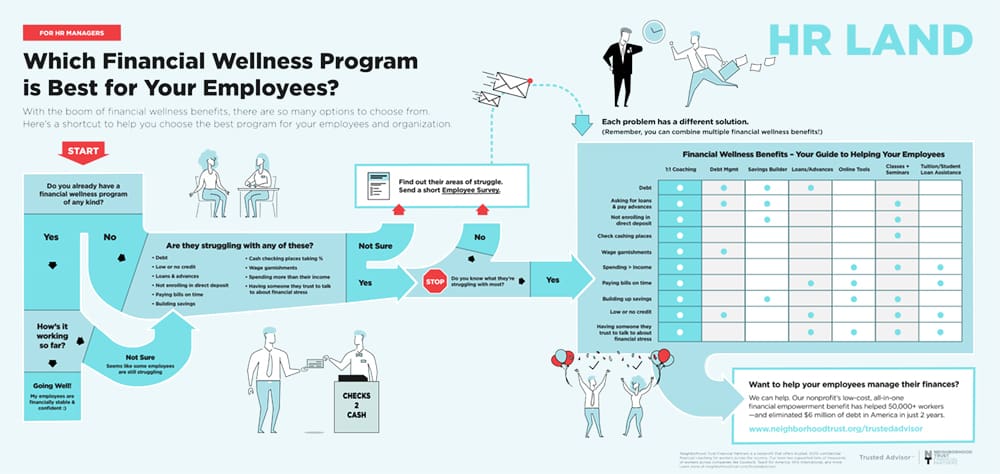

With the growing popularity of financial wellness benefits — there are so many options for employers to choose from.

To make it easier to choose the right one for you and your organization, we made a shortcut 30-second game map (remember Candyland?) to help guide you.

Have fun in HR Land!

Download the HR Land Infographic.

Learn more about each financial wellness offering that’s available to you:

- Financial coaching is a 1–1 service where the coach establishes a relationship with clients through which they can facilitate conversations about finances, provide encouragement and attain financial goals. The medium of such services will depend on the provider (e.g. in-person, over the phone or online).

- Debt management services are designed to help clients assess different debt reduction strategies. The type of strategies proposed and the ensuing results will vary widely by provider.

- Savings products and services can be designed to help meet short- or long-term goals. Many employers today help employees save for their retirement, education or other financial goals.

- Workplace loans and wage advances are offered to help recipients meet emergencies or unexpected budgetary shortfalls. Such programs can be offered directly by employers or via a third party operating at the workplace.

- Online financial management tools help employees manage and/or automate their finances (e.g., estimate how much to save, determine how much to take out in loans, track daily expenses) through a website or mobile app.

- Financial education classes and seminars typically involve a financial professional or volunteer coming to the workplace to deliver courses or workshops about a range of financial topics.

Know someone struggling with their finances?

We can help. Our team at Neighborhood Trust Financial Partners has worked with 50,000+ workers across the country to conquer their finances and get out of debt for good. Learn more about our offering TrustPlus.

Follow Us