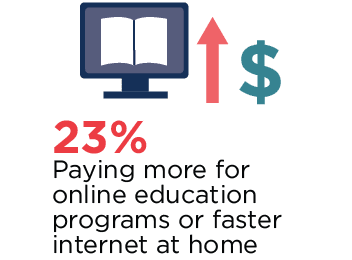

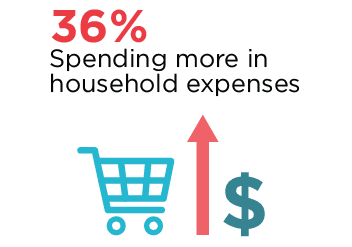

Our cash relief recipients reflect the people hardest hit by the economic effects of the pandemic:

Who We Served

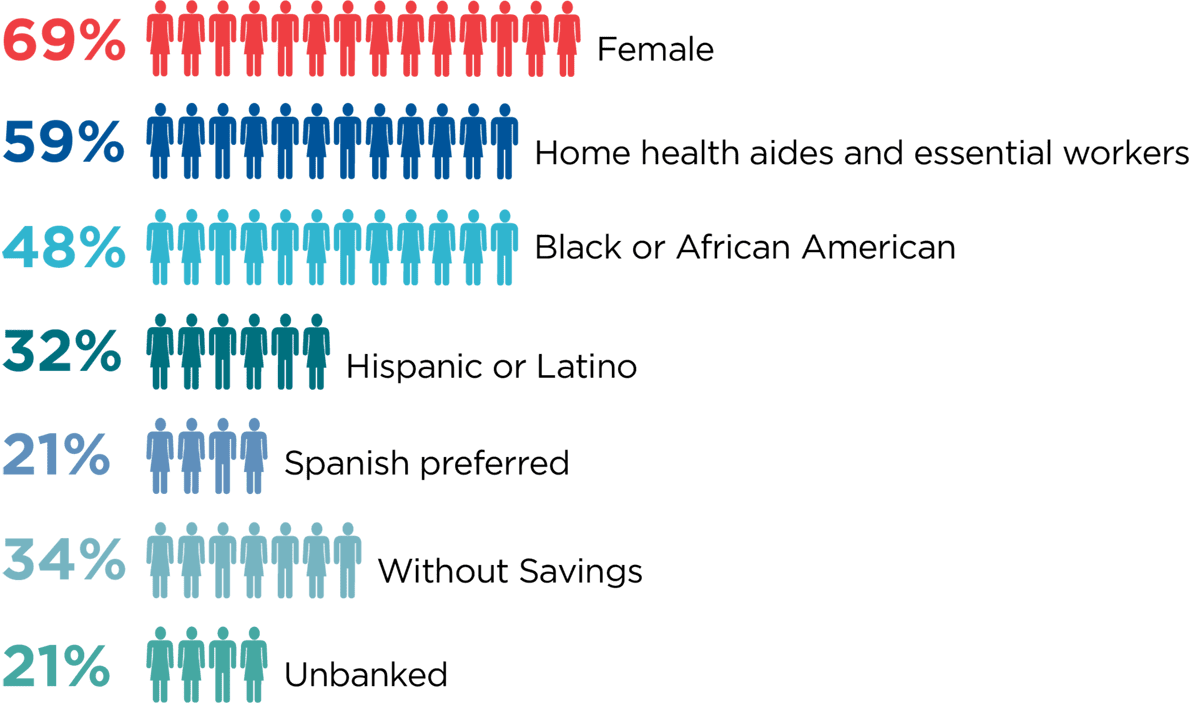

How Recipients Were Impacted by the Crisis

When the crisis broke, our recipients, like millions of us across the U.S., were concerned about job loss, fear of not being able to pay rent, providing food for their families, and anxiety and uncertainty about what was to come.

How has it affected them emotionally?

How has the crisis affected them financially?

Human Touch Critical for Bridging the Digital and Banking Divide

For the majority of cash relief recipients, it was relatively easy for them to onboard with little support. But for about 20% of recipients who did not have a bank account or who were inexperienced or uncomfortable with technology, they needed significantly more support to get through the process.

With a legacy of poor treatment by financial services, they are very wary of scams, scared of their data being used in predatory ways, and scared of taking risks because they are operating on thin margins.

20% needed extra support:

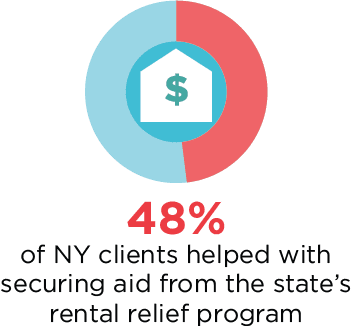

48% Help with application

28% Other (Setting up email accounts, tracking down lost payments, etc.)

17% Verify legitimacy of offer

6% Support for banking issues

1% All of the above

As a result, things about a website that are intuitive to most people who are accustomed to navigating the internet can be challenging or daunting to others, such as knowing where to click next to go to the next screen, understanding that you have to fill out data to go to next screen—these can be a challenge for people not used to doing things online.

Also, many people we spoke with thought “I can’t do this” when they saw the application, but after we walked them through it, they realized it wasn’t that complicated. In many cases, they just had an instinctive resistance to technology and wanted to speak to a person to make sure they were filling it out properly.

Technology and Banking Challenges Faced

For those who struggled with technology and banking challenges, it typically surfaced in the following ways:

Unaccustomed or uncomfortable with digital payment products: For people accustomed to deal exclusively or primarily with cash, they were experiencing digital payment products, linking to online bank accounts, etc. for the first time. They needed additional guidance in understanding the different options to select which one would be best for them.

No email / underutilized email accounts: Often they technically had an email account, but their daughter, nephew, or cousin set it up and they didn’t check it regularly or remember the password. Our team had to speak with the family member to assist in tracking down an email or reset password, or helped the recipient create a new email address altogether.

Banking challenges: The tech literacy gap overlapped with the lack of existing financial infrastructure in these households when digital platforms offered an option to link payment to a bank account. People without bank accounts got stuck, unsure how to navigate – will they be able to get paid if they didn’t have a bank account? Will there be repercussions if they skip that prompt? In the COVID-19 cash relief recipient pool alone, 21% of recipients did not have a bank account.

Unreliable wifi: Unreliable wifi signals meant that click-through pages would disappear when the signal dropped, or if users entered information incorrectly.

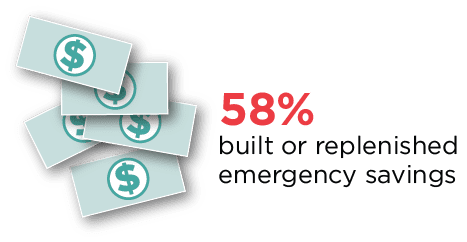

Impact of Ongoing Support

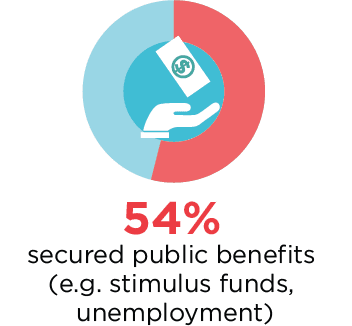

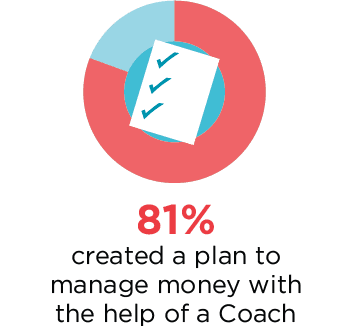

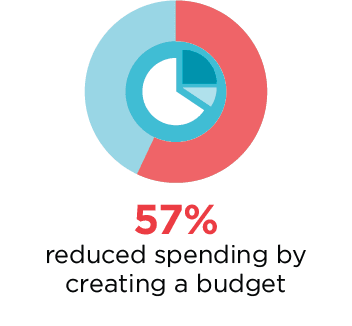

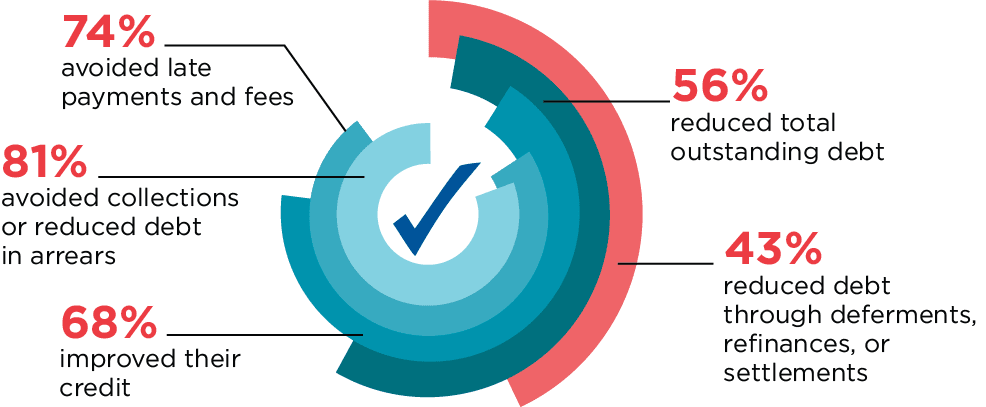

After recipients received cash, we continued to provide support via financial coaching, helping cash relief recipients identify additional resources, develop a plan and stick to it to achieve financial security.

Accessing cash relief

Managing money

Managing debt and credit

Rebuilding savings

Takeaways

Make sure cash relief doesn’t leave out the hardest to serve. As nonprofits, Neighborhood Trust and SaverLife are both committed to making sure the money gets into the hands of the most vulnerable. By pairing cash relief with financial coaching, we helped ensure a more inclusive program that helped bridge the digital and banking divide.

There’s an opportunity to leverage cash transfers to connect people to quality banking services. The methods of cash transfer distribution offer different trade-offs, between short-term efficiency (i.e. user experience and reducing friction during one-time transactions) and efficacy in bringing the beneficiary populations into mainstream financial services (i.e. establishing on-ramps to credit unions and bank accounts). While our program was focused on emergency cash relief where speed is a big priority, we see an opportunity to leverage ongoing cash infusions like UBI as opportunities to get people banked.

Follow Us