By the Numbers

Influencing Individuals, Institutions, and the Market

Financial insecurity has become the norm for most U.S. workers, rooted in the failures of the labor and financial services markets to understand and meet workers’ needs. We’re out to change that. Our results to date:

Influencing Individuals, Institutions, and the Market

Financial insecurity has become the norm for most U.S. workers, rooted in the failures of the labor and financial services markets to understand and meet workers’ needs. We’re out to change that. Our results to date:

Our National Reach

Since our national expansion in 2012, Neighborhood Trust’s Financial Coaching has reached:

62,450 workers

in 49 states

and 250+ Customers

at 24 credit unions

and in 61 cities in partnership with the Cities for Financial Empowerment Fund

Through 2022:

reduced $131M in debt

2,610 workers eliminated their debt

7,477 eliminated their collections debts

5,484 established credit

6,830 reached prime credit scores

62% of our clients are women, 83% are people of color, and 46% have debt in collections. Their median annual income is $30,000.

Results FOR WORKERS

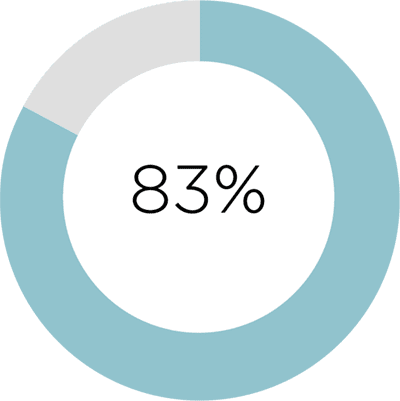

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

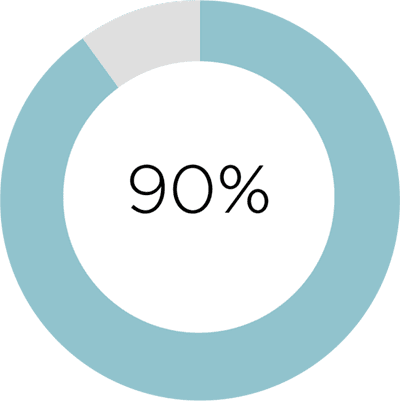

90% of clients agreed that “Working with my coach helped me create or improve a plan for managing my finances during these uncertain times.”

While 90% of clients carry consumer debt…

|

55% then reduced their debt by a median of $4,248

|

While 46% of our clients had debt in collections…

|

49% reduced these debts and a quarter eliminated them entirely

|

While 72% of our clients had subprime credit scores…

|

67% improved their credit and 18% improved to a prime credit score

|

Results FOR WORKERS

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

90% of clients agreed that “Working with my coach helped me create or improve a plan for managing my finances during these uncertain times.”

While 90% of clients carry consumer debt…

|

55% then reduced their debt by a median of $4,248

|

While 46% of our clients had debt in collections…

|

49% reduced these debts and a quarter eliminated them entirely

|

While 72% of our clients had subprime credit scores…

|

67% improved their credit and 18% improved to a prime credit score

|

Results FOR WORKERS

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

90% of clients agreed that “Working with my coach helped me create or improve a plan for managing my finances during these uncertain times.”

While 90% of clients carry consumer debt…

|

55% then reduced their debt by a median of $4,248

|

While 46% of our clients had debt in collections…

|

49% reduced these debts and 1/4 eliminated them entirely

|

While 72% of our clients had subprime credit scores…

|

67% improved their credit and 18% improved to a prime credit score

|

Follow Us