First Look: 2022 Innovations

Building Financial Security for All Workers

First Look: 2022 Innovations

Building Financial Security for All Workers

First Look:

2022 Innovations

Building Financial Security for All Workers

Neighborhood Trust is a financial services innovator reshaping the marketplace of financial products, services and benefits to better serve low-wage workers.

Our worker solutions are primarily delivered through TrustPlus, our workplace financial health benefit that is embedded within small businesses, large employers, FinTechs, worker power organizations, and more. We also advise credit unions and city governments on how to use our proprietary coaching model to help workers build financial health.

Our Financial Coaches and digital tools provide trusted financial guidance to workers, and connect them to safe and effective financial products that help reduce and avoid debt and address immediate financial challenges.

“I was stuck a year ago. Now I’m much, much better and I’m in the process of buying a home.”

—Edward, who heard about Neighborhood Trust through the Workers Benefit Fund.

“I was stuck a year ago. Now I’m much, much better and I’m in the process of buying a home.”

—Edward, who heard about Neighborhood Trust through the Workers Benefit Fund.

“I was stuck a year ago. Now I’m much, much better and I’m in the process of buying a home.”

—Edward, who heard about Neighborhood Trust through the Workers Benefit Fund.

As a social enterprise, every day, we prove the business value of centering workers’ needs in the benefits and financial services markets.

Workers who face systems pushing them toward a cycle of cash shortfalls, debt, and subprime credit depend on the trusted guidance Neighborhood Trust offers.

But we don’t stop there.

Fueled by a deep commitment to innovation and financial justice, we use the insights from our work to help employers, nonprofits, banks and FinTechs better understand the unique financial challenges facing the workers they serve, and to push the marketplace to prioritize workers and be more accountable to their needs.

We equip workers to reduce or avoid expensive debt, achieve prime credit scores, and assert control over their financial lives.

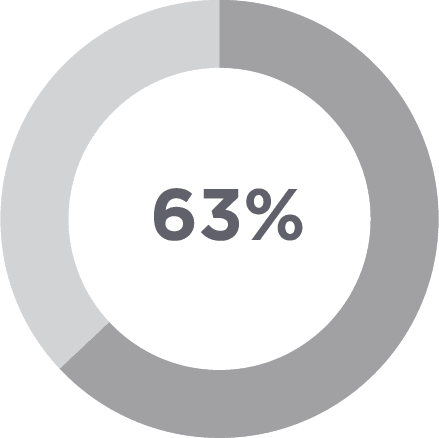

63% of workers say their financial stress has increased since the start of the pandemic—and those employees are twice as likely to use payday loans or take early distributions from retirement accounts.

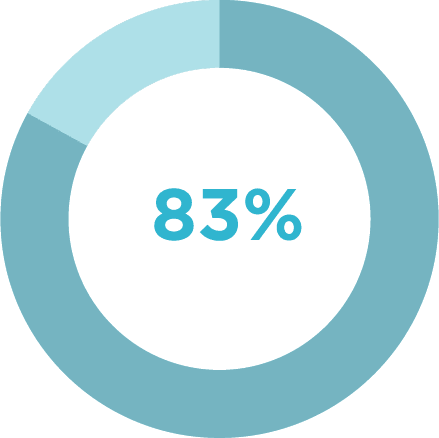

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

While 92% of our clients carry consumer debt

![]()

59% then reduced their debt by a median $2,340

![]()

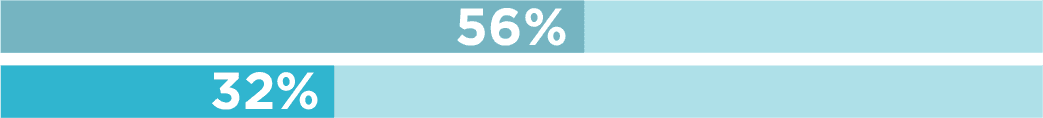

While 50% of our clients had debt in collections

![]()

56% then reduced their debts and 32% eliminated those

collections debts entirely

While 62% of our clients had subprime credit scores

![]()

70% improved their credit and 21% improved to a

prime credit score

We equip workers to reduce or avoid expensive debt, achieve prime credit scores, and assert control over their financial lives.

63% of workers say their financial stress has increased since the start of the pandemic—and those employees are twice as likely to use payday loans or take early distributions from retirement accounts.

83% of Neighborhood Trust clients report “working with my coach reduced my financial stress.”

While 92% of our clients carry consumer debt

59% then reduced their debt by a median $2,340

While 50% of our clients had debt in collections

56% then reduced their debts and 32% eliminated those

collections debts entirely

While 62% of our clients had subprime credit scores

70% improved their credit and 21% improved to a

prime credit score

First Look: 2022 Innovations

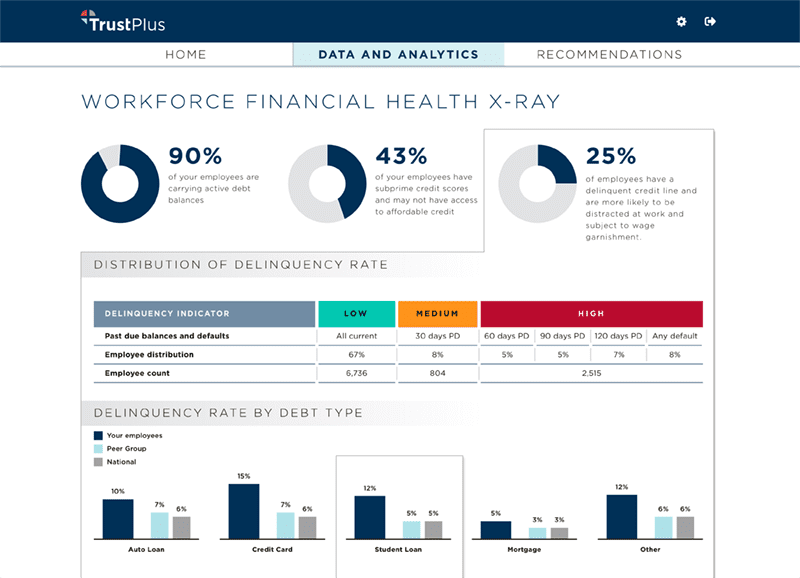

We know how to improve individuals’ financial health. What does that look like across institutions and systems?

Our solutions in development leverage data from our daily worker dialogues to catalyze market-level insights that improve worker financial health collectively.

Our new Project X-ray profiles the financial health of a customers’ workforce, synthesizing credit bureau and bank data alongside insights gleaned from our Financial Coaching sessions. Based on their workers’ needs, we then link to curated prescriptions which improve worker financial security as a workforce-level solution.

We are piloting this product with a home health aide agency customer employing 2,000 workers who provide a vital service yet still struggle with financial security.

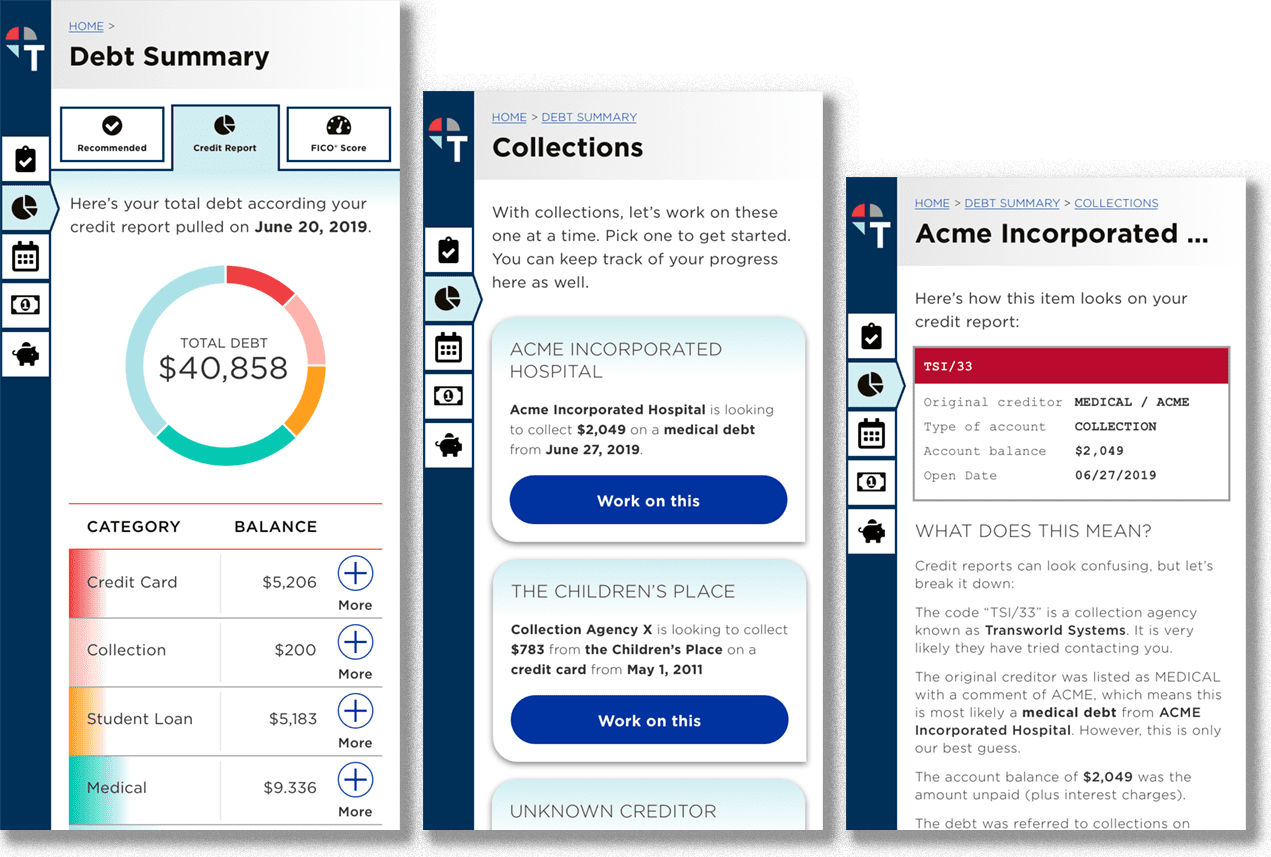

Neighborhood Trust is also reimagining the tools we use to tackle workers’ unmanageable debt loads.

We are developing machine-learning techniques to predict points of cash flow shortfall and proactively intervene.

Over time, our clients’ improved interactions with various actors in the debt industry (from collectors to payday lenders to installment loans and credit card issuers) will transform into collective leverage to reduce outstanding debt owed and credit damaged from this industry.

Your reinvestment is critical

To accelerate our growth, we are asking for your financial support today.

We aim to raise $8.2 million over the next three years to scale our solution and build financial security for more than 100,00 workers annually.

You are critical to reaching this goal. Will you renew your support today?

Follow Us