Your questions about the federal government’s emergency aid package answered

By Justin Enany, Project Manager / Financial Coach

On March 27, Congress signed into law a $2 trillion emergency aid package designed to mitigate the economic impact of the coronavirus pandemic (1). Called the Coronavirus Aid, Relief, and Economic Security (CARES) Act, it is a comprehensive relief package that includes:

- One-time direct payments to adults who filed income tax returns in 2018 or 2019 (1);

- An increase in the amount of unemployment benefits as well as an expansion of the eligibility requirements (2);

- Loans (which can be partially or entirely forgiven depending on eligibility) for small businesses and nonprofits (3);

- Free counseling and low-cost training for small businesses (3); and

- A temporary pause on student loan payments and interest.

If you’re one of the millions of Americans who have been financially impacted by this pandemic and you’re wondering how the CARES Act affects you and whether you now qualify for any of the benefits, we’ve put together a helpful guide to answer your questions. If your question is not addressed below, email us at [email protected].

ONE TIME DIRECT PAYMENTS

How much will I receive?

- It depends. It’s based on your 2019 tax filing or, if you haven’t done that yet, your 2018 filing. Take a look at this calculator issued by The Washington Post.

I’m eligible. Do I need to take action to receive my one-time direct payment?

- Not necessarily. If you filed your 2019 or 2018 tax return and were eligible, the IRS will determine where to send your check and your eligibility from there. You will automatically receive a direct deposit to the bank account listed on your 2019 return, or in the absence of a 2019 return, the 2018 return. If a bank account is not listed, the IRS will mail the check to the address that is listed for either the 2019 or in its absence 2018 return. (4)

- You should file your 2019 return as soon as possible if it would increase your eligibility. The Treasury will be developing an online portal for people to update their information to receive their checks directly if they need to update their banking information/address. (4)

I am not typically required to file a tax return. Can I still receive my payment?

- Yes. People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax. (4)

How can I file the tax return needed to receive my economic impact payment?

- IRS.gov/coronavirus will soon provide information instructing people in these groups on how to file a 2019 tax return with simple, but necessary, information including their filing status, number of dependents and direct deposit bank account information. (4)

I have not filed my tax return for 2018 or 2019. Can I still receive an economic impact payment?

- Yes. The IRS urges anyone with a tax filing obligation who has not yet filed a tax return for 2018 or 2019 to file as soon as they can to receive an economic impact payment. Taxpayers should include direct deposit banking information on the return. (4)

I need to file a tax return. How long are the economic impact payments available?

For those concerned about visiting a tax professional or local community organization in person to get help with a tax return, these economic impact payments will be available throughout the rest of 2020. (4)

Am I eligible if I’m not a citizen?

- Yes — as long as you’re living and working in the U.S. with a valid Social Security number. That includes green card holders, and it generally includes those on work visas, such as an H-1B and H-2A. But it generally excludes visitors and people who are in the U.S. illegally. (5)

Is this money taxable?

- No (5)

Can this money be withheld for money that I owe in back taxes or child support?

- You’ll receive the full amount even if you have tax arrears

- Child support arrears COULD affect what you receive if the arrears were reported by your state to the Treasury Dept. (5)

STUDENT LOANS (9)

What has changed with federal student loans?

No payments are required on federal student loans owned by the U.S. Department of Education between March 13, 2020 and September 30, 2020.

Student loans are placed in an automatic administrative forbearance.

During this time, interest will be set to 0% on the following types of loans:

- Defaulted and non-defaulted Direct Loans;

- Defaulted and non-defaulted FFEL Program loans; and

- Federal Perkins Loans.

How can I take advantage of this 0% interest period if I have a Federal Family Education Loan (FFEL) Program and Federal Perkins loans not owned by ED?

- While your lender or school can provide these benefits should it choose to do so, you can consolidate your FFEL Program or Federal Perkins loans not owned by ED into a Direct Consolidation Loan, which would be eligible for 0% interest. However, if you consolidate, after the 0% interest rate period ends, the interest rate on your loan may be higher than what you are currently paying. In addition, when you consolidate, any outstanding interest will capitalize, meaning that any outstanding interest is added to your principal balance. Your servicer can provide you with information about how your loan balance, interest rate, and total amount to be paid would change if you consolidated into a Direct Consolidation Loan.

Will my wages, Social Security, or tax refund be garnished for student loan debt collection?

- No, not during this period. In terms of a wage garnishment, per studentaid.gov: Your human resources department will receive a letter from ED instructing them to stop your wage garnishment. If ED receives funds from a garnishment between March 13, 2020, and Sept. 30, 2020, we will refund your garnished wages.

Will I still get credit towards my public service loan forgiveness (PSLF) during this time?

- Yes, pausing your federal student loan payments will still result in you getting monthly payment “credit” for public service loan forgiveness

UNEMPLOYMENT

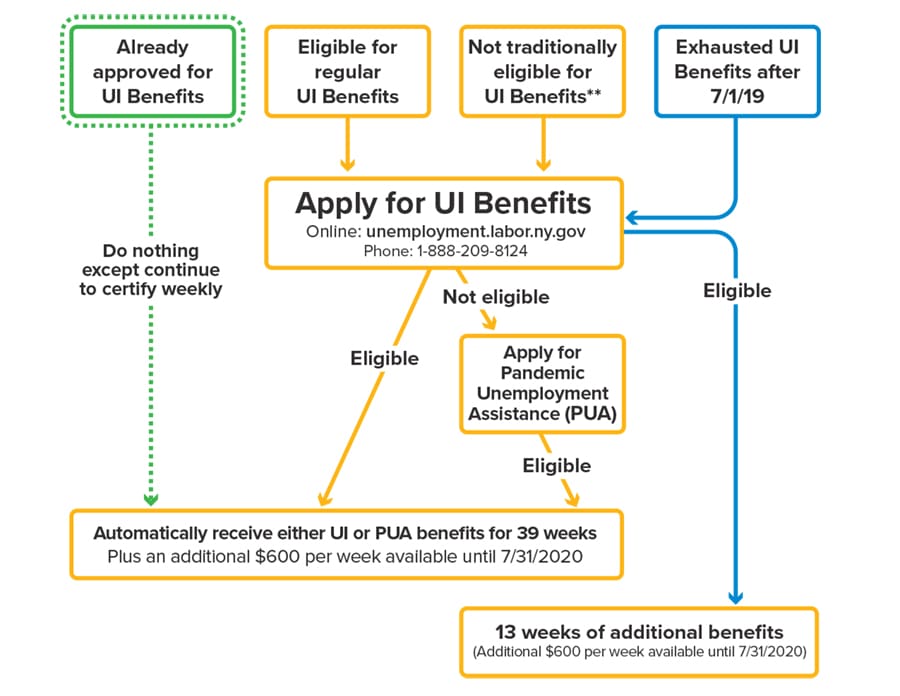

How are those who are traditionally eligible for unemployment affected?

- Unemployment benefits have been extended from 26 to 39 weeks.

- In addition to one’s usual unemployment benefit, recipients will receive an additional $600/week starting 4/5/20 through 7/31/2020. (7)

- Eligibility has been expanded but one still applies through the regular state-specific channels (e.g. NY Dept of Labor)

What is pandemic unemployment assistance?

- Pandemic Unemployment Assistance (PUA) provides emergency support for workers who are left out of their state’s standard unemployment coverage, workers who have already exhausted those benefits or workers who are unable to work due to certain circumstances caused by the coronavirus pandemic. (6)

Who qualifies for Pandemic Unemployment Assistance?

According to the National Employment Law Project (NELP), those eligible for PUA include self-employed workers, independent contractors, freelancers, workers seeking part-time work, workers who do not have a long enough work history to qualify for state UI benefits, and workers who have exhausted their standard state UI benefits. Importantly, those who are eligible for their state’s normal unemployment benefits do not qualify for this special pandemic assistance.

- You have been diagnosed with COVID-19 or have symptoms of it and are seeking a diagnosis

- A member of your household has been diagnosed with COVID-19

- You are providing care for someone diagnosed with COVID-19

- You are providing care for a child or other household member who can’t attend school or work because it is closed due to COVID-19

- You are quarantined or have been advised by a health care provider to self-quarantine

- You were scheduled to start employment and do not have a job or cannot reach your place of employment as a result of a COVID-19 outbreak

- You have become the breadwinner for a household because the head of household has died as a direct result of COVID-19

- You had to quit your job as a direct result of COVID-19

- Your place of employment is closed as a direct result of COVID-19 (6)

When do PUA benefits start?

- The PUA program runs from January 27, 2020, through December 31, 2020, and benefits can be received retroactively for qualifying applicants. Eligibility ends on December 31, unless the program is later extended.

- PUA benefits can be claimed for a maximum of 39 weeks. (6)

How much will PUA applicants receive?

- The calculations are based on the federal Disaster Unemployment Assistance program under the Stafford Act, which means the minimum weekly benefit amount payable is half (50%) of the average benefit amount in the state you apply in. According to the NELP, that’s about $190 per week. (6)

How do I apply?

- Begin by visiting your state’s labor department or equivalent website. For New Yorkers, head to labor.ny.gov. If you are not traditionally eligible for unemployment benefits, begin the standard unemployment insurance application process, and apply for Pandemic Unemployment Assistance. (6)

Can undocumented workers receive PUA?

- No. Workers must be authorized to work to be eligible for the program.

Do PUA recipients get other benefits from the CARES Act?

- Yes. If you qualify for PUA but do not traditionally qualify for your state’s unemployment insurance, you also qualify for:

- The Pandemic Unemployment Compensation (PUC): An additional $600 per week through July 31, 2020, and;

- Pandemic Emergency Unemployment Compensation (PEUC): An extended 13 weeks of coverage provided to unemployed individuals who have exhausted their state’s regular unemployment coverage (in most cases, 26 weeks). (6)

Is there a handy chart from the NY Dept of Labor that explains all this clearly?

- Yes.

SELF-EMPLOYED/SMALL BUSINESS

Are self-employed people eligible for unemployment benefits?

- Yes, see the above section on Pandemic Unemployment Assistance(PUA) and this guide for applying.

Are there other available financial resources for small business/self-employed people?

- Yes, the Paycheck Protection Program, which is a loan that is potentially forgivable if used to cover qualifying expenses.

RETIREMENT ACCOUNTS

Temporary Waiver of Required Minimum Distributions

- Required minimum distributions (RMDs) for Defined Contribution plans — 401k, 403b, and 457 — and IRAs are waived for 2020. Coronavirus-Related Plan Distributions. (8)

Coronavirus-Related Plan Distributions

The 10% tax penalty is waived for “Coronavirus-related distributions” of up to $100,000 for a “qualified individual”, defined as someone who:

- Is diagnosed with COVID-19

- Whose spouse or dependent is diagnosed with COVID-19

- Who experiences adverse financial consequences as a result of

- Being quarantined, furloughed, laid off, having hours reduced

- Being unable to work due to lack of child care due to COVID-19

- Closing or reducing hours of a business owned or operated by the individual due to COVID19

A retirement plan administrator can rely on an individual’s certification that he or she meets these requirements.

- Additionally, the automatic 20% withholding requirement on these distributions does not apply; instead, individuals have the option for a special tax treatment in which the income taxes from the distribution are spread in equal amounts over 2020, 2021, and 2022.

- Individuals can choose to repay the distribution amount to their plan over three years, tax-free, without it counting against the annual contribution limits. The ability to repay these distributions is key. (8)

Loans

- Outstanding loan payments scheduled to be made on or after the enactment date through December 31, 2020, may be delayed for one year without penalty.

- For a period of 180 days beginning the enactment date, current retirement plan loan limits are doubled to the lesser of $100,000 or 100% of the participant’s vested account balance (from $50,000/50%)

- The rules requiring consideration of the highest loan balance during the one-year period before a loan is made when applying the loan cap is not changed(8)

Please note — these changes are permissive, not mandatory for qualified plans, so employers can decide whether to implement them. (8)

Sources

- https://www.nbcnews.com/politics/congress/coronavirus-checks-direct-deposits-are-coming-here-s-everything-you-n1168936

- https://www.nbcnews.com/politics/congress/coronavirus-unemployment-benefits-here-s-who-qualifies-how-much-they-n1169846

- https://www.sbc.senate.gov/public/_cache/files/2/9/29fc1ae7-879a-4de0-97d5-ab0a0cb558c8/1BC9E5AB74965E686FC6EBC019EC358F.the-small-business-owner-s-guide-to-the-cares-act-final-.pdf

- https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

- https://www.nbcnews.com/politics/congress/coronavirus-checks-direct-deposits-are-coming-here-s-everything-you-n1168936

- https://www.syracuse.com/coronavirus/2020/03/coronavirus-stimulus-how-to-get-unemployment-aid-for-freelancer-contractor-part-time-workers-typically-left-out.html

- https://labor.ny.gov/ui/cares-act.shtm

- Dan LaRosa, Ritholtz Wealth Management

- https://studentaid.gov/announcements-events/coronavirus#zero-interest-questions

TrustPlus is expanding our financial coaching services and providing critical resources to protect workers and families impacted financially by COVID-19. Learn more about our relief efforts here.

Follow Us