Pathways to Financial Empowerment

Pathways to Financial Empowerment

Trusted Guidance and Insights for Credit Unions Nationwide

In partnership with Inclusiv, a national network of community development credit unions, Pathways embeds our financial coaching IP and outcomes tracking platform into credit unions across the country. We help credit unions formalize their financial coaching programs with Neighborhood Trust’s best-in-class model of action-oriented financial coaching, ensuring trusted financial guidance is woven throughout their client experience.

Pathways also builds the capacity of credit unions to track client financial health data and outcomes via our proprietary technology platform. The Pathways service ensures banking products are thoughtfully incorporated into clients’ goals, facilitating financial health, client loyalty, and strengthened customer operations.

Trusted Guidance and Insights for Credit Unions Nationwide

In partnership with Inclusiv, a national network of community development credit unions, Pathways embeds our financial coaching IP and outcomes tracking platform into credit unions across the country. We help credit unions formalize their financial coaching programs with Neighborhood Trust’s best-in-class model of action-oriented financial coaching, ensuring trusted financial guidance is woven throughout their client experience.

Pathways also builds the capacity of credit unions to track client financial health data and outcomes via our proprietary technology platform. The Pathways service ensures banking products are thoughtfully incorporated into clients’ goals, facilitating financial health, client loyalty, and strengthened customer operations.

Trusted Guidance and Insights for Credit Unions Nationwide

In partnership with Inclusiv, a national network of community development credit unions, Pathways embeds our financial coaching IP and outcomes tracking platform into credit unions across the country. We help credit unions formalize their financial coaching programs with Neighborhood Trust’s best-in-class model of action-oriented financial coaching, ensuring trusted financial guidance is woven throughout their client experience.

Pathways also builds the capacity of credit unions to track client financial health data and outcomes via our proprietary technology platform. The Pathways service ensures banking products are thoughtfully incorporated into clients’ goals, facilitating financial health, client loyalty, and strengthened customer operations.

If you’d like to learn more or have questions, please contact Hector Hidalgo at [email protected].

If you’d like to learn more or have questions, please contact Hector Hidalgo at [email protected].

What We Offer

Pathways offers a range of services to credit unions to strengthen their capacity to meet the needs of their members while receiving valuable insights into the effectiveness of their financial products and services.

- Training on In-Depth Financial Coaching and Data Platform: Customized financial coaching training for frontline staff and managers, along with licensing and training on Pathways platform, which provides member outcomes tracking and text messaging software.

- Ongoing Technical Assistance: Technical assistance for credit union staff and management on impact reporting, quality assurance, and continued training.

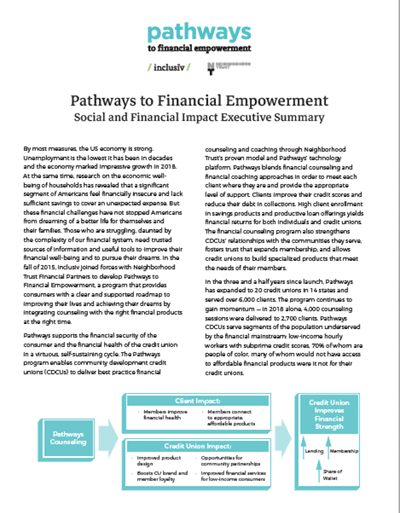

PATHWAYS COACHING AND DATA PLATFORM

CLIENT IMPACT

Clients improve financial health

Clients connect to appropriate, affordable products

CUSTOMER INSTITUTION IMPACT

Improved product design

Boosts brand and member loyalty

Opportunities for community partnerships

Improved financial services for low-income consumers

CUSTOMER INSTITUTION IMPROVES FINANCIAL STRENGTH

Lending

Membership

Share of wallet

PATHWAYS COACHING AND DATA PLATFORM

CLIENT IMPACT

Clients improve financial health

![]()

Clients connect to appropriate, affordable products

CUSTOMER INSTITUTION IMPACT

Improved product design

Boosts brand and member loyalty

Opportunities for community partnerships

Improved financial services for low-income consumers

CUSTOMER INSTITUTION IMPROVES FINANCIAL STRENGTH

![]()

Lending

![]()

Membership

Share of wallet

PATHWAYS COACHING AND DATA PLATFORM

![]()

CLIENT IMPACT

Clients improve financial health

![]()

Clients connect to appropriate, affordable products

CUSTOMER INSTITUTION IMPACT

![]()

Improved product design

Boosts brand and member loyalty

![]()

Opportunities for community partnerships

![]()

Improved financial services for low-income consumers

![]()

CUSTOMER INSTITUTION IMPROVES FINANCIAL STRENGTH

Lending

Membership

Share of wallet

Our Partners

Our Partners

Our Partners

Our Reach

Pathways has served nearly 18,000 CLIENTS, reducing more than $35.5 MILLION IN CONSUMER DEBT and $3.2 MILLION IN COLLECTIONS accounts.

Our Reach

Pathways has served nearly 18,000 CLIENTS, reducing more than $35.5 MILLION IN CONSUMER DEBT and $3.2 MILLION IN COLLECTIONS accounts.

Follow Us