Who’s affected by wage garnishments?

Answer: more people than you’d think…

Almost 9.5 million people in America have their wages garnished.

As an employer, if you have employees facing wage garnishments, you know it’s one of the most difficult things to overcome.

Understanding Wage Garnishment Basics

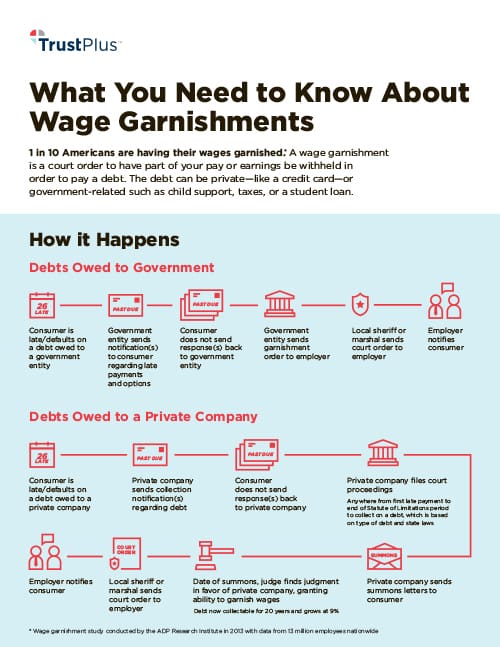

A wage garnishment is a court order to have part of your pay or earnings be withheld in order to pay a debt.

- This debt can be private (consumer):

- Credit card

- Car loan

- Or government related:

- Child support

- Taxes

- Student loan

How did the debt get here? The timeline for a worker is often like the following:

- Private Debt:

-

- Late with debt payment

- Notified of negative account from creditor

- Lack of response from debtor

- Creditor files court proceedings to attempt to collect debt

- Company sends summons to employee

- Judgment granted in favor of creditor and grants wage garnishment

- Garnishment order sent to employer

- HR notifies employee of wage garnishment

- Government Debt:

Often child support or student loans. Judgment not needed like a private debt.

-

- Late payment

- Notified by negative account standings

- Lack of response

- Garnishment order sent to employer

- Marshal sends court ordered garnishment to employee and employer

- HR notifies employee of wage garnishment

How to help your employee evaluate their options

If your company policy allows, let your employee know about his or her wage garnishment. It may be the first time he or she hear about it.

Schedule a time to meet with your employee, ideally a confidential space where the employee will feel comfortable having a conversation.

Share this worksheet to:

- Explain how wage garnishments happen

- Find out whether the amount is correct

- Determine and recommend next steps

Have employees asking for loans and advancements?

Get the employee loans worksheet too.

How our nonprofit can help further

When you see your employees struggling to pay the bills like this, it’s hard to know what, if anything, you can do about it.

But there ARE things you can do as an employer to reduce your workers’ reliance on loans and advances, break them out of the cycle of debt, and help them achieve life-changing financial stability.

Neighborhood Trust Financial Partners is one of the nation’s leading providers of financial empowerment services. With over 20 years of experience, we have served over 50,000 people. Neighborhood Trust is the largest provider for the New York City Office of Financial Empowerment and was named CFSI Financial Health Leader in 2017 and 2019.

We aim to help workers reach their financial goals by supporting them with tailored one-on-one financial coaching with our trusted Financial Coaches. Neighborhood Trust empowers individuals to become productive participants in the U.S. financial system and achieve their financial goals in a safe and confidential environment.

“We don’t just oach or educate. We work with clients to build financial plans, change financial behavior, and access socially responsible and affordable financial products.”

Learn how Neighborhood Trust’s holistic financial coaching program can help your workers

Follow Us