Insurance Alone Is Not Enough

THE PROBLEM

Medical debt and the unaffordability of healthcare is a crisis affecting most individuals across the United States, with 57% of adults having owed medical debt at least once in the past five years, and 24% currently carrying past due medical debts, or bills that they are unable to pay. And it’s an even greater challenge for people of color: at least half of Black (56%) and Hispanic (50%) adults said they have debt due to medical or dental bills, compared to 37% of white adults.

In this brief, we will profile our study’s findings that insurance alone is not enough to prevent medical debt or its negative ripple effects on physical, mental and financial health.

- 70% of survey respondents with healthcare coverage through their employer reported currently carrying medical debt.

- 70% of respondents who had household income below $100,000 reported currently carrying medical debt, compared to 40% of those making over $100,000 annually.

- 45% of those earning under $100,000 reported that their medical debt has had a negative impact on their mental health compared to only 15% of those earning over $100,000.

- Nearly 40% of respondents with coverage through their employer are at-risk* of accruing more medical debt.

OUR FINDINGS

Confusion around insurance coverage is a challenge for nearly half of respondents with employer-provided coverage, and over 20% struggle to understand how HSAs or FSAs work. While employers seem to have successfully made the enrollment process more accessible (only 5% reported trouble enrolling), employers are leaving information gaps unaddressed.

It is incredibly confusing, and despite a lot of effort, I can never tell how much I will owe before I get the bill. Makes me nervous to go to the doctor, as who knows when I’ll get a huge bill.

—JOHN

Affordability is another major barrier to avoiding medical debt: over 60% of survey respondents with coverage through their employer reported struggling to afford their prescription medications, nearly 50% of respondents don’t have enough money to contribute to an HSA or FSA, and 45% have trouble affording their monthly insurance premium. 30% struggle to afford copays and 25% struggle to predict upcoming health-related costs.

What Challenges Do You Have Accessing Health Insurance?

(Results from respondents with health insurance through their employer)

48% I struggle to understand my health insurance coverage

|

34% I struggle to understand my medical bills when they arrive in the mail

|

22% I struggle to understand how HSAs or FSAs work

|

5% I’ve had trouble enrolling in health insurance coverage

|

48% I struggle to understand my health insurance coverage

|

34% I struggle to understand my medical bills when they arrive in the mail

|

22% I struggle to understand how HSAs or FSAs work

|

5% I’ve had trouble enrolling in health insurance coverage

|

I have spent years avoiding healthcare related needs because of the high cost of copays, and confusion over coverage. I began seeing the doctor again when I became pregnant. The copays and out-of-pocket costs were astronomical. It was stressful and scary.

—DONNA

Deferred care is a common adverse coping response to medical debt. Those with current medical debt reported skipping routine care (45%), skipping seeing a doctor when I needed to (50%), and skipping doses or taking less medication than prescribed (25%) atmuch higher rates than those without current medical debt. Even among respondents with insurance coverage through their employer, 30% reported skipping seeing a doctor and/or skipping routine care such as check-ups, screenings and vaccines.

I pay what I can when I can. If I feel like I can make it through the pain, I won’t go to see a doctor.

—ANA

It is too expensive just to go see a doctor. I am a single mother and most of my money goes to bills and food. I cannot miss work because I’ll be short on my pay. So I try to selfcare and Google my symptoms.

—JENNIFER

Our findings are substantiated by research from Kaiser Family Foundation, which found that “65% of people in households earning less than $40,000, and 51% of people in households with incomes between $40,000 and $75,000, indicated that they found it difficult to afford premiums or care, despite employer-sponsored coverage.” Another KFF survey found that 51% of respondents who are on an employer healthcare plan, reported that “someone in their household skipped or postponed care or filling a prescription in the past year because of the expense.”

In 2021, employer-based coverage deductibles reached a record high of $2,379 for single coverage at small firms and $1,397 at larger firms. And while evidence shows that high-deductible health plans (HDHPs) do in fact lead to reduced health spending, researchers find that this is primarily due to people receiving less care overall–including necessary care–not because they’re choosing less expensive providers or only reducing unnecessary care. Many individuals choose an HDHP because it is the only plan with a premium they can afford, which means they certainly can’t afford to then also contribute to savings or an HSA to account for the high deductible. Instead, they are forced to either take on a huge amount of debt before they hit their out-of-pocket deductible or forego care altogether.

What Challenges Do You Have With Paying for Health Insurance?

(Results from respondents with health insurance through their employer)

63% Affording prescription medications

|

49% Having enough money to contribute to my HSA or FSA

|

45% Affording my monthly health insurance premium

|

29% Affording copays when I see the doctor

|

25% Being able to predict my upcoming health-related costs

|

20% Affording the costs of healthcare that insurance doesn’t pay for

|

63% Affording prescription medications

|

49% Having enough money to contribute to my HSA or FSA

|

45% Affording my monthly health insurance premium

|

29% Affording copays when I see the doctor

|

25% Being able to predict my upcoming health-related costs

|

20% Affording the costs of healthcare that insurance doesn’t pay for

|

WHY THIS MATTERS FOR EMPLOYERS

Medical benefits have always been a job differentiator, but insurance is not enough on its own to prevent workers from accruing medical debt or suffering from its negative impacts. Uninsured survey respondents were 19 percentage points more likely to carry medical debt than insured respondents; yet respondents with employer-provided insurance still reported high rates of medical debt (70%), risk of accruing future medical debt (40%), and stress due to medical debt (40%). Addressing medical debt is important not only for workers’ overall health, but also for businesses’ bottom lines:

- Confusion around insurance or complementary benefits among workers means a lower return on investment (ROI) on employer healthcare benefit spending because workers are not equipped to make use of the benefits available to them.

- Barriers to affordability further reduces employers’ ROI on healthcare spending because if employees aren’t equipped to fulfill out-of-pocket requirements, they won’t be able to effectively take advantage of the coverage they do have and will end up with worse physical, mental and financial health outcomes.

- Deferred care caused by insufficient coverage and medical debt translates to worse health outcomes, which in the long run results in missing work, reduced productivity, increased healthcare costs, and job attrition.

WHAT CAN I DO?

Better healthcare coverage that helps close gaps left by insurance will enable workers to access the care they need without worrying about financial collapse, resulting in both healthier and more loyal employees. We recommend starting with surveying your own employees or conducting focus groups to understand to what degree they’re struggling with medical debt, and ask them what would be most helpful to them. You may learn that what they need is as simple as a tutorial on their coverage from the provider. Or perhaps their needs require more complex solutions such as the following recommendations to emerge from prior research:

- Provide prorated employer premium subsidies based on salary to increase equitable outcomes

- Offer a benchmark dollar amount for what someone with the same health background and demographics as a given employee typically spends on healthcare annually

- Provide the option to easily adjust HSA contributions per paycheck

- Create a hardship fund (which have demonstrated benefits for those who use the fund as well as those who don’t, but feel supported nonetheless knowing it’s there if they need it)

Email us at [email protected] if you want to be notified when we publish our next report on what role employers can play in solving the medical debt crisis for their employees.

Project Background

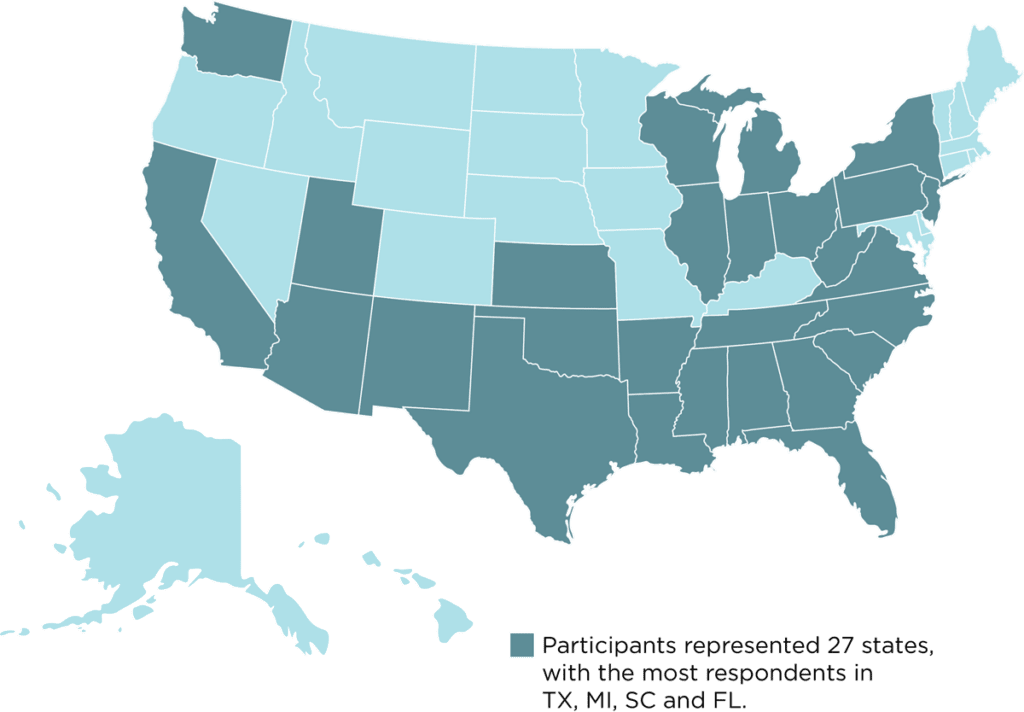

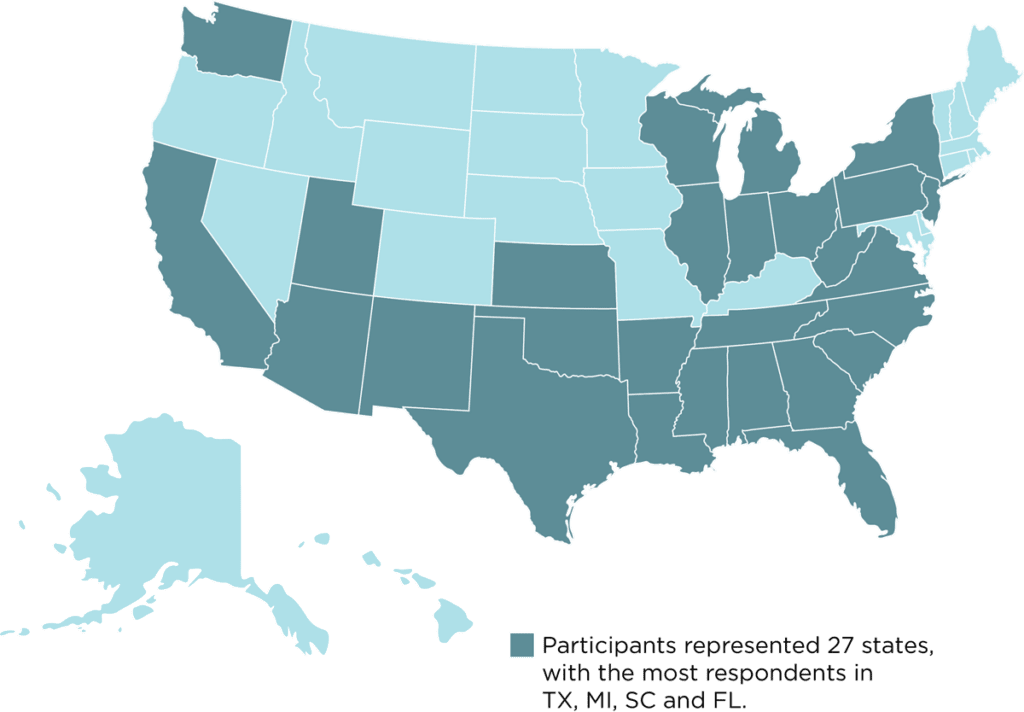

Neighborhood Trust and RIP Medical Debt are partnering to generate awareness, understanding and solutions that enable employers and hospitals to do their part to reduce medical debt burdens, specifically among lower-wage workers. This work will bring the perspectives of low-income workers and those below the poverty line to the forefront of discussions about medical debt and health benefit designs. For Phase 1** of this project, we surveyed*** 230 low-income individuals, including Neighborhood Trust’s financial coaching clients and those who have benefited from RIPMD’s medical debt relief work. The survey included questions about respondents’ medical debt burdens, the impacts of their debt, and how they accrued it.

Survey Respondent Demographics

- 76% of respondents reported household income of $60,000 or below.

- 80% identified as female.

- 32% identified as Black or African American, 36% as Caucasian or White, and 17% Hispanic or Latino.

- Average health rating on scale of 1–5 was a 2.83, with 1 being poor and 5 being excellent.

- 68% reported currently having medical debt.

- 75% estimated having between $500 and $10,000 in medical debt.

Survey Respondent Demographics

- 76% of respondents reported household income of $60,000 or below.

- 80% identified as female.

- 32% identified as Black or African American, 36% as Caucasian or White, and 17% Hispanic or Latino.

- Average health rating on scale of 1–5 was a 2.83, with 1 being poor and 5 being excellent.

- 68% reported currently having medical debt.

- 75% estimated having between $500 and $10,000 in medical debt.

Footnotes

*We deemed respondents at-risk of accruing future medical debt if they relied on any form of credit or informal borrowing rather than insurance or savings, to pay their last medical bill.

**Phase 1 (“Awareness) of this project intends to increase awareness of the prevalence and negative impacts of medical debt, and why it should matter to employers and hospitals to intervene. Phase 2 (“Understanding”) will aim to surface nuanced underlying drivers of medical debt that may be overlooked or misunderstood, and that present innovative leverage points to reduce medical debt, via individual qualitative interviews. And Phase 3 (“Solutions”) will offer recommended solutions for employers and hospitals to take up, incorporating new leverage points revealed in Phase 2 and accounting for implementation barriers.

***We designed our survey in QuestionPro, with support from the Social Policy Institute at WashU. Several of the questions we included were previously validated by the Kaiser Family Foundation’s research. We emailed the survey to 3,220 Neighborhood Trust clients, and 897 RIP Medical Debt beneficiaries, and pledged $5 gift cards for their time. We received 230 complete responses after 3 rounds of outreach. We then conducted X/Y comparison analysis in Excel.

Follow Us