2020 laid bare worker insecurity. Neighborhood Trust delivered financial relief across the country—with a human touch.

“I was in a position where I had to choose between eating, paying rent, or paying my student loans. With my financial coach’s help, now I have enough savings to cover a month’s expenses for the first time in my life.” —Milly T.

From Our CEO

Dear Friends,

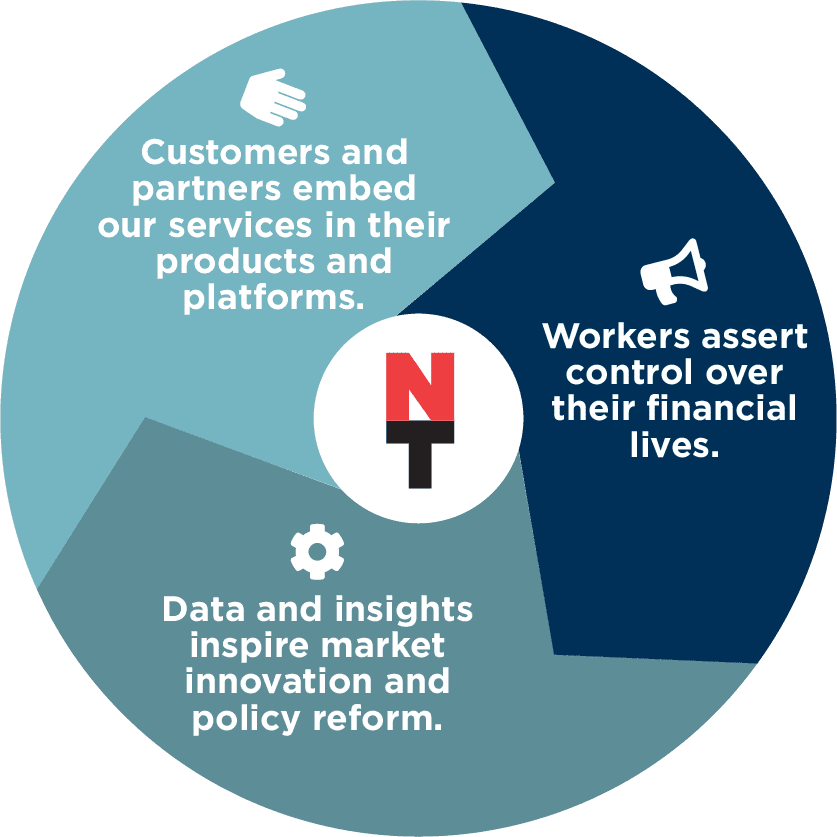

As we all struggled under the specter of a worldwide pandemic, we also witnessed the unequal distribution of the pain, by race and class. This should not have been a surprise given that, pre-pandemic, more than half of working families were living paycheck to paycheck; for workers of color especially, the chasm between work and opportunity has only grown. This, our first Annual Report, captures the power of Neighborhood Trust’s national presence—a technology platform that ensures our trusted, human-touch financial coaching is accessible in an increasingly algorithmic and unequal economy. This year I am especially honored to celebrate our financial coaches who have served as first responders for thousands of struggling families.

Our work behind the scenes was just as powerful, as we overlaid our financial coaching operation with a data collection and analytics effort surfacing invaluable insights about, and showing the human face of, income inequality. We continue to invest in this feedback loop, spurring collaborations with customers and partners on better financial products, and bolstering allies in supporting a bold workers’ rights agenda.

As we get to work in 2021, we benefit from a portfolio of small businesses, large-scale benefits providers, FinTechs and worker platforms who serve as channels to millions of workers we are ready to serve.

Today, the commitment to a new, more equitable, economy is shared by so many, and the potential for innovation is palpable. As a nonprofit steeped in the cooperative values of the credit union movement, we are energized by the opportunity to work alongside our peer nonprofits, as well as our customers, to help workers gain leverage.

I am grateful to our many allies and advocates for their support of our work; and energized by our shared commitment to bold action. I’m wishing everyone a secure and healthy 2021.

Justine Zinkin

Chief Executive Officer

We deliver trusted financial guidance and tools at scale. We leverage our clients’ stories as a force for an inclusive and equitable economy.

Our reach in 2020

- 7,400+ clients served

- 3,600+ cash relief recipients

- 230+ portfolio customers and partners

“This is a community of working poor. People are living check to check… It’s all up in the air.” —DAVID

“This is a community of working poor. People are living check to check… It’s all up in the air.” —DAVID

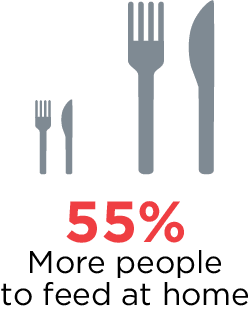

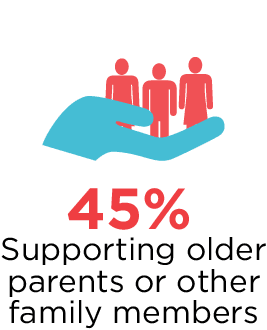

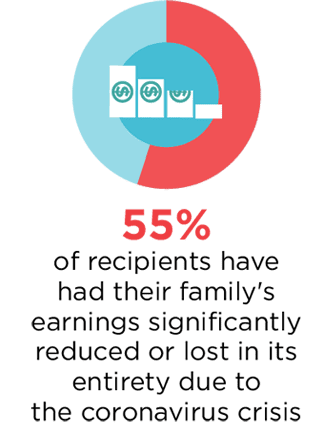

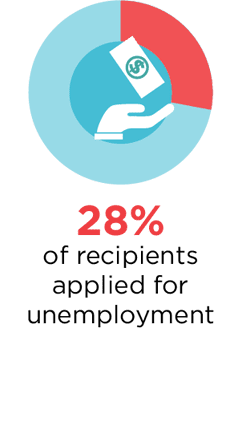

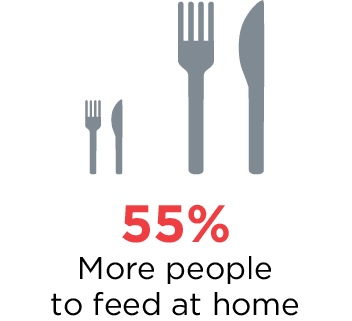

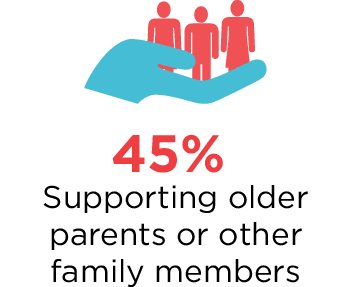

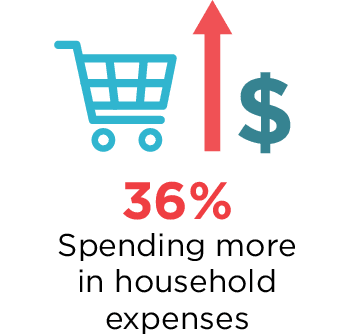

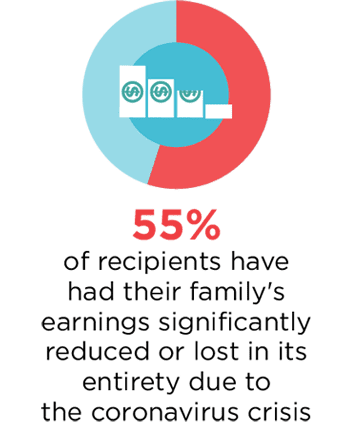

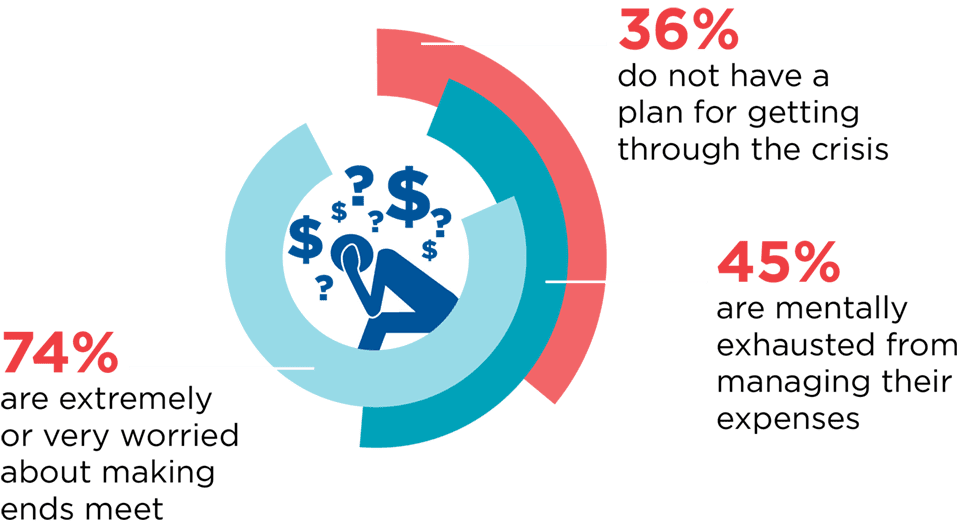

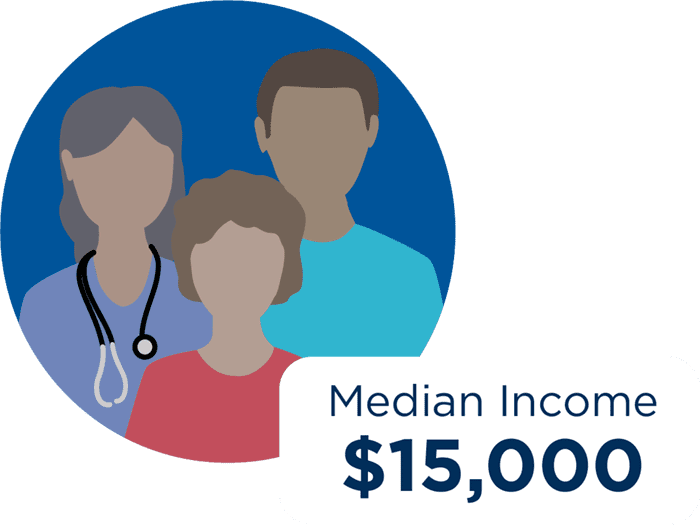

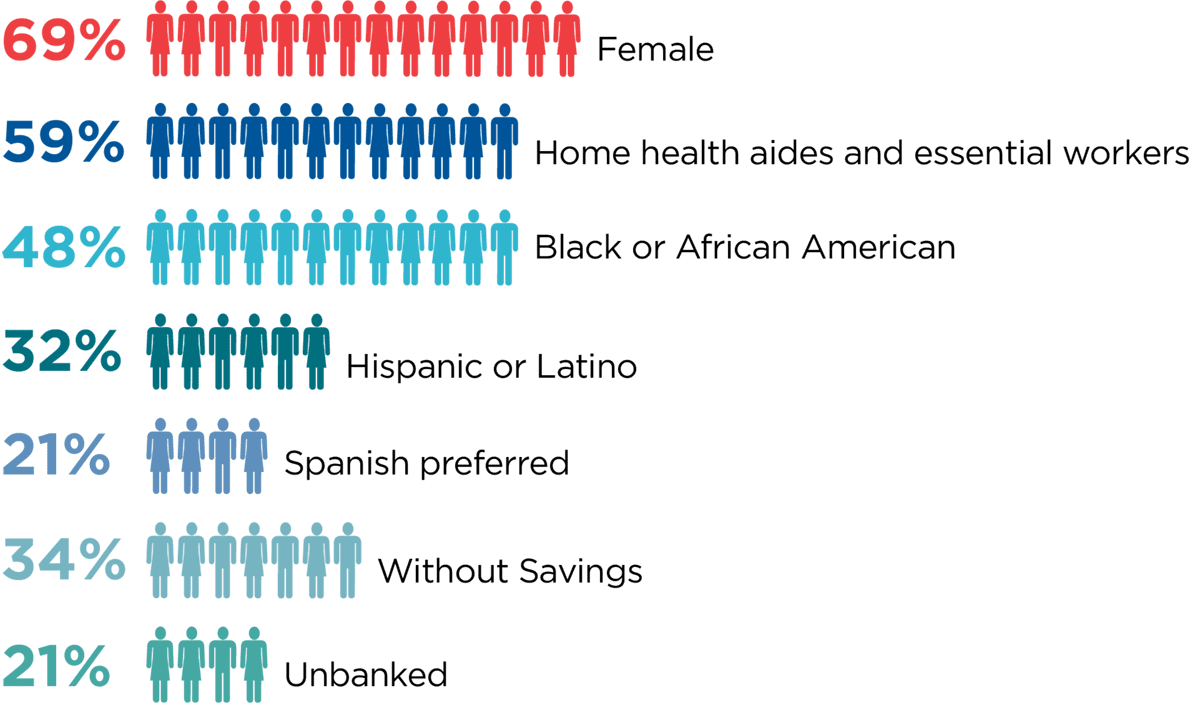

Our clients are in crisis: earnings dissipated while basic expenses grew

How has the crisis affected our clients financially?

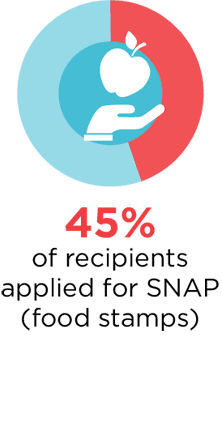

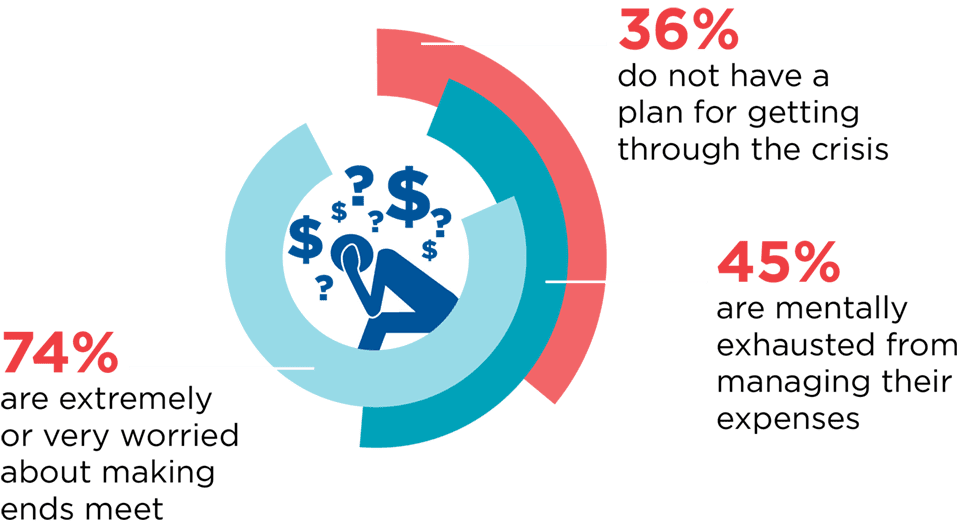

How else has the crisis affected our clients?

Our clients are in crisis: earnings dissipated while basic expenses grew

How has the crisis affected our clients financially?

How else has the crisis affected our clients?

Financial

First Responders

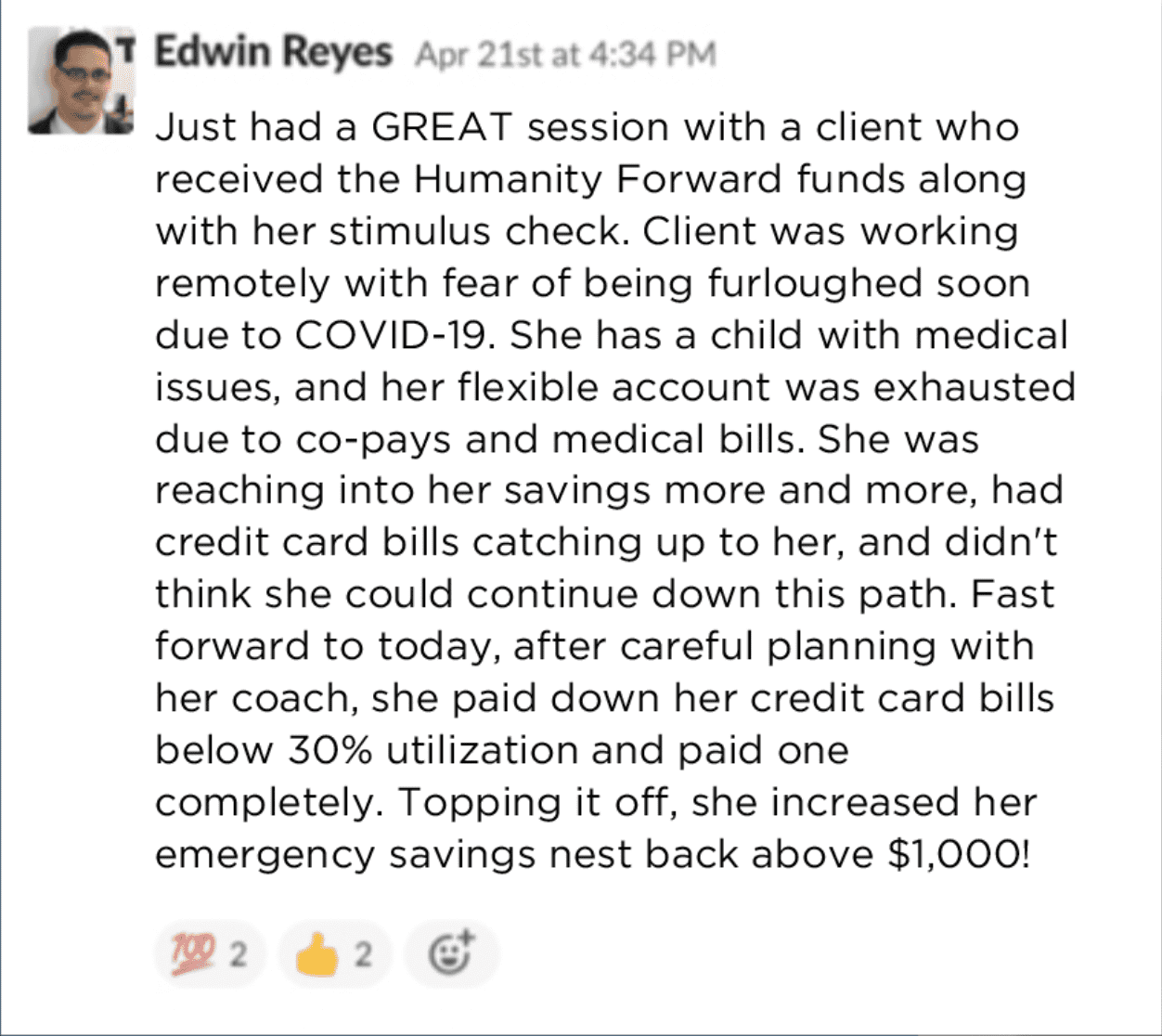

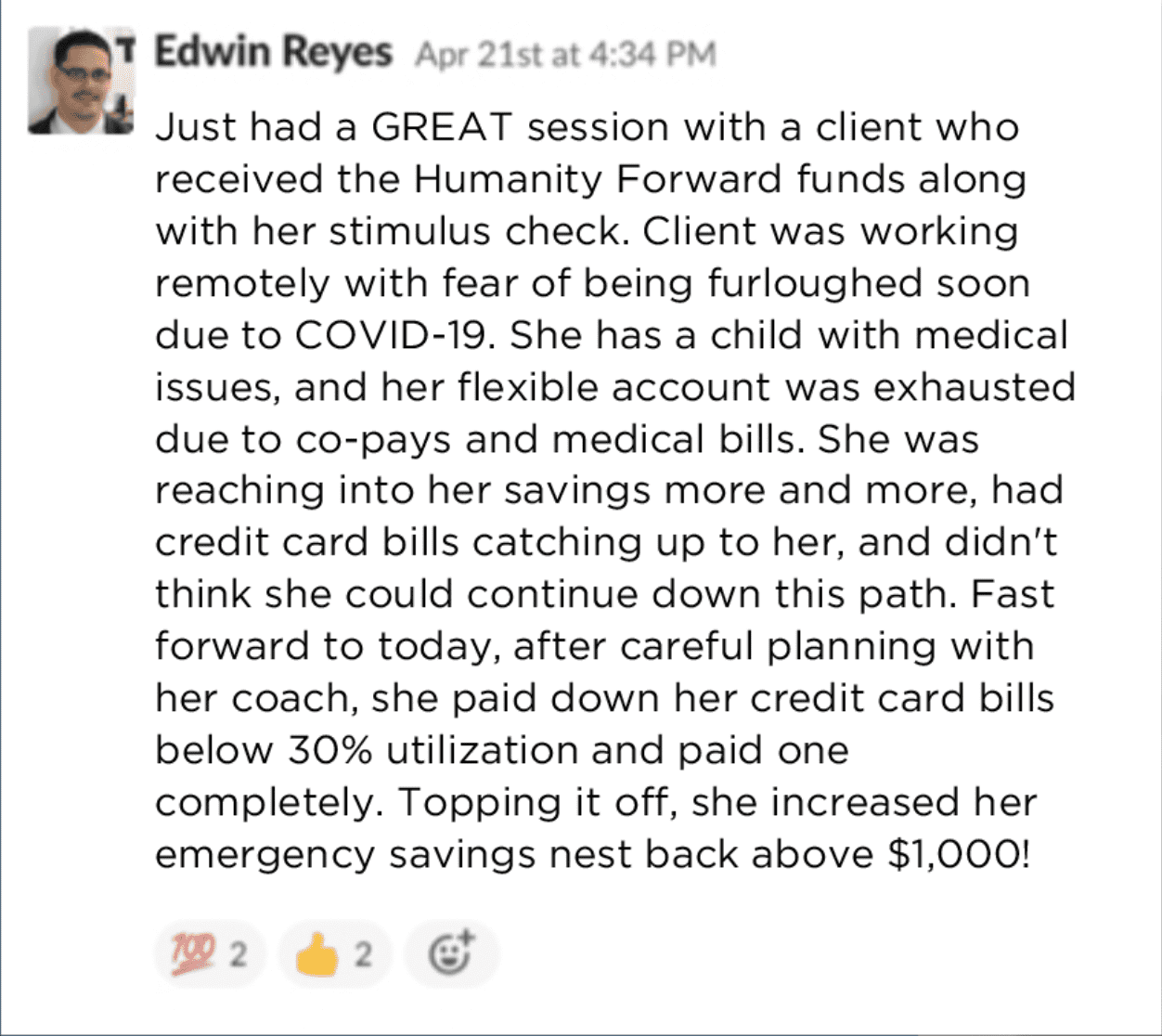

Pairing our human-touch financial coaching with unconditional cash relief magnifies the impact of each—which is why funders turned to Neighborhood Trust to safely and reliably distribute cash directly to those in need.

$2M distributed to 3,600+ recipients

Our inclusive cash transfer model works: trusted financial coaches, embedded in credit unions and trusted FinTechs like SaverLife, overcome barriers of trust and technology and put money in families’ hands fast.

“I’m in the South Bronx and we’re getting hit so hard. We ran out of food stamps two weeks ago and have only had $5 cash for two weeks. Getting $1,000 is such a blessing. When I got the text I broke down crying because there was no other help.” —RAMONA

Financial

First Responders

Pairing our human-touch financial coaching with unconditional cash relief magnifies the impact of each—which is why funders turned to Neighborhood Trust to safely and reliably distribute cash directly to those in need.

$2M distributed to 3,600+ recipients

Our inclusive cash transfer model works: trusted financial coaches, embedded in credit unions and trusted FinTechs like SaverLife, overcome barriers of trust and technology and put money in families’ hands fast.

“I’m in the South Bronx and we’re getting hit so hard. We ran out of food stamps two weeks ago and have only had $5 cash for two weeks. Getting $1,000 is such a blessing. When I got the text I broke down crying because there was no other help.” —RAMONA

Recognizing our unique proximity to the hardest-hit workers, these funders reached out to us to coordinate cash relief:

Our partnerships with these organizations made our inclusive cash relief efforts possible:

Recognizing our unique proximity to the hardest-hit workers, these funders reached out to us to coordinate cash relief:

Our partnerships with these organizations made our inclusive cash relief efforts possible:

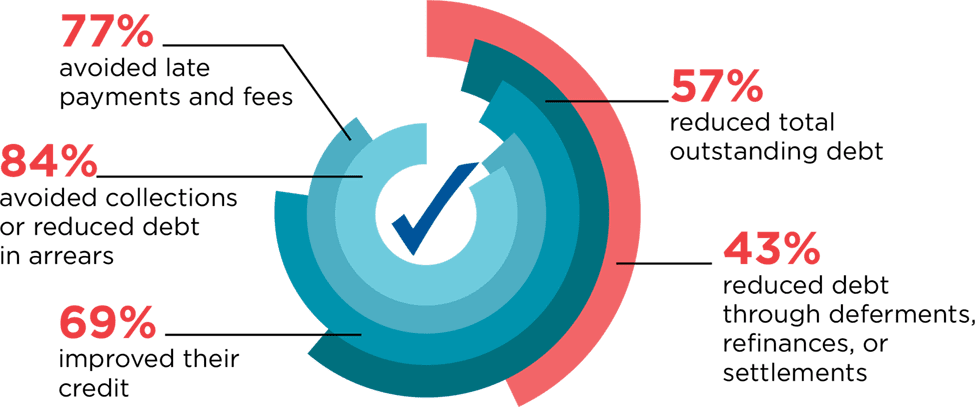

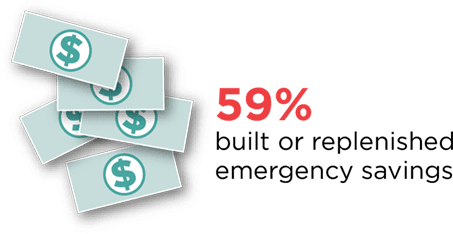

Pairing cash transfers with financial coaching magnifies impact

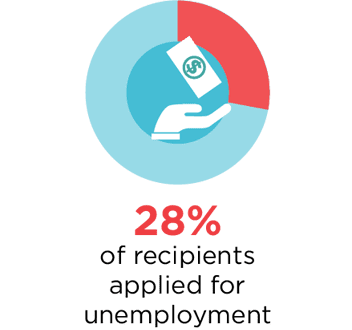

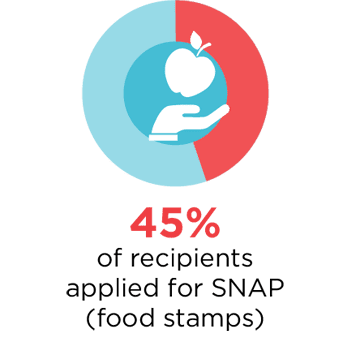

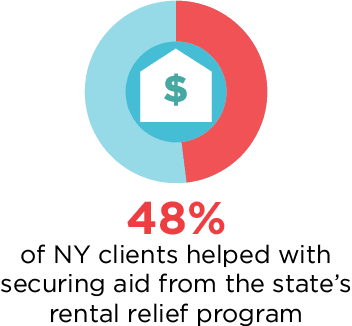

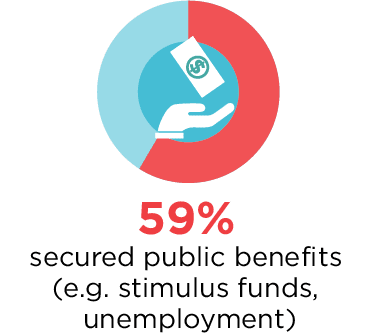

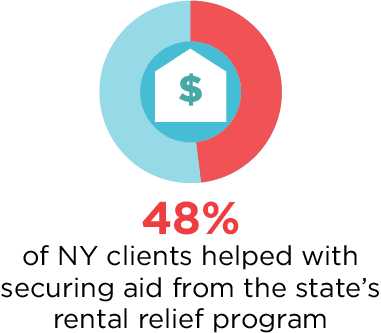

Accessing cash relief

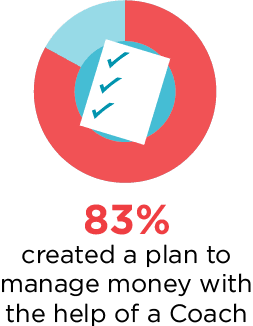

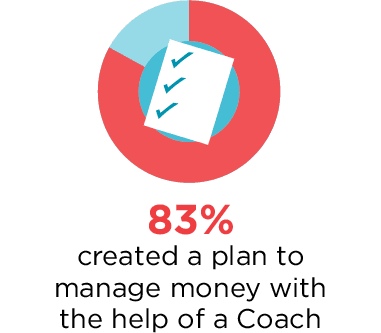

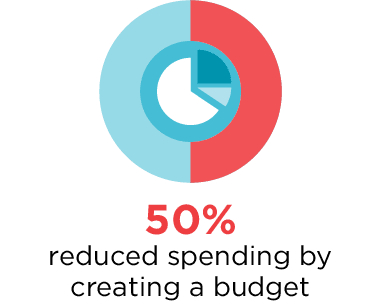

Managing money

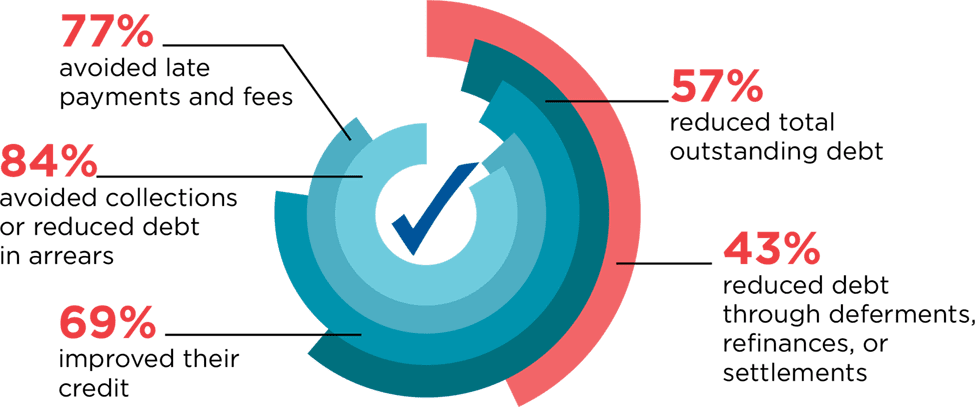

Managing debt and credit

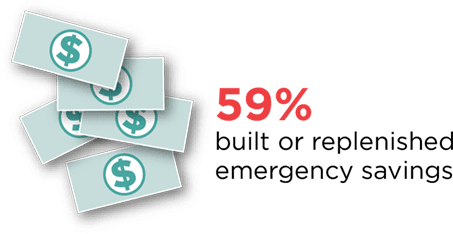

Rebuilding savings

Accessing cash relief

Managing money

Managing debt and credit

Rebuilding savings

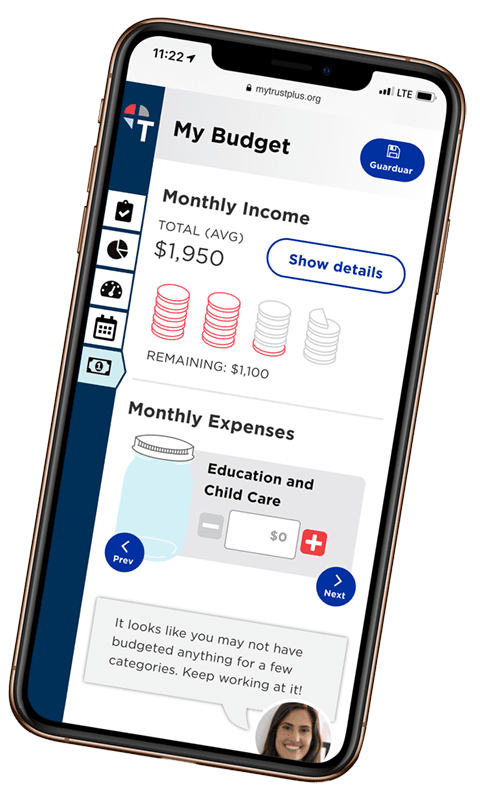

TrustPlus is our social enterprise offering a workplace financial health solution to small businesses, large employers, FinTechs, and worker power organizations across the country.

TrustPlus is our social enterprise offering a workplace financial health solution to small businesses, large employers, FinTechs, and worker power organizations across the country.

TrustPlus is a financial health benefit that blends trusted financial coaching with action-oriented tools and workplace products, so that workers can make the most of every hard-earned paycheck.

We provide the trusted, human side of financial products that work for low-wage workers. In 2020, we went beyond the workplace to serve furloughed and unemployed workers, while doubling down on our commitment to small businesses that have been hit hardest: we made TrustPlus free for all who needed it.

Workers with healthier finances mean employers with healthier businesses. 74% of TrustPlus clients reported reduced financial stress, and 60% increased their savings. And despite the many crises of 2020, 57% of TrustPlus clients reduced their debt by an average of $2,933.

2020 Topline Data

![]() 2,270 clients served

2,270 clients served

![]() 180 customers in 34 states

180 customers in 34 states

![]() 145 small and medium-sized businesses served

145 small and medium-sized businesses served

We’re full steam ahead forging innovative new partnerships.

“TrustPlus is traditionally a program where employers offer this benefit to their employees. What we’re doing at Amalgamated is much larger scale. We’re offering TrustPlus to our 40,000 customers across the entire country.”

“TrustPlus is traditionally a program where employers offer this benefit to their employees. What we’re doing at Amalgamated is much larger scale. We’re offering TrustPlus to our 40,000 customers across the entire country.”

— Maura Keaney, First Vice President, Nonprofit Banking, Amalgamated Bank

Watch Maura talk about how Amalgamated is bringing TrustPlus to their clients

PerkUp is a workplace financial health platform serving the hospitality industry in Greater New Orleans, including Hyatt and Hilton Hotels.

PerkUp is a workplace financial health platform serving the hospitality industry in Greater New Orleans, including Hyatt and Hilton Hotels.

National Domestic Workers Alliance offers nannies, home care workers, and house cleaners across the nation access to critical financial, health, and policy resources.

National Domestic Workers Alliance offers nannies, home care workers, and house cleaners across the nation access to critical financial, health, and policy resources.

Amalgamated Bank, America’s largest B-Corp bank, serves 40,000 customers across New York City, California, Washington, D.C., and Colorado.

Amalgamated Bank, America’s largest B-Corp bank, serves 40,000 customers across New York City, California, Washington, D.C., and Colorado.

One Fair Wage offers our financial coaching to their members advocating for workers’ rights in the hospitality industry.

One Fair Wage offers our financial coaching to their members advocating for workers’ rights in the hospitality industry.

We serve a diverse portfolio of customers

We’re full steam ahead forging innovative new partnerships.

“TrustPlus is traditionally a program where employers offer this benefit to their employees. What we’re doing at Amalgamated is much larger scale. We’re offering TrustPlus to our 40,000 customers across the entire country.”

“TrustPlus is traditionally a program where employers offer this benefit to their employees. What we’re doing at Amalgamated is much larger scale. We’re offering TrustPlus to our 40,000 customers across the entire country.”

— Maura Keaney, First Vice President, Nonprofit Banking, Amalgamated Bank

Watch Maura talk about how Amalgamated is bringing TrustPlus to their clients

PerkUp is a workplace financial health platform serving the hospitality industry in Greater New Orleans, including Hyatt and Hilton Hotels.

PerkUp is a workplace financial health platform serving the hospitality industry in Greater New Orleans, including Hyatt and Hilton Hotels.

National Domestic Workers Alliance offers nannies, home care workers, and house cleaners across the nation access to critical financial, health, and policy resources.

National Domestic Workers Alliance offers nannies, home care workers, and house cleaners across the nation access to critical financial, health, and policy resources.

Amalgamated Bank, America’s largest B-Corp bank, serves 40,000 customers across New York City, California, Washington, D.C., and Colorado.

Amalgamated Bank, America’s largest B-Corp bank, serves 40,000 customers across New York City, California, Washington, D.C., and Colorado.

One Fair Wage offers our financial coaching to their members advocating for workers’ rights in the hospitality industry.

One Fair Wage offers our financial coaching to their members advocating for workers’ rights in the hospitality industry.

We serve a diverse portfolio of customers

TrustPlus Clients in 2020

- 71% are women

- 70% identify as Latinx or Black

- $30,000 median income

- $28,665 median total debt

Catalino

Catalino has a simple and effective business model called Handyman120—for $120, he will do anything that needs to get done in a home over the course of six hours, from plumbing to electrical. The business was growing steadily—until the novel coronavirus hit New York City.

With a $1,000 payment from Humanity Forward’s partnership with Neighborhood Trust, Catalino and his wife Ariel were able to survive the tough months that he couldn’t work.

Working with his TrustPlus financial coach, Jonathan, Catalino is now steadily building his credit score, putting away 10% of his income for savings, and he’s hoping to buy a house in the coming year.

“My wife and I, we want to get our credit up and buy a property. I would love to own lots of real estate. Not for me, but for who comes behind me. For my daughter.”

TrustPlus Clients in 2020

- 71% are women

- 70% identify as Latinx or Black

- $30,000 median income

- $28,665 median total debt

Catalino

Catalino has a simple and effective business model called Handyman120—for $120, he will do anything that needs to get done in a home over the course of six hours, from plumbing to electrical. The business was growing steadily—until the novel coronavirus hit New York City.

With a $1,000 payment from Humanity Forward’s partnership with Neighborhood Trust, Catalino and his wife Ariel were able to survive the tough months that he couldn’t work.

Working with his TrustPlus financial coach, Jonathan, Catalino is now steadily building his credit score, putting away 10% of his income for savings, and he’s hoping to buy a house in the coming year.

“My wife and I, we want to get our credit up and buy a property. I would love to own lots of real estate. Not for me, but for who comes behind me. For my daughter.”

With Pathways, credit unions leverage financial coaching, using our impact- tracking platform, so products and services are delivered with a human touch.

With Pathways, credit unions leverage financial coaching, using our impact- tracking platform, so products and services are delivered with a human touch.

A partnership between Neighborhood Trust and credit union network Inclusiv, Pathways trains credit union staff to provide our model of trusted, action-oriented financial coaching to its members and track data and results via our proprietary technology platform.

2020 Topline Data

![]() 3,151 clients served

3,151 clients served

![]() 19 credit union customers

19 credit union customers

![]() $28,800 median client income

$28,800 median client income

“It helps our members build trust in the credit union, knowing that… we’re looking out for their best interest.”

—Kathy Breaux, New Orleans Firemen’s Federal Credit Union

This year, our reach grew significantly with our partnership with Patelco, one of the largest credit unions in the country, serving almost 400,000 customers, primarily in California.

We helped our credit union partners adapt their coaching to the needs of their members in this financial crisis, connecting them to relief benefits and managing tight budgets through uncertainty.

A partnership between Neighborhood Trust and credit union network Inclusiv, Pathways trains credit union staff to provide our model of trusted, action-oriented financial coaching to its members and track data and results via our proprietary technology platform.

2020 Topline Data

![]() 3,151 clients served

3,151 clients served

![]() 19 credit union customers

19 credit union customers

![]() $28,800 median client income

$28,800 median client income

“It helps our members build trust in the credit union, knowing that… we’re looking out for their best interest.”

—Kathy Breaux, New Orleans Firemen’s Federal Credit Union

This year, our reach grew significantly with our partnership with Patelco, one of the largest credit unions in the country, serving almost 400,000 customers, primarily in California.

We helped our credit union partners adapt their coaching to the needs of their members in this financial crisis, connecting them to relief benefits and managing tight budgets through uncertainty.

We continue to partner with the City of New York to promote financial health

2020 Topline Data

![]() 1,500 served in partner-ship with the NYC DCWP

1,500 served in partner-ship with the NYC DCWP

![]() 7 Financial Empowerment Centers across NYC that shifted to remote services

7 Financial Empowerment Centers across NYC that shifted to remote services

![]() 250+ drivers reached

250+ drivers reached

We continue to partner with the NYC Department of Consumer and Worker Protection (DCWP) as a leading provider of financial coaching at the City’s Financial Empowerment Centers. In 2020, we expanded on this partnership to provide financial coaching under the Taxi and Limousine Commission’s (TLC) Driver Resource Center, which serves medallion owners and drivers in the wake of collapsing medallion valuation, predatory loans, and the COVID-19 crisis.

“The TLC Resource Center is a critical support, especially during COVID-19,” said Taxi and Limousine Commissioner and Chair Aloysee Heredia Jarmoszuk, “and we will continue ensure that all Licensees have access to professional legal and financial advice and to as many available benefits as possible.”

Using our proprietary train-the-trainer financial coaching model, the Cities for Financial Empowerment Fund hired us to replicate our NYC model in 15 cities across the country.

2020 Topline Data

![]() 1,500 served in partner-ship with the NYC DCWP

1,500 served in partner-ship with the NYC DCWP

![]() 7 Financial Empowerment Centers across NYC that shifted to remote services

7 Financial Empowerment Centers across NYC that shifted to remote services

![]() 250+ drivers reached

250+ drivers reached

We continue to partner with the City of New York to promote financial health

We continue to partner with the NYC Department of Consumer and Worker Protection (DCWP) as a leading provider of financial coaching at the City’s Financial Empowerment Centers. In 2020, we expanded on this partnership to provide financial coaching under the Taxi and Limousine Commission’s (TLC) Driver Resource Center, which serves medallion owners and drivers in the wake of collapsing medallion valuation, predatory loans, and the COVID-19 crisis.

“The TLC Resource Center is a critical support, especially during COVID-19,” said Taxi and Limousine Commissioner and Chair Aloysee Heredia Jarmoszuk, “and we will continue ensure that all Licensees have access to professional legal and financial advice and to as many available benefits as possible.”

Using our proprietary train-the-trainer financial coaching model, the Cities for Financial Empowerment Fund hired us to replicate our NYC model in 15 cities across the country.

We’re surfacing real time economic insights and building an advocacy agenda to fight for workers’ rights

Our dialogues with thousands of clients helped us take the pulse of workers’ finances in the midst of shock and uncertainty. In 2020 we built systems to surface insights and trends using our rich qualitative data. In 2021 we will enhance this data mining and analytics engine to support worker-focused campaigns for market and policy change. We continue tax season coalition efforts to benefit workers, while building our case for inclusive unconditional cash transfers paired with human-touch financial coaching.

We’re surfacing real time economic insights and building an advocacy agenda to fight for workers’ rights

Our dialogues with thousands of clients helped us take the pulse of workers’ finances in the midst of shock and uncertainty. In 2020 we built systems to surface insights and trends using our rich qualitative data. In 2021 we will enhance this data mining and analytics engine to support worker-focused campaigns for market and policy change. We continue tax season coalition efforts to benefit workers, while building our case for inclusive unconditional cash transfers paired with human-touch financial coaching.

2020 Financial Position

Financial Highlights

- $8M in total net assets, including unrestricted net assets of $3.9M

- $2.6M in positive change in cash

- $6.1M in fundraising support, with almost half (44%) unrestricted

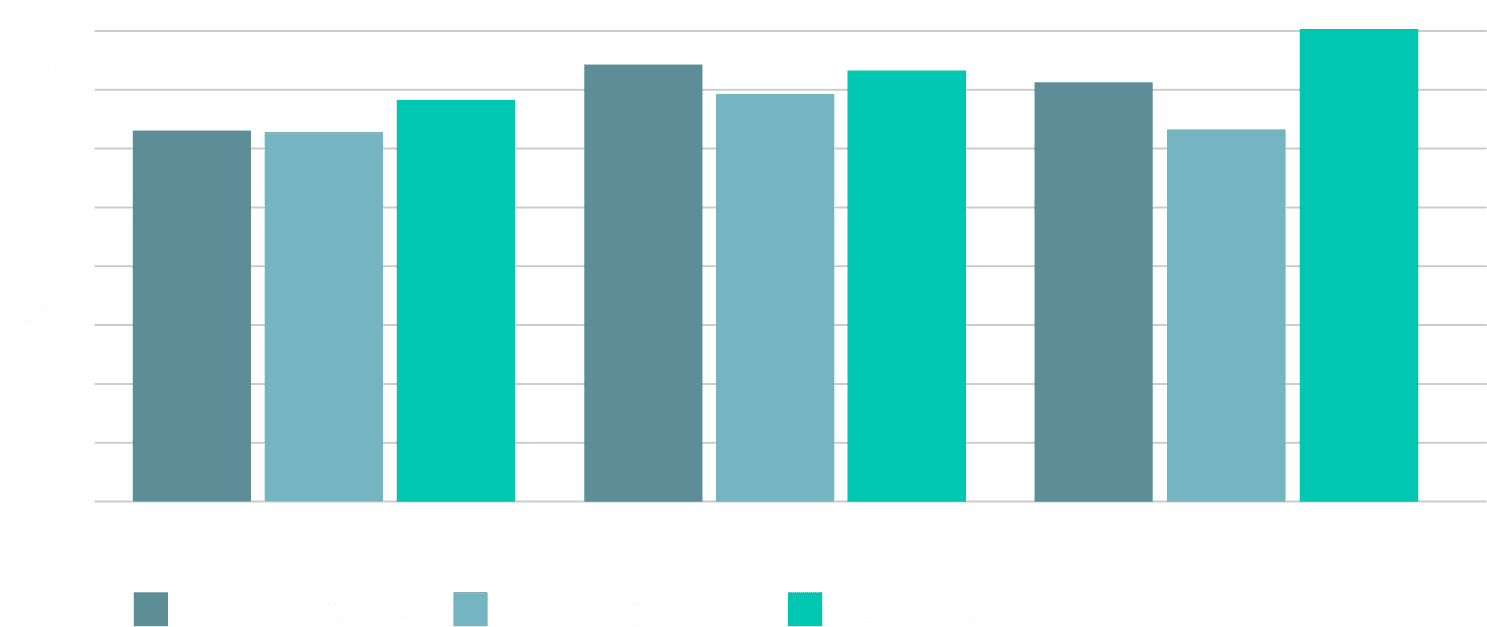

Strong and Growing Net Assets

| 2020 INCOME STATEMENT (Unaudited) | |

| Revenues | |

| Contributions | $ 6,096,871 |

| Government Grants | 844,552 |

| Earned Revenue | 168,132 |

| Total Revenue | $ 7,109,555 |

| Expenses | |

| TrustPlus | $ 3,809,419 |

| Other Programs | 1,139,836 |

| Support Expenses | 1,389,261 |

| Total Expenses | $ 6,338,515 |

| Total Change in Net Assets | $ 771,040 |

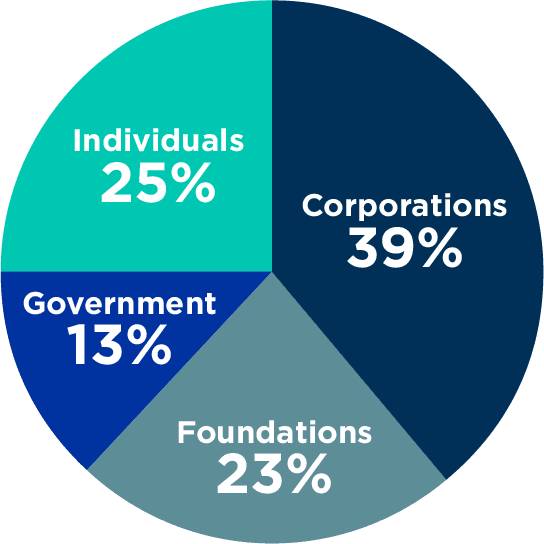

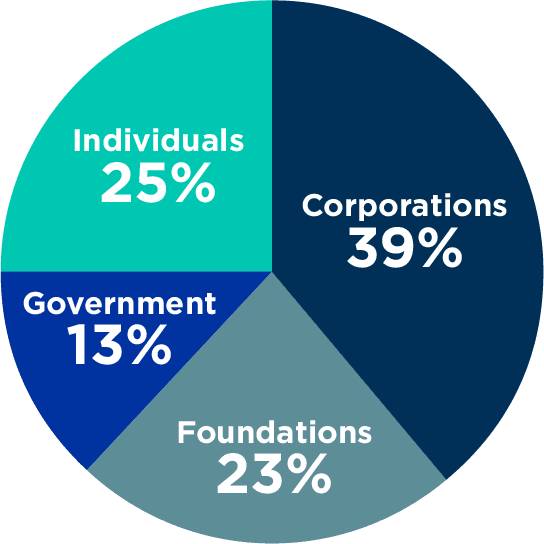

Diverse Funding Sources

Supported by a diverse base of funders, of which almost half (44%) provided unrestricted contributions

2020 Financial Position

Financial Highlights

- $8M in total net assets, including unrestricted net assets of $3.9M

- $2.6M in positive change in cash

- $6.1M in fundraising support, with almost half (44%) unrestricted

Strong and Growing Net Assets

| 2020 INCOME STATEMENT (Unaudited) | |

| Revenues | |

| Contributions | $ 6,096,871 |

| Government Grants | 844,552 |

| Earned Revenue | 168,132 |

| Total Revenue | $ 7,109,555 |

| Expenses | |

| TrustPlus | $ 3,809,419 |

| Other Programs | 1,139,836 |

| Support Expenses | 1,389,261 |

| Total Expenses | $ 6,338,515 |

| Total Change in Net Assets | $ 771,040 |

Diverse Funding Sources

Supported by a diverse base of funders, of which almost half (44%) provided unrestricted contributions

Not only are we grateful for your support—so are our clients.

Not only are we grateful for your support—so are our clients.

Follow Us